Trimming Winning Stock Positions in U.S. Mid Caps

• Nearly 40% of Weight Returned Over 50%: It was a great year in U.S. mid-caps, and WTMEI’s constituents were no exception. The overall Index returned approximately 40% between annual rebalance screening dates. Prior to the November 30, 2013, screening, almost 40% of its weight was in constituents that had returned better than 50%.

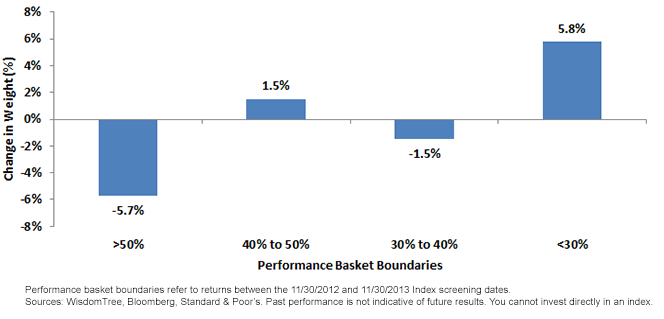

• Subtracting from Winners and Adding to Losers: Regardless of how strong a year it must be to have “losers” defined as those returning less than 30%, we clearly see that weight is taken from those firms with returns greater than 50% over the prior year and redistributed to firms with returns below 30%.

• Accounting for the “Drop-Down” and “Move Up” Effects: Some might correctly point out the possibility for underperforming firms in the WisdomTree Earnings 500 Index (WTEPS) to decrease in their market capitalizations such that they can become constituents of WTMEI. On the other hand, there is also the possibility for strongly performing constituents of the WisdomTree SmallCap Earnings Index (WTSEI) to increase in market capitalization and ultimately qualify for membership in WTMEI. Looking at these impacts:

o Drop-Downs: Drop-downs from WTEPS accounted for approximately 7% of the weight in WTMEI as of the November 30 screening. Their average performance was 5%—definitely below that of the broader U.S. large-cap equity market.

o Move-Ups: Move-Ups from WTSEI accounted for approximately 4% of the weight in WTMEI as of the November 30 screening. Their average performance was greater than 100%—definitely above that of the broader U.S. small-cap equity market.

Effectively Taking the “Decision” Off the Table

WTMEI’s relative value rebalance, the mechanics of which are seen above, is helpful in that it attacks the market in a disciplined way each and every year. This is especially important after the phenomenal performance of U.S. mid-caps this year, in that we believe investors might tend to want to hold on to the stronger performers. In sticking to the investment mantra “buy low, sell high,” a relative value rebalance may aid in accomplishing this notably difficult action as well as allowing for the potential to become smarter with mid-cap beta.5

1Mid-cap equity: Refers to the S&P MidCap 400 Index.

2Refers to the period from 12/31/2012 to 11/30/2013; source: Bloomberg.

3U.S. large caps: Refers to the S&P 500 Index.

4Refers to the period between the 11/30/2012 and 11/30/2013 Index screenings.

5A play on the term “smart beta,” which means rules-based investment strategies that don’t use conventional market-cap weightings.

• Nearly 40% of Weight Returned Over 50%: It was a great year in U.S. mid-caps, and WTMEI’s constituents were no exception. The overall Index returned approximately 40% between annual rebalance screening dates. Prior to the November 30, 2013, screening, almost 40% of its weight was in constituents that had returned better than 50%.

• Subtracting from Winners and Adding to Losers: Regardless of how strong a year it must be to have “losers” defined as those returning less than 30%, we clearly see that weight is taken from those firms with returns greater than 50% over the prior year and redistributed to firms with returns below 30%.

• Accounting for the “Drop-Down” and “Move Up” Effects: Some might correctly point out the possibility for underperforming firms in the WisdomTree Earnings 500 Index (WTEPS) to decrease in their market capitalizations such that they can become constituents of WTMEI. On the other hand, there is also the possibility for strongly performing constituents of the WisdomTree SmallCap Earnings Index (WTSEI) to increase in market capitalization and ultimately qualify for membership in WTMEI. Looking at these impacts:

o Drop-Downs: Drop-downs from WTEPS accounted for approximately 7% of the weight in WTMEI as of the November 30 screening. Their average performance was 5%—definitely below that of the broader U.S. large-cap equity market.

o Move-Ups: Move-Ups from WTSEI accounted for approximately 4% of the weight in WTMEI as of the November 30 screening. Their average performance was greater than 100%—definitely above that of the broader U.S. small-cap equity market.

Effectively Taking the “Decision” Off the Table

WTMEI’s relative value rebalance, the mechanics of which are seen above, is helpful in that it attacks the market in a disciplined way each and every year. This is especially important after the phenomenal performance of U.S. mid-caps this year, in that we believe investors might tend to want to hold on to the stronger performers. In sticking to the investment mantra “buy low, sell high,” a relative value rebalance may aid in accomplishing this notably difficult action as well as allowing for the potential to become smarter with mid-cap beta.5

1Mid-cap equity: Refers to the S&P MidCap 400 Index.

2Refers to the period from 12/31/2012 to 11/30/2013; source: Bloomberg.

3U.S. large caps: Refers to the S&P 500 Index.

4Refers to the period between the 11/30/2012 and 11/30/2013 Index screenings.

5A play on the term “smart beta,” which means rules-based investment strategies that don’t use conventional market-cap weightings.Important Risks Related to this Article

Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.