India: A Focus on Earnings Leading to Large Gains

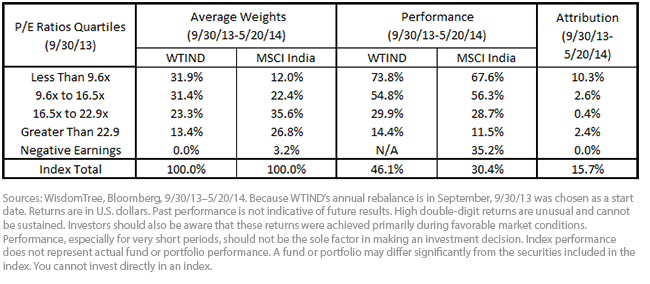

• Low P/E Ratio Overweight Drove Outperformance – WTIND’s overweight exposure to low P/E stocks added more than 10% of outperformance compared to the MSCI India Index. This is impressive considering it accounted for almost two-thirds of the total 15.7% outperformance during the period.

• More Weight in Lower P/E Ratios – WTIND had over 2.5x more weight in firms with the lowest P/E ratios. Evenly impressive is the fact that WTIND had almost two-thirds of its weights in firms with a P/E ratio less than 16.5x earnings, compared to the MSCI India Index, which had more than two-thirds of its weight in firms with a P/E ratio greater than 16.5x earnings.

• Lower P/E Ratio Firms Outperformed – Firms within the lowest quartile outperformed firms in the highest quartile by more than 55% within both WTIND and MSCI India. Although the performance differentials among quartiles for the Indexes were similar, WTIND was able to outperform over the period as a result of its overweight to stocks within the lowest P/E quartiles. When sentiment gets very negative, the market often moves more than changes in fundamentals — in this case the earnings. Rebalancing back to those fundamentals may then be rewarded when positive sentiment returns, as we have seen in last nine months.

• No Weight In Negative Earnings – Since WTIND screens companies for inclusion based on earnings, the Index will remove all unprofitable companies at its annual reconstitution. While company earnings may fluctuate between screening dates, we think this annual screening factor helps the Index manage valuation risks.

Weighting by Earnings Focuses on Lower P/E Ratios

Given how low-priced stocks contributed to the performance, let’s discuss how the Index continually focuses on this segment of the Indian market at each annual rebalance. In order to garner significant weights in the Index, the index methodology requires that a company grow its profits rather than increase its market capitalization. As a result, we can generalize the impact of the rebalance as follows:

• Typical Additions in Weight – Firms whose share prices may have performed poorly or stayed flat but whose earnings increased.

• Typical Reductions in Weight – Firms whose share prices may have performed quite well but whose earnings growth was negative or flat.

This rebalancing process is a key differentiating element of WisdomTree’s indexing approach and one that WisdomTree believes will continue to provide value over time.

Conclusion

The landslide victory by Narendra Modi and his party in the Indian prime minister election has garnered much attention and celebration in equities. A concern with such large gains in a short period is that the market may become expensive. WisdomTree’s earnings-weighted approach helps to focus on lower-priced segments of the Indian market, and the Index rebalances each September to help manage the valuation risk from the big winners. For those looking for continued improvement in India, EPI — which can be considered a broad representative of the Indian market and economy, but also employs a process to manage equity valuation risk — could be an attractive way to gain exposure to India.

• Low P/E Ratio Overweight Drove Outperformance – WTIND’s overweight exposure to low P/E stocks added more than 10% of outperformance compared to the MSCI India Index. This is impressive considering it accounted for almost two-thirds of the total 15.7% outperformance during the period.

• More Weight in Lower P/E Ratios – WTIND had over 2.5x more weight in firms with the lowest P/E ratios. Evenly impressive is the fact that WTIND had almost two-thirds of its weights in firms with a P/E ratio less than 16.5x earnings, compared to the MSCI India Index, which had more than two-thirds of its weight in firms with a P/E ratio greater than 16.5x earnings.

• Lower P/E Ratio Firms Outperformed – Firms within the lowest quartile outperformed firms in the highest quartile by more than 55% within both WTIND and MSCI India. Although the performance differentials among quartiles for the Indexes were similar, WTIND was able to outperform over the period as a result of its overweight to stocks within the lowest P/E quartiles. When sentiment gets very negative, the market often moves more than changes in fundamentals — in this case the earnings. Rebalancing back to those fundamentals may then be rewarded when positive sentiment returns, as we have seen in last nine months.

• No Weight In Negative Earnings – Since WTIND screens companies for inclusion based on earnings, the Index will remove all unprofitable companies at its annual reconstitution. While company earnings may fluctuate between screening dates, we think this annual screening factor helps the Index manage valuation risks.

Weighting by Earnings Focuses on Lower P/E Ratios

Given how low-priced stocks contributed to the performance, let’s discuss how the Index continually focuses on this segment of the Indian market at each annual rebalance. In order to garner significant weights in the Index, the index methodology requires that a company grow its profits rather than increase its market capitalization. As a result, we can generalize the impact of the rebalance as follows:

• Typical Additions in Weight – Firms whose share prices may have performed poorly or stayed flat but whose earnings increased.

• Typical Reductions in Weight – Firms whose share prices may have performed quite well but whose earnings growth was negative or flat.

This rebalancing process is a key differentiating element of WisdomTree’s indexing approach and one that WisdomTree believes will continue to provide value over time.

Conclusion

The landslide victory by Narendra Modi and his party in the Indian prime minister election has garnered much attention and celebration in equities. A concern with such large gains in a short period is that the market may become expensive. WisdomTree’s earnings-weighted approach helps to focus on lower-priced segments of the Indian market, and the Index rebalances each September to help manage the valuation risk from the big winners. For those looking for continued improvement in India, EPI — which can be considered a broad representative of the Indian market and economy, but also employs a process to manage equity valuation risk — could be an attractive way to gain exposure to India.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.