Emerging Markets and State Owned Enterprises

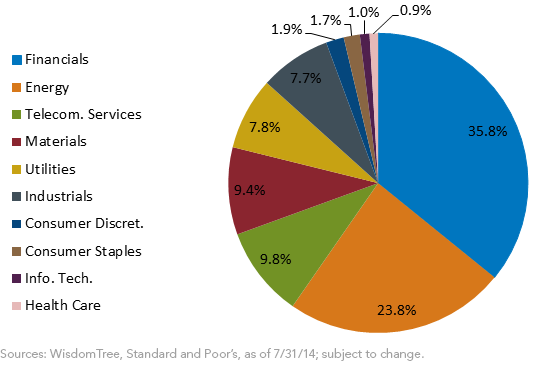

• Ownership Concentrated among Public Good Sectors: Given that the Financials, Energy, Telecom and Utilities sectors are among the most systemically important sectors to economic development, we are not surprised that governments tend to play a more active role in these sectors.

• Less Ownership among Private Good Sectors: Currently, governments are less involved in the Consumer Discretionary and Consumer Staples, Information Technology and Health Care sectors. Companies in many consumer-focused sectors tend to be less vital to the strategic economic development and welfare of emerging market governments. These sectors also are often the focus for growth investors who see a burgeoning opportunity as emerging market consumers develop and increase their income and standard of living.

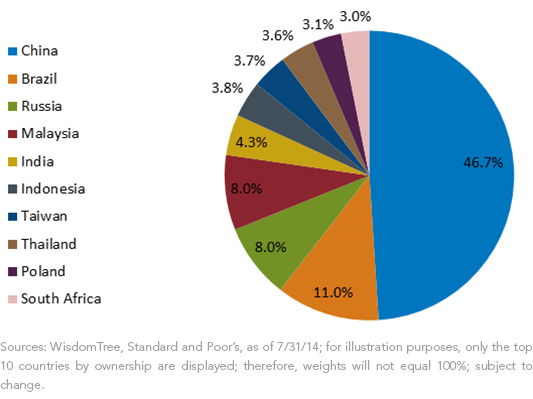

Figure 2: State-Owned Enterprises by Country

• Ownership Concentrated among Public Good Sectors: Given that the Financials, Energy, Telecom and Utilities sectors are among the most systemically important sectors to economic development, we are not surprised that governments tend to play a more active role in these sectors.

• Less Ownership among Private Good Sectors: Currently, governments are less involved in the Consumer Discretionary and Consumer Staples, Information Technology and Health Care sectors. Companies in many consumer-focused sectors tend to be less vital to the strategic economic development and welfare of emerging market governments. These sectors also are often the focus for growth investors who see a burgeoning opportunity as emerging market consumers develop and increase their income and standard of living.

Figure 2: State-Owned Enterprises by Country

• China Displayed the Largest Government Involvement: Given China’s communist background, it is not surprising that almost half of the SOE market cap companies are Chinese companies. A large percentage of the Chinese government’s market cap ownership comes from the stakes it holds in the country’s large financial institutions. These large state-owned banks are among the lowest-priced areas of the entire emerging markets, with average dividend yields over 6% and price-to-earnings (P/E) ratios below 5x.2

• Russia Also Displayed Significant Government Involvement: Russia’s socialist and communist history has led to noteworthy government ownership in the Energy and Financials sectors. Although the recent Ukrainian conflicts have further depressed valuations, the Russian Energy sector had already displayed depressed valuations compared to the broader emerging markets before the crisis. For example, Gazprom and Rosneft, two of the largest state-owned energy companies, have dividend yields north of 5% and P/E ratios under 5x.3

WisdomTree Emerging Markets ex-State-Owned Enterprises Index

WisdomTree created a broad-based Index to emerging market stocks that are not state-owned enterprises; this Index will help investors monitor the performance of this subset. In a future blog post, we will introduce this new Index, the WisdomTree Emerging Markets ex-State-Owned Enterprises (EMXSOE), designed to measure the performance of broad-based emerging market stocks that exclude state-owned companies.

1Sources: WisdomTree, Standard and Poor’s, as of 7/31/14.

2Sources: WisdomTree, Bloomberg; refers to the five largest dividend-paying Chinese banks as of 9/30/14.

3Sources: WisdomTree, Bloomberg, as of 9/30/14. The WisdomTree Emerging Markets Ex State Owned Enterprises Index does not hold Gazprom or Rosneft.

• China Displayed the Largest Government Involvement: Given China’s communist background, it is not surprising that almost half of the SOE market cap companies are Chinese companies. A large percentage of the Chinese government’s market cap ownership comes from the stakes it holds in the country’s large financial institutions. These large state-owned banks are among the lowest-priced areas of the entire emerging markets, with average dividend yields over 6% and price-to-earnings (P/E) ratios below 5x.2

• Russia Also Displayed Significant Government Involvement: Russia’s socialist and communist history has led to noteworthy government ownership in the Energy and Financials sectors. Although the recent Ukrainian conflicts have further depressed valuations, the Russian Energy sector had already displayed depressed valuations compared to the broader emerging markets before the crisis. For example, Gazprom and Rosneft, two of the largest state-owned energy companies, have dividend yields north of 5% and P/E ratios under 5x.3

WisdomTree Emerging Markets ex-State-Owned Enterprises Index

WisdomTree created a broad-based Index to emerging market stocks that are not state-owned enterprises; this Index will help investors monitor the performance of this subset. In a future blog post, we will introduce this new Index, the WisdomTree Emerging Markets ex-State-Owned Enterprises (EMXSOE), designed to measure the performance of broad-based emerging market stocks that exclude state-owned companies.

1Sources: WisdomTree, Standard and Poor’s, as of 7/31/14.

2Sources: WisdomTree, Bloomberg; refers to the five largest dividend-paying Chinese banks as of 9/30/14.

3Sources: WisdomTree, Bloomberg, as of 9/30/14. The WisdomTree Emerging Markets Ex State Owned Enterprises Index does not hold Gazprom or Rosneft.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.