What Role Can Negative Duration High Yield Play in Investor Portfolios?

For definitions of terms in the chart, please visit our Glossary.

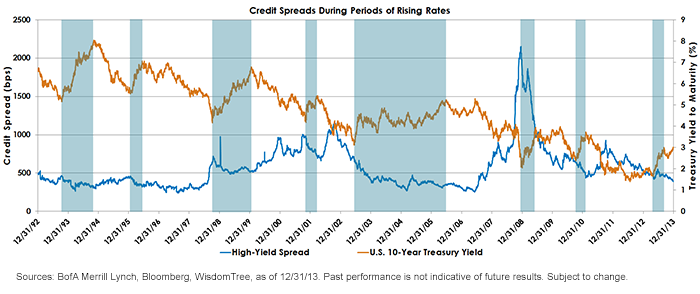

Historically, interest rates have tended to rise as a function of a growing economy. Additionally, as shown in the chart above, in most of these periods of rising rates (shaded blue), credit spreads have tended to decline. One rationale behind this is that with stronger economic growth, borrowers may pose less credit risk to lenders. However, from a traditional bond investor’s perspective, gains from tightening credit spreads were oftentimes offset by losses from increases in nominal interest rates. In the case of a negative duration, high-yield exposure, investors could benefit from both sides of the trade: increases in interest rates and declines in credit spreads.

Through the combination of a high-yield bond portfolio and a negative duration component, we believe that this integrated approach to fixed income may stand to benefit in a rising-rate environment as outlined above. For investors with a broader portfolio of interest rate-sensitive investments, a negative duration, high-yield approach may be a beneficial tool for maintaining current income and mitigating overall interest rate risk.

How Does HYND Work?

For definitions of terms in the chart, please visit our Glossary.

Historically, interest rates have tended to rise as a function of a growing economy. Additionally, as shown in the chart above, in most of these periods of rising rates (shaded blue), credit spreads have tended to decline. One rationale behind this is that with stronger economic growth, borrowers may pose less credit risk to lenders. However, from a traditional bond investor’s perspective, gains from tightening credit spreads were oftentimes offset by losses from increases in nominal interest rates. In the case of a negative duration, high-yield exposure, investors could benefit from both sides of the trade: increases in interest rates and declines in credit spreads.

Through the combination of a high-yield bond portfolio and a negative duration component, we believe that this integrated approach to fixed income may stand to benefit in a rising-rate environment as outlined above. For investors with a broader portfolio of interest rate-sensitive investments, a negative duration, high-yield approach may be a beneficial tool for maintaining current income and mitigating overall interest rate risk.

How Does HYND Work?

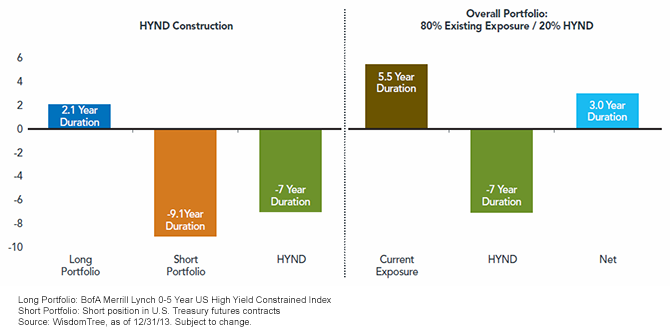

As shown above, HYND comprises a long portfolio of high-yield bonds and a short position of U.S. Treasury futures that target a negative 7-year duration. By taking a 20% allocation in HYND and the remainder in a traditional bond portfolio with a duration of 5.5 years, investors are able to reduce their net bond duration to 3 years.

Although investors will generally be better off if interest rates don’t move or decline relative to an unhedged position, we believe that HYND provides a reasonable balance between current income and negative interest rate exposure. Should nominal interest rates rise in 2014 and credit spreads decline, HYND could provide investors with stronger returns compared to unhedged bond portfolios.

As shown above, HYND comprises a long portfolio of high-yield bonds and a short position of U.S. Treasury futures that target a negative 7-year duration. By taking a 20% allocation in HYND and the remainder in a traditional bond portfolio with a duration of 5.5 years, investors are able to reduce their net bond duration to 3 years.

Although investors will generally be better off if interest rates don’t move or decline relative to an unhedged position, we believe that HYND provides a reasonable balance between current income and negative interest rate exposure. Should nominal interest rates rise in 2014 and credit spreads decline, HYND could provide investors with stronger returns compared to unhedged bond portfolios.

Important Risks Related to this Article

HYND is new and has a limited operating history. You cannot invest directly in an index. There are risks associated with investing, including possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. ALPS Distributors, Inc., is not affiliated with BofA Merrill Lynch. Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates (“BofA Merrill Lynch”) indexes and related information, the name “BofA Merrill Lynch” and related trademarks are intellectual property licensed from BofA Merrill Lynch and may not be copied, used or distributed without BofA Merrill Lynch’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability and are not regulated, issued, endorsed, sold, guaranteed or promoted by BofA Merrill Lynch. BOFA MERRILL LYNCH MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDEXES, ANY RELATED INFORMATION, ITS TRADEMARKS OR THE PRODUCT(S) (INCLUDING, WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.