Are Investors Under Allocated to India?

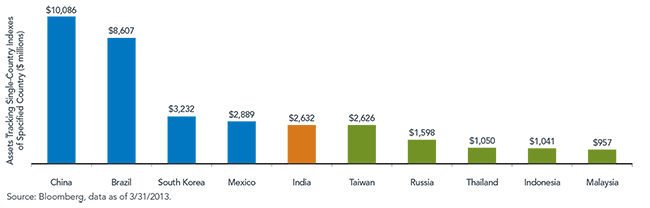

• Brazil & China: China AUM is by far the highest, followed by Brazil AUM. After Brazil, there is quite a drop-off.

• South Korea & Mexico: These countries are not part of BRIC, but the asset picture indicates significant interest. Both are ahead of the other two BRIC country AUMs, India and Russia.

Based on Economic Size and Growth Potential, Investors Appear Under-Allocated to India

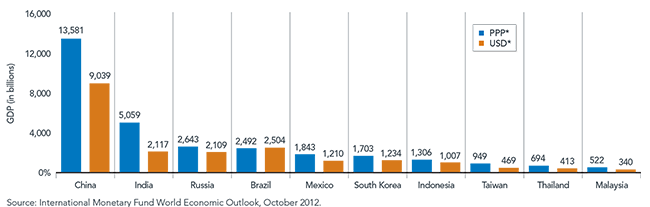

One metric that suggests investors are under-weight: the relative size of the various economies.

• Brazil & China: China AUM is by far the highest, followed by Brazil AUM. After Brazil, there is quite a drop-off.

• South Korea & Mexico: These countries are not part of BRIC, but the asset picture indicates significant interest. Both are ahead of the other two BRIC country AUMs, India and Russia.

Based on Economic Size and Growth Potential, Investors Appear Under-Allocated to India

One metric that suggests investors are under-weight: the relative size of the various economies.

• On a PPP basis, India is the second-largest economy behind China and third-largest economy with GDP measured in U.S. dollars.

• The large difference between India’s GDP in U.S. dollar terms versus PPP terms illustrates the potential for India’s currency to appreciate over time. It doesn’t necessarily imply immediate or significant appreciation of India’s currency, but we believe differences in PPP value of a currency is a sign of the currency’s undervalued nature.

• India, Russia and Brazil are very similarly sized on a USD GDP basis. However, Brazil AUM is about five times the size of Russia AUM and about three times the size of India AUM.

Based on economic size, it makes sense that China AUM ranks first—it’s the largest economy on this list by a significant margin, whichever exchange rate measurement is used. However, what makes less sense to us (again, just looking at the GDP data) is that South Korea and Mexico AUM are larger than India AUM and that the margin between Brazil AUM and India AUM is so great.

Economic Growth

Admittedly, absolute economic size is only part of the story. The potential for growth of those economies also is important.

• India Ranks Fourth: Of the countries included within our analysis, India exhibits the fourth-highest GDP growth rate based on International Monetary Fund estimates for 2013. This places it ahead of Brazil, South Korea and Mexico. In fact, by this metric, South Korea and Mexico are ranked 9th and 10th, respectively.

Conclusion

By these metrics, it intuitively makes sense that China ranks first in total assets among emerging market countries. However, after China, the allocation discussion becomes murky, when looking at economic size and growth. The size and growth potential of these economies do not show why Brazil, South Korea, or Mexico would have significantly more assets under management than India. In our next blog, we’ll discuss the potential of risk, returns and diversification in offering further explanation for these AUM rankings.

Read our full research here.

1Source: CIA World Factbook, July 2013 Population Estimate.

2Source: International Monetary Fund, World Economic Outlook, October 2012.

• On a PPP basis, India is the second-largest economy behind China and third-largest economy with GDP measured in U.S. dollars.

• The large difference between India’s GDP in U.S. dollar terms versus PPP terms illustrates the potential for India’s currency to appreciate over time. It doesn’t necessarily imply immediate or significant appreciation of India’s currency, but we believe differences in PPP value of a currency is a sign of the currency’s undervalued nature.

• India, Russia and Brazil are very similarly sized on a USD GDP basis. However, Brazil AUM is about five times the size of Russia AUM and about three times the size of India AUM.

Based on economic size, it makes sense that China AUM ranks first—it’s the largest economy on this list by a significant margin, whichever exchange rate measurement is used. However, what makes less sense to us (again, just looking at the GDP data) is that South Korea and Mexico AUM are larger than India AUM and that the margin between Brazil AUM and India AUM is so great.

Economic Growth

Admittedly, absolute economic size is only part of the story. The potential for growth of those economies also is important.

• India Ranks Fourth: Of the countries included within our analysis, India exhibits the fourth-highest GDP growth rate based on International Monetary Fund estimates for 2013. This places it ahead of Brazil, South Korea and Mexico. In fact, by this metric, South Korea and Mexico are ranked 9th and 10th, respectively.

Conclusion

By these metrics, it intuitively makes sense that China ranks first in total assets among emerging market countries. However, after China, the allocation discussion becomes murky, when looking at economic size and growth. The size and growth potential of these economies do not show why Brazil, South Korea, or Mexico would have significantly more assets under management than India. In our next blog, we’ll discuss the potential of risk, returns and diversification in offering further explanation for these AUM rankings.

Read our full research here.

1Source: CIA World Factbook, July 2013 Population Estimate.

2Source: International Monetary Fund, World Economic Outlook, October 2012.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.