How to Reposition in Less Expensive Stocks

WTSEI Pushes Weight into the Lowest P/E Quartile (as of 11/30/2013 Index Screening)

WTSEI Pushes Weight into the Lowest P/E Quartile (as of 11/30/2013 Index Screening)

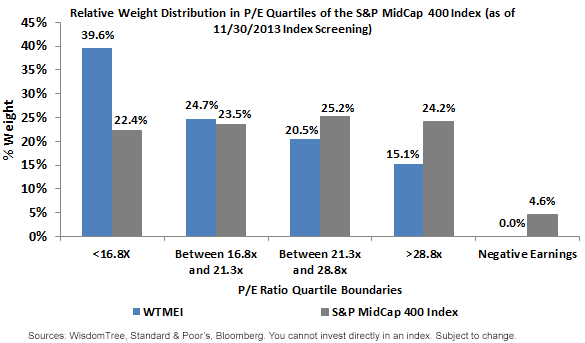

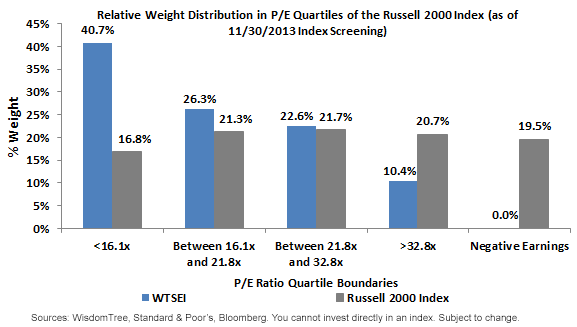

• Two-Thirds’ Weight in Lower P/E Quartiles: Both WTMEI and WTSEI have approximately two-thirds of their constituent weight in firms in the two lower P/E ratio quartiles. Effectively, this illustrates an important impact of an earnings-weighted approach. The market capitalization-weighted indexes show much different positioning.

• Valuation Expansion Doesn’t Impact All Firms Equally: We have indicated in a prior blog post that an important driver of the returns witnessed in 2013 has been the expansion, or increase, of the P/E multiple. At face value, some may look at changing index-level P/E multiples and conclude that U.S. small- or mid-cap stocks have become expensive. However, we believe that some more appropriate conclusions could be:

o P/E Ratios Have Increased for Some Firms: One important reason for this has been earnings contractions, as there have been firms that have lost money over the prior year.

o Opportunities Still Abound: What these charts tell us is that there are small- and mid-cap firms with lower P/E ratios and not all mid- and small-cap companies are expensive.

Dealing with Negative Earnings

Each of the indexes featured in these charts has a different objective, which determines how they deal with firms with negative earnings over the prior year. The Russell 2000 Index, seeking broadness of exposure, allows constituents to be initially included with negative earnings, which explains why it has almost a 20% weight in such firms. The S&P MidCap 400 Index requires four quarters of positive, cumulative earnings prior to initial index inclusion—it thus has less exposure to firms with negative earnings over the prior 12 months than the Russell 2000 Index. Finally, the WisdomTree Indexes (both WTMEI and WTSEI) require four quarters of cumulative positive earnings leading up to every screening date. That’s why it has a zero exposure within these charts. Minimizing (or eliminating) exposure to firms with negative earnings can also help lower the P/E ratio of a broader index.

Concluding the 2013 WisdomTree Earnings Family Rebalance Series

This blog post concludes our series on the 2013 Earnings Family rebalance. We believe the crucial takeaways are:

• U.S. equity market performance3 has been strong as of late, driving the potential for stocks to become more expensive.

• A relative value rebalance can help trim weight from strong performers and reallocate it to those that haven’t kept pace.

• Weighting by earnings can potentially tilt more weight toward firms with lower P/E ratios.

While none of this can in any way guarantee future performance, we believe it can potentially provide a disciplined approach that’s lacking in market capitalization-weighted indexes.

1Refers to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index.

2Source: Bloomberg, as of 11/30/2013.

3Refers specifically to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index all performing well from 12/31/2012 to 11/30/2013; source: Bloomberg, as of 11/30/2013.

• Two-Thirds’ Weight in Lower P/E Quartiles: Both WTMEI and WTSEI have approximately two-thirds of their constituent weight in firms in the two lower P/E ratio quartiles. Effectively, this illustrates an important impact of an earnings-weighted approach. The market capitalization-weighted indexes show much different positioning.

• Valuation Expansion Doesn’t Impact All Firms Equally: We have indicated in a prior blog post that an important driver of the returns witnessed in 2013 has been the expansion, or increase, of the P/E multiple. At face value, some may look at changing index-level P/E multiples and conclude that U.S. small- or mid-cap stocks have become expensive. However, we believe that some more appropriate conclusions could be:

o P/E Ratios Have Increased for Some Firms: One important reason for this has been earnings contractions, as there have been firms that have lost money over the prior year.

o Opportunities Still Abound: What these charts tell us is that there are small- and mid-cap firms with lower P/E ratios and not all mid- and small-cap companies are expensive.

Dealing with Negative Earnings

Each of the indexes featured in these charts has a different objective, which determines how they deal with firms with negative earnings over the prior year. The Russell 2000 Index, seeking broadness of exposure, allows constituents to be initially included with negative earnings, which explains why it has almost a 20% weight in such firms. The S&P MidCap 400 Index requires four quarters of positive, cumulative earnings prior to initial index inclusion—it thus has less exposure to firms with negative earnings over the prior 12 months than the Russell 2000 Index. Finally, the WisdomTree Indexes (both WTMEI and WTSEI) require four quarters of cumulative positive earnings leading up to every screening date. That’s why it has a zero exposure within these charts. Minimizing (or eliminating) exposure to firms with negative earnings can also help lower the P/E ratio of a broader index.

Concluding the 2013 WisdomTree Earnings Family Rebalance Series

This blog post concludes our series on the 2013 Earnings Family rebalance. We believe the crucial takeaways are:

• U.S. equity market performance3 has been strong as of late, driving the potential for stocks to become more expensive.

• A relative value rebalance can help trim weight from strong performers and reallocate it to those that haven’t kept pace.

• Weighting by earnings can potentially tilt more weight toward firms with lower P/E ratios.

While none of this can in any way guarantee future performance, we believe it can potentially provide a disciplined approach that’s lacking in market capitalization-weighted indexes.

1Refers to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index.

2Source: Bloomberg, as of 11/30/2013.

3Refers specifically to the Russell 3000 Index, S&P 500 Index, S&P MidCap 400 Index and Russell 2000 Index all performing well from 12/31/2012 to 11/30/2013; source: Bloomberg, as of 11/30/2013. Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.