How to Position Your International Portfolio

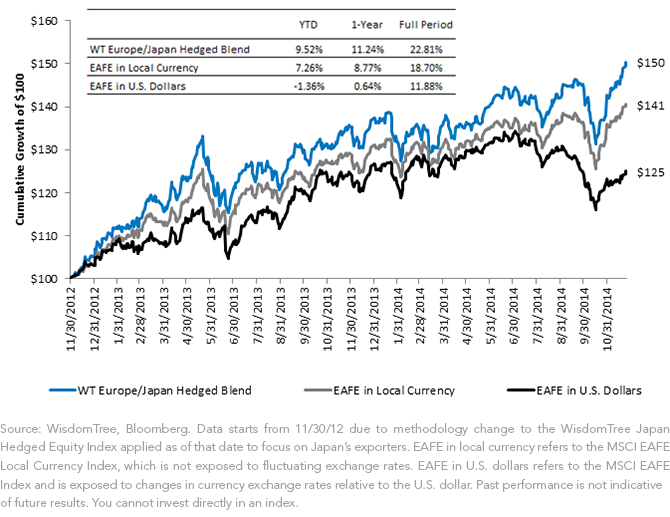

• In 2014, the year-to-date differential from the WisdomTree Europe/Japan (60/40) blend over MSCI EAFE in U.S. dollars was more than 10 percentage points. This shows just how important currency was as a driver of international returns in 2014.

• The WT Hedged Blend Performs Well Compared to EAFE in Local Currency: Over this period, we can see clearly that the blend outpaced the EAFE in local currency. The correlation between the two was actually 0.95—a very high number—showing how closely tied these two markets are to the overall international benchmarks.

• Japan Drives the Relative Gains: Over the past two years, Japan has been a robust generator of strong equity market returns—returns that if unhedged would be significantly cut by the depreciation of the yen. As we have written here, we remain optimistic on prospects for Japan from a standpoint of valuation as well as increased flows from the Bank of Japan, the Japanese pension funds and other institutional investors.

• Why Europe/Japan May Be Opportunely Focused Blend: Since the WisdomTree Europe Hedged Equity Index focuses solely on equity markets that use the euro currency, the United Kingdom (approximately 21% of MSCI EAFE) and Switzerland (approximately 9% of MSCI EAFE)4 are missed. The only other market with a greater than 5% weight in the MSCI EAFE that is missed is Australia (approximately 8% of MSCI EAFE) . We’d note that the case for central bank policy divergence is the most clear with Europe and Japan—the United Kingdom is actually close to hiking rates alongside the U.S. Federal Reserve, and the cost to hedge Australia currency exposure is higher due to the country’s higher short-term interest rates. Investors may therefore think this blended combination of currency hedging Europe and Japan is where to focus the currency hedge part of international benchmarks.

Currency Hedging Becoming a More Important Consideration: The difference between EAFE in local currency and EAFE in U.S. dollars has been widening, starting from July 2014 when the yen (-12.86%), the euro (-6.84%) and the pound (-6.98%) depreciated against the U.S. dollar, with specific levels of depreciation noted in parentheses5. The one-month interest rate differentials between the Euro and the Yen contribute to making the current cost to hedge these currencies inexpensive. Given the uncertain nature of exchange rates, we believe at least blending in partial currency hedges makes sense for international investors, and the 60/40 Europe/Japan blend discussed in this piece is where we’d begin the focus.

1Broad international benchmarks: Refers to the MSCI EAFE Index and the MSCI EAFE Local Currency Index, as measures of the performance of developed international equities with and without the risk of fluctuating currencies against the U.S. dollar.

2Source: Bloomberg for data on exposures within the MSCI EAFE Index as of 11/25/14. Subject to change.

360% Europe/40% Japan hedged equity blend: Refers to a 60% weight to the WisdomTree Europe Hedged Equity Index and a 40% weight to the WisdomTree Japan Hedged Equity Index, rebalanced annually.

4Source: Bloomberg for data on exposures within the MSCI EAFE Index as of 11/25/14. Subject to change.

5Source: Bloomberg, with depreciation versus U.S. dollar measured from 7/31/14–11/25/14.

• In 2014, the year-to-date differential from the WisdomTree Europe/Japan (60/40) blend over MSCI EAFE in U.S. dollars was more than 10 percentage points. This shows just how important currency was as a driver of international returns in 2014.

• The WT Hedged Blend Performs Well Compared to EAFE in Local Currency: Over this period, we can see clearly that the blend outpaced the EAFE in local currency. The correlation between the two was actually 0.95—a very high number—showing how closely tied these two markets are to the overall international benchmarks.

• Japan Drives the Relative Gains: Over the past two years, Japan has been a robust generator of strong equity market returns—returns that if unhedged would be significantly cut by the depreciation of the yen. As we have written here, we remain optimistic on prospects for Japan from a standpoint of valuation as well as increased flows from the Bank of Japan, the Japanese pension funds and other institutional investors.

• Why Europe/Japan May Be Opportunely Focused Blend: Since the WisdomTree Europe Hedged Equity Index focuses solely on equity markets that use the euro currency, the United Kingdom (approximately 21% of MSCI EAFE) and Switzerland (approximately 9% of MSCI EAFE)4 are missed. The only other market with a greater than 5% weight in the MSCI EAFE that is missed is Australia (approximately 8% of MSCI EAFE) . We’d note that the case for central bank policy divergence is the most clear with Europe and Japan—the United Kingdom is actually close to hiking rates alongside the U.S. Federal Reserve, and the cost to hedge Australia currency exposure is higher due to the country’s higher short-term interest rates. Investors may therefore think this blended combination of currency hedging Europe and Japan is where to focus the currency hedge part of international benchmarks.

Currency Hedging Becoming a More Important Consideration: The difference between EAFE in local currency and EAFE in U.S. dollars has been widening, starting from July 2014 when the yen (-12.86%), the euro (-6.84%) and the pound (-6.98%) depreciated against the U.S. dollar, with specific levels of depreciation noted in parentheses5. The one-month interest rate differentials between the Euro and the Yen contribute to making the current cost to hedge these currencies inexpensive. Given the uncertain nature of exchange rates, we believe at least blending in partial currency hedges makes sense for international investors, and the 60/40 Europe/Japan blend discussed in this piece is where we’d begin the focus.

1Broad international benchmarks: Refers to the MSCI EAFE Index and the MSCI EAFE Local Currency Index, as measures of the performance of developed international equities with and without the risk of fluctuating currencies against the U.S. dollar.

2Source: Bloomberg for data on exposures within the MSCI EAFE Index as of 11/25/14. Subject to change.

360% Europe/40% Japan hedged equity blend: Refers to a 60% weight to the WisdomTree Europe Hedged Equity Index and a 40% weight to the WisdomTree Japan Hedged Equity Index, rebalanced annually.

4Source: Bloomberg for data on exposures within the MSCI EAFE Index as of 11/25/14. Subject to change.

5Source: Bloomberg, with depreciation versus U.S. dollar measured from 7/31/14–11/25/14.

Important Risks Related to this Article

Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.