What Tools Can Investors Use to Reduce Interest Rate Risk?

Potential Tradeoffs

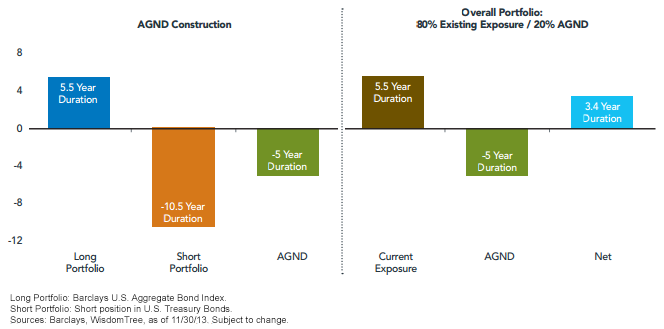

Although the Fund seeks to target a negative five-year duration, an increase in rates of 100 basis points does not necessarily guarantee a 5% price return. Given that interest rates may rise at different speeds along various points of the yield curve, it may be possible that the targeted negative exposure is not effective at offsetting losses from long bond positions. Additionally, should rates remain constant (or fall), the strategy may underperform a long-only portfolio. However, given the low cost of this insurance in today’s market environment, we believe that the potential upside for rising rates outweighs the potential losses in carry from putting on this exposure.

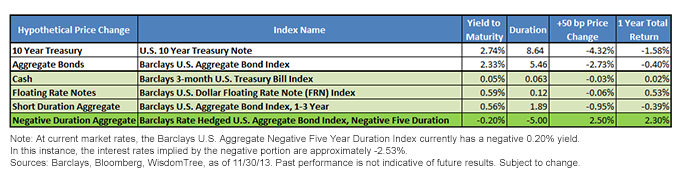

A Summary of Bond Yields and Durations as of November 30, 2013

Potential Tradeoffs

Although the Fund seeks to target a negative five-year duration, an increase in rates of 100 basis points does not necessarily guarantee a 5% price return. Given that interest rates may rise at different speeds along various points of the yield curve, it may be possible that the targeted negative exposure is not effective at offsetting losses from long bond positions. Additionally, should rates remain constant (or fall), the strategy may underperform a long-only portfolio. However, given the low cost of this insurance in today’s market environment, we believe that the potential upside for rising rates outweighs the potential losses in carry from putting on this exposure.

A Summary of Bond Yields and Durations as of November 30, 2013

For definitions of terms and indexes in the chart above please visit our Glossary.

As we have shown, investors have a variety of ways of attempting to mitigate the impact of rising rates on their bond portfolios. As another tool for reducing overall interest rate risk in a portfolio, strategies with a negative duration exposure can be used not only as a standalone tactical investment, but also as a way to help offset interest rate risk across their broader fixed income portfolio.

1Investors have also sought to increase credit risk in their portfolios as a way of reducing interest rate risk, but we are attempting to only focus on the impact of higher rates.

For definitions of terms and indexes in the chart above please visit our Glossary.

As we have shown, investors have a variety of ways of attempting to mitigate the impact of rising rates on their bond portfolios. As another tool for reducing overall interest rate risk in a portfolio, strategies with a negative duration exposure can be used not only as a standalone tactical investment, but also as a way to help offset interest rate risk across their broader fixed income portfolio.

1Investors have also sought to increase credit risk in their portfolios as a way of reducing interest rate risk, but we are attempting to only focus on the impact of higher rates.Important Risks Related to this Article

The AGND Fund is new and has a limited operating history. There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions of U.S. Treasuries where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of certain Fund’s they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. ALPS Distributors, Inc. is not affiliated with Barclays. Barclays Capital Inc. and its affiliates ("Barclays") is not the issuer or producer of the Fund and Barclays has no responsibilities, obligations or duties to investors in the Fund. This Barclays Index is a trademark owned by Barclays Bank PLC and licensed for use by WisdomTree with respect to the WisdomTree trust as the Issuer of the Fund. Barclays only relationship to WisdomTree is the licensing of these Barclays Indexes which is determined, composed and calculated by Barclays without regard to WisdomTree or the Funds. While WisdomTree may for itself execute transaction(s) with Barclays in or relating to these Barclays Indexes in connection with the Funds that investors acquire from WisdomTree, investors in the Funds neither acquire any interest in these Barclays Indexes nor enter into any relationship of any kind whatsoever with Barclays upon making an investment in the Funds. The Funds are not sponsored, endorsed, sold or promoted by Barclays, and Barclays makes no representation or warranty (express or implied) to the owners of the Funds, the Issuer or members of the public regarding the advisability, legality or suitability of the Funds or use of these Barclays Indexes or any data included therein. Barclays shall not be liable in any way to the Issuer, investors, or to other third parties in respect of the use or accuracy of these Barclays Indexes or any data included therein or in connection with the administration, marketing, purchasing or performance of the Funds.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.