Are There Valuation Improvements in Russia?

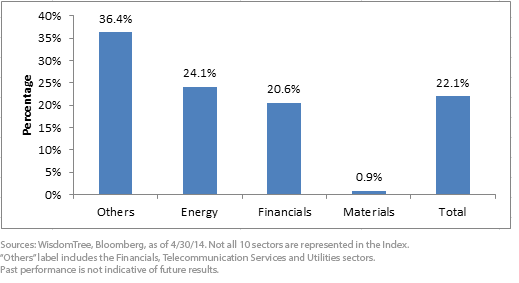

• Energy Is Largest Payer – The sector is by far the largest in the Index, accounting for more than 60% of the total Dividend Stream. Dividend increases from Russia’s largest Energy firms, including Rosneft and Gazprom, led the Dividend Stream growth with 60% and 20% growth, respectively. With these dividend increases, both Rosneft and Gazprom had an indicated dividend yield over 5%, higher than their estimated price-to-earnings ratios of 4.8x and 2.7x. Gazprom is targeting a dividend payout ratio of between 17.5% and 35%, and Rosneft targets a payout ratio of 25%. The median dividend payout among all firms in the Index is 26%.6

• Financials Are Another Important Payer – The largest payer in the sector was Sberbank, which happens to be the largest bank in Russia.7 Sberbank was able to grow its dividend by an impressive 25%. I think it is important to see dividend growth among financial firms because future economic growth typically relies on the financing they provide.

• Other Sectors Displayed Growth – Although not all sectors are represented in the Index, it is quite impressive that we saw growth among the majority of sectors represented. One of the largest growers within the other category is from Consumer Staples firm Magnit OJSC, Russia’s largest retailer by number of stores and revenue. It recently reported sales growth of 30%, which possibly signals strong underlying consumption trend growth.8 Given its broad exposure and penetration across Russia, I think this company is well-positioned to benefit from a growing emerging market consumer. Other large growers within the other category were Telecommunication Services firms Mobile TeleSystems and Sistema, with growth rates of 63% and 115%, respectively. Utilities were the only sector that didn’t see growth, and this is because there is only one Utility firm in the Index and it hasn’t announced its yearly dividend yet.

Outlook

There remains a lively debate about the ongoing risks from investing in Russia during this time of conflict, but how much of the risks are already priced into these securities? These concerns have caused major Russian companies to trade at depressed valuations, whether looking at price-to-earnings ratios or dividend yields compared to their historical medians. Famed investment writer James Grant recently referred to Gazprom as being the opposite of Tesla Motors, pointing to the former’s discounted valuations and high dividend yield as reasons to own the stock.

During times of volatility, the focus tends to be less on individual companies and their fundamentals and more on fears of a worsening situation. Recent dividend announcements from some of the largest companies in Russia are fundamentally positive, and if the situation improves in the region, these stocks may indeed represent significant investment opportunities.

For current holdings of the WisdomTree Emerging Markets Dividend Index, click here.

1Sources: WisdomTree, Bloomberg, historical median calculated from 4/30/04–4/30/14

2Source: Bloomberg, 4/30/14

3Sources: WisdomTree, Bloomberg, historical median calculated from 4/30/04–4/30/14

4Source: WisdomTree, Bloomberg, 4/30/14

5Source: Bloomberg, 4/30/13–4/30/14

6Source: Bloomberg, 4/30/14

7Source: Bloomberg, 4/30/14

8Source: Magnit Q1 2014 Investor Presentation, 4/30/14

• Energy Is Largest Payer – The sector is by far the largest in the Index, accounting for more than 60% of the total Dividend Stream. Dividend increases from Russia’s largest Energy firms, including Rosneft and Gazprom, led the Dividend Stream growth with 60% and 20% growth, respectively. With these dividend increases, both Rosneft and Gazprom had an indicated dividend yield over 5%, higher than their estimated price-to-earnings ratios of 4.8x and 2.7x. Gazprom is targeting a dividend payout ratio of between 17.5% and 35%, and Rosneft targets a payout ratio of 25%. The median dividend payout among all firms in the Index is 26%.6

• Financials Are Another Important Payer – The largest payer in the sector was Sberbank, which happens to be the largest bank in Russia.7 Sberbank was able to grow its dividend by an impressive 25%. I think it is important to see dividend growth among financial firms because future economic growth typically relies on the financing they provide.

• Other Sectors Displayed Growth – Although not all sectors are represented in the Index, it is quite impressive that we saw growth among the majority of sectors represented. One of the largest growers within the other category is from Consumer Staples firm Magnit OJSC, Russia’s largest retailer by number of stores and revenue. It recently reported sales growth of 30%, which possibly signals strong underlying consumption trend growth.8 Given its broad exposure and penetration across Russia, I think this company is well-positioned to benefit from a growing emerging market consumer. Other large growers within the other category were Telecommunication Services firms Mobile TeleSystems and Sistema, with growth rates of 63% and 115%, respectively. Utilities were the only sector that didn’t see growth, and this is because there is only one Utility firm in the Index and it hasn’t announced its yearly dividend yet.

Outlook

There remains a lively debate about the ongoing risks from investing in Russia during this time of conflict, but how much of the risks are already priced into these securities? These concerns have caused major Russian companies to trade at depressed valuations, whether looking at price-to-earnings ratios or dividend yields compared to their historical medians. Famed investment writer James Grant recently referred to Gazprom as being the opposite of Tesla Motors, pointing to the former’s discounted valuations and high dividend yield as reasons to own the stock.

During times of volatility, the focus tends to be less on individual companies and their fundamentals and more on fears of a worsening situation. Recent dividend announcements from some of the largest companies in Russia are fundamentally positive, and if the situation improves in the region, these stocks may indeed represent significant investment opportunities.

For current holdings of the WisdomTree Emerging Markets Dividend Index, click here.

1Sources: WisdomTree, Bloomberg, historical median calculated from 4/30/04–4/30/14

2Source: Bloomberg, 4/30/14

3Sources: WisdomTree, Bloomberg, historical median calculated from 4/30/04–4/30/14

4Source: WisdomTree, Bloomberg, 4/30/14

5Source: Bloomberg, 4/30/13–4/30/14

6Source: Bloomberg, 4/30/14

7Source: Bloomberg, 4/30/14

8Source: Magnit Q1 2014 Investor Presentation, 4/30/14Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focused in Russia are increasing the impact of events and developments associated with the region, which can adversely affect performance.