Portfolio Pilates: Building a Strong Core, Part I

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

In my next two blog posts, I am going to get back to basics by focusing on our core strategic Model Portfolios, specifically our Core Equity and our Fixed Income Model Portfolios. These two Model Portfolios serve as the base for almost every other Model Portfolio we manage, including our Strategic Multi-Asset Model Portfolios, our Endowment Model Portfolios, our Multi-Asset Income Model Portfolios and the Siegel-WisdomTree Longevity Model Portfolio.

As with all WisdomTree Model Portfolios, or Core Equity and Fixed Income Model Portfolios share certain common characteristics:

- They are global in nature. WisdomTree is a global asset management firm, and we believe in global diversification.

- They are ETF-centric, which we believe helps to optimize fees and taxes.

- They are open architecture and allocate to both WisdomTree and third-party strategies. This is (a) the right thing to do for advisors and end clients, (b) allows us the freedom to deploy other firms’ “best ideas”, and (c) helps us to build Model Portfolios diversified by both asset class and risk factor.

- The factor tilts (dividends, quality, value, size, etc.) embedded into most WisdomTree ETFs allow us to construct core/satellite Model Portfolios in a more cost- and tax-effective manner than the traditional approach, that involves building an inexpensive passive (i.e., market cap-weighted) core and surrounding that core with actively managed mutual funds or separately managed accounts. Mutual funds tend to be more expensive and less tax efficient than ETFs.

- WisdomTree charges no strategist fee on any of its Model Portfolios—our revenue is generated only by the expense ratios of the WisdomTree products that are included in any given Model Portfolio.

We refer to the Core Equity and Fixed income Model Portfolios as our “strategic building blocks.” While they can be and are used as stand-alone Model Portfolios, they often are mixed and matched together to create different variations of multi-asset Model Portfolios.

Core Equity

Let’s begin with the Core Equity Model Portfolio. It currently contains 11 individual line items of globally diversified equity ETFs. We maintain a geographic/regional exposure that is roughly in line with the MSCI ACWI index. As of February 28, 2022, the Model Portfolio had roughly 59% allocated to U.S., 29% to EAFE (developed international) and 13% to emerging markets (“EM”). At a line allocation level, the Model Portfolio holds 71% in WisdomTree products and 29% in third-party strategies.

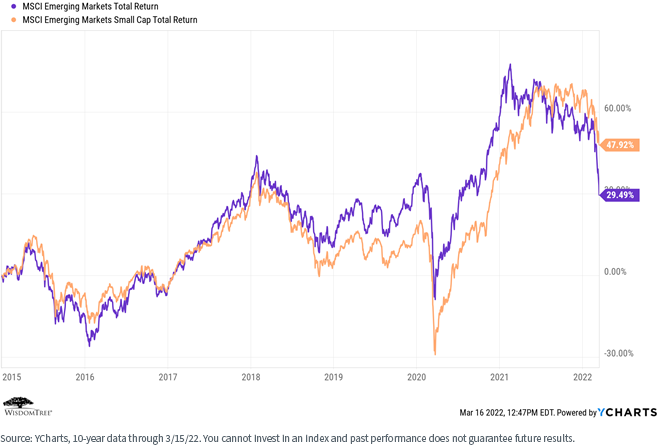

Somewhat uniquely, we believe, our Core Equity Model Portfolio has specific allocations to U.S. small-cap stocks (via DGRS), but also to both developed international and emerging markets (via DLS and DGS, respectively). We very much believe these allocations will play out well over full market cycles, as the size premium exists overseas as well as in the U.S. Consider how EAFE and EM small caps have performed relative to large caps over the past 10 years.

For definitions of terms in the chart above, please visit the glossary.

For definitions of terms in the chart above, please visit the glossary.

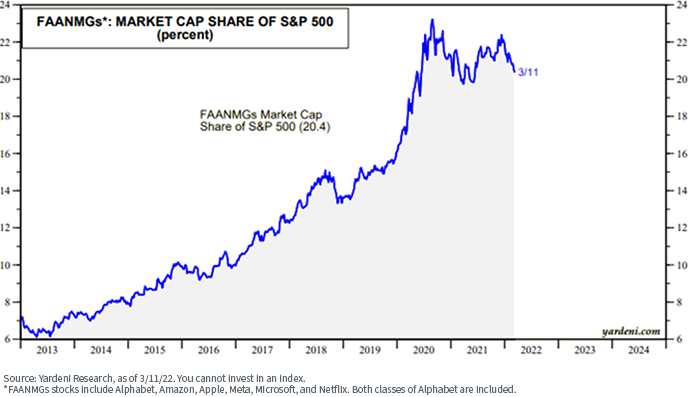

Given the underlying factor tilts of many of the WisdomTree products, the Model Portfolio has overweight allocations to smaller-cap stocks, higher quality stocks (where “quality” is defined as companies that have higher profitability metrics, stronger earnings, balance sheets and cash flows), value stocks and dividend paying stocks. It is also more diversified at the risk factor level than most broad market indexes that, because they are market cap-weighted, tend to be dominated by larger growth stocks (for example, according to Yardeni Research the six “FAANGM” stocks—Facebook (Meta), Amazon, Apple, Netflix, Google (Alphabet) and Microsoft—currently represent more than 20% of the market cap of the entire S&P 500 index).

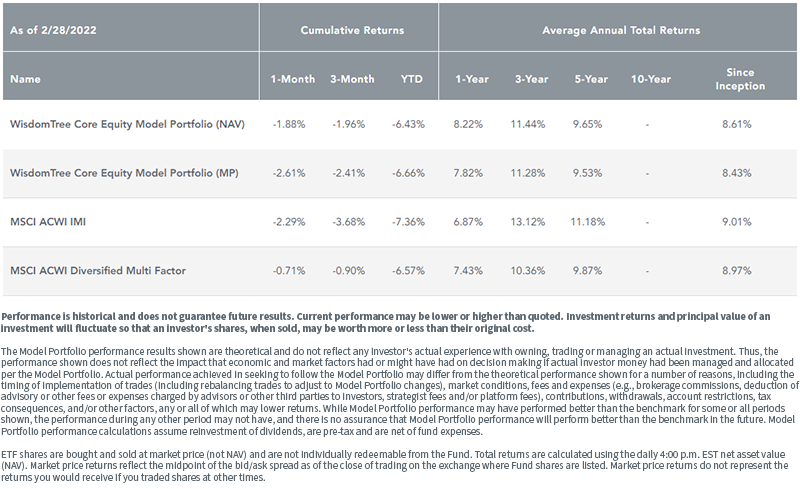

Given current market conditions, in which value, quality and dividends have rotated “into favor” and growth has rotated “out of favor,” it is no surprise that our Core Equity Model Portfolio has performed well on a benchmark-relative basis over the past 12 months.

Since inception in 2013, its performance has held up very well despite a multi-year environment where large-cap growth stocks dominated market performance. We attribute this to both smart asset allocation and smart security selection decisions.

For standardized performance, please click here.

You will note that we use two external benchmarks when evaluating the performance of this Model Portfolio: (1) the MSCI ACWI IMI index (which is a global all-cap index that includes mid- and small-cap stocks) and (2) the MSCI ACWI Diversified Multi-Factor index, given both the global nature and the emphasis on factor investing embedded in the Model Portfolio.

Our view is that the market rotation toward value, size, dividends and quality will continue for at least the rest of this year, so we are very comfortable with how our Core Equity Model Portfolio is positioned and allocated.

Two final observations:

- The current expense ratio for our Core Equity Model Portfolio is 0.24% (24 basis points) —which we believe is very attractive for an actively managed global equity portfolio; and

- The current 12-month dividend yield on the Model Portfolio (through 2/28/22) is 2.50%, which compares very favorably to the 1.80% yield offered by the MSCI ACWI IMI index as of that same date.

Conclusion

The WisdomTree Core Equity Model Portfolio is the foundational base for almost every other Model Portfolio we manage. It is constructed to deliver risk-adjusted alpha relative to its benchmarks, while delivering a superior yield and dividend profile.

Since inception on December 18, 2013, this Model Portfolio has performed as we have expected, and we believe it is well positioned to take advantage of the market regime we believe we will have for at least the rest of this year.

Financial advisors can register with WisdomTree to access fully transparent information (performance, fees, yield, allocations, etc.) via our Model Adoption Center.

We hope you will take a look.

Part II of this blog mini-series will be a deeper dive into our Fixed Income Model Portfolio. See you there.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Please click on wisdomtree.com/mac/model-portfolios#strategicmodelportfolios_strategicbuildingblocks and go to the Fund Performance tab for individual fund standardized performance, and go to the Fund Details tab for fund-specific links for yield, most recent month-end performance and a prospectus.

Model Portfolio12-month yield is calculated using the weighted average trailing 12-month distribution yields of the Fund constituents. Funds incepted less than 12 months ago do not have trailing 12-month dividend yields.

Neither diversification nor an asset allocation strategy assures a profit or eliminates the risk of experiencing investment losses.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.