WisdomTree Creates an Emerging Markets ex State Owned Enterprises Index

For definitions of terms in the chart, please visit our glossary.

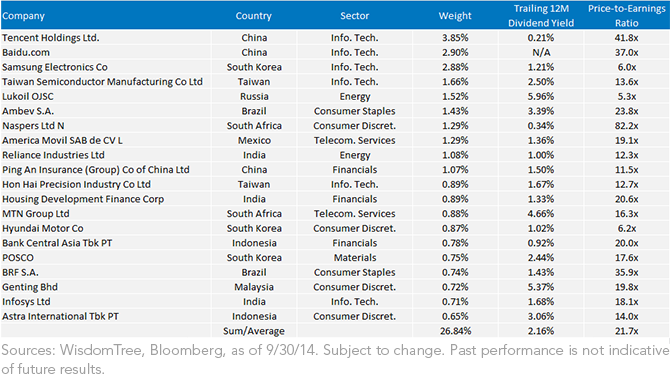

Information Technology Rises to the Top: Given emerging market governments’ low involvement in the Information Technology sector, we are not surprised that the weights of some of the largest companies increase after the state-owned enterprises have been removed. Although the sector is well-represented among the top five holdings, the Index caps sector differentials to 3%, compared to the starting universe, at each annual rebalance, in an effort to remain diversified and not take large sector risks.

As emerging market countries continue to grow and transform, investors will demand more ways to gain access to this unique asset class. Recently, some investors have expressed concern over state-owned enterprises, and they have sought tools to limit their exposure, even after understanding the valuation differences. These investors are interested in concentrating their exposure on the private sector and accessing higher growth potential. Although it is impossible to know which area will be more beneficial to focus on going forward, we think it is important to have different tools available, and the case for either exposure could be made, depending on an investor’s goals and objectives.

For full research on the Emerging Markets ex-State-Owned Enterprises Index click here.

1Source: The Economist, 11/22/14.

2Companies domiciled or incorporated in those countries but trading primarily on a U.S. stock exchange are also eligible for inclusion.

3The maximum country factor is set at 3.0, or no country’s weight can be increased more than 3x after state-owned enterprises have been removed.

For definitions of terms in the chart, please visit our glossary.

Information Technology Rises to the Top: Given emerging market governments’ low involvement in the Information Technology sector, we are not surprised that the weights of some of the largest companies increase after the state-owned enterprises have been removed. Although the sector is well-represented among the top five holdings, the Index caps sector differentials to 3%, compared to the starting universe, at each annual rebalance, in an effort to remain diversified and not take large sector risks.

As emerging market countries continue to grow and transform, investors will demand more ways to gain access to this unique asset class. Recently, some investors have expressed concern over state-owned enterprises, and they have sought tools to limit their exposure, even after understanding the valuation differences. These investors are interested in concentrating their exposure on the private sector and accessing higher growth potential. Although it is impossible to know which area will be more beneficial to focus on going forward, we think it is important to have different tools available, and the case for either exposure could be made, depending on an investor’s goals and objectives.

For full research on the Emerging Markets ex-State-Owned Enterprises Index click here.

1Source: The Economist, 11/22/14.

2Companies domiciled or incorporated in those countries but trading primarily on a U.S. stock exchange are also eligible for inclusion.

3The maximum country factor is set at 3.0, or no country’s weight can be increased more than 3x after state-owned enterprises have been removed.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.