Indian Rupee: Are Investors Overlooking an Opportunity?

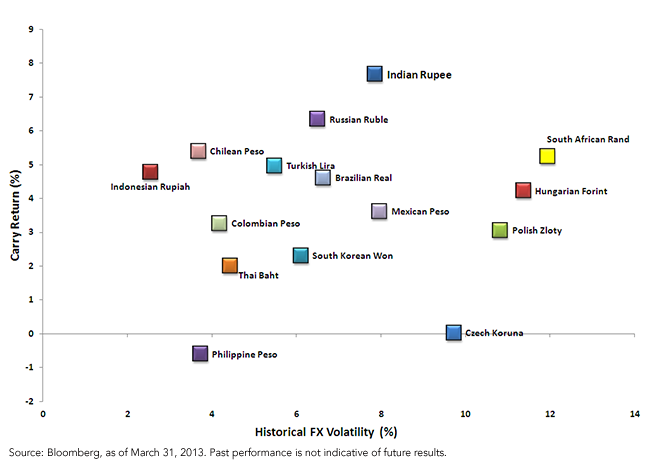

As the chart above shows, the Indian rupee has provided some of the highest implied interest rates of any emerging market country over the past year. However, it has also seen its volatility climb compared to other Asian and Latin American currencies over the past year. Yet when compared to many European or African currencies, the rupee has been comparatively attractive given its higher carry and lower levels of volatility.

Outlook for the Remainder of 2013

If rate cuts and inflows are supplemented by further political reforms, we believe the Indian rupee has the ability to deliver sizable appreciation against the U.S. dollar by the end of the year. Combined with higher local interest rates, investments in the Indian rupee could potentially provide an attractive entry point for investors near current levels.

1Source: International Monetary Fund (IMF), 2013.

2Source: Bloomberg, 4/30/2013.

3IMF, 2013.

4IMF, 3/31/2013.

5Source: Bloomberg, May 3, 2013

6Source: Bloomberg, 2013

As the chart above shows, the Indian rupee has provided some of the highest implied interest rates of any emerging market country over the past year. However, it has also seen its volatility climb compared to other Asian and Latin American currencies over the past year. Yet when compared to many European or African currencies, the rupee has been comparatively attractive given its higher carry and lower levels of volatility.

Outlook for the Remainder of 2013

If rate cuts and inflows are supplemented by further political reforms, we believe the Indian rupee has the ability to deliver sizable appreciation against the U.S. dollar by the end of the year. Combined with higher local interest rates, investments in the Indian rupee could potentially provide an attractive entry point for investors near current levels.

1Source: International Monetary Fund (IMF), 2013.

2Source: Bloomberg, 4/30/2013.

3IMF, 2013.

4IMF, 3/31/2013.

5Source: Bloomberg, May 3, 2013

6Source: Bloomberg, 2013Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Some funds focus their investments in specific regions or countries, thereby increasing the impact of events and developments associated with the region or country, which can adversely affect performance. Investments in emerging or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.