Robust Demand Continues for Floating Rate Treasury Debt

Catalysts for Investment

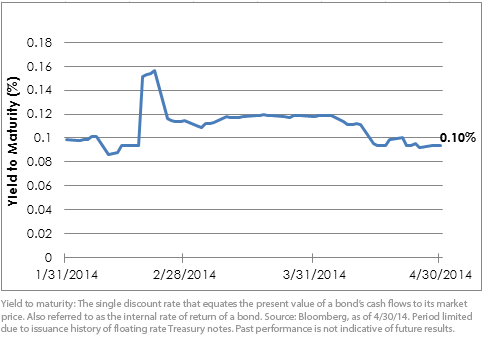

In my view, floating rate Treasuries make sense in the current market environment for investors looking for a cash-like alternative with very little interest rate risk and virtually zero credit risk. Given that short-term interest rates are at all-time lows and the Federal Reserve (Fed) has stated that it could be at least a year before it begins hiking rates, it may not make sense for investors to devote a large portion of their portfolios to these securities.

However, this will not always be the case. I believe that once the market has fully digested tapering and starts to focus on the timing of the first round of interest rate hikes by the Fed, the value of these securities will begin to show their worth compared to money market securities and other longer-term fixed income securities. Given the weekly reset, the floaters should adjust more quickly than Treasury bills and will likely be spared the potential losses experienced by two-year Treasury notes as the market adjusts to future hikes in the federal funds rate.

1Source: U.S. Department of the Treasury

2Source: Bloomberg

Catalysts for Investment

In my view, floating rate Treasuries make sense in the current market environment for investors looking for a cash-like alternative with very little interest rate risk and virtually zero credit risk. Given that short-term interest rates are at all-time lows and the Federal Reserve (Fed) has stated that it could be at least a year before it begins hiking rates, it may not make sense for investors to devote a large portion of their portfolios to these securities.

However, this will not always be the case. I believe that once the market has fully digested tapering and starts to focus on the timing of the first round of interest rate hikes by the Fed, the value of these securities will begin to show their worth compared to money market securities and other longer-term fixed income securities. Given the weekly reset, the floaters should adjust more quickly than Treasury bills and will likely be spared the potential losses experienced by two-year Treasury notes as the market adjusts to future hikes in the federal funds rate.

1Source: U.S. Department of the Treasury

2Source: Bloomberg

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but they may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.