Global Chief Investment Officer

Follow Jeremy Schwartz

In my

recent blog, I discussed the potential

dividend yield advantage of international equities over domestic equities, as well as the potential yield advantage of international mid and small caps over large caps. Below I review another reason to focus on international mid and small caps: the size and sector diversification they provide.

International Equities Represent Larger Opportunity Set

For starters, based on a dividend analysis, international markets represent a larger investment opportunity set than U.S. markets. Based on the

WisdomTree Global Dividend Index, the

Dividend Stream® as of the most recent screening date (May 31, 2012) was over $1 trillion. While the U.S. market made up 29.2% of the total

Dividend Stream, the developed world ex-U.S. accounted for 53.8% of it.

Considering this, we feel most investors tend to have a home bias and are usually over-weight in their own domestic market. Also, when U.S. investors decide to invest internationally, we believe they usually do so through large-cap companies. We believe the mid- and small-cap international dividend payers offer a further set of exposures beyond this more traditional option.

For instance, international mid- and small-cap dividend-paying stocks represent just a small percentage of the

MSCI EAFE Index, the often-tracked benchmark.

Weight of Stocks in the MSCI EAFE Index1:

WisdomTree International MidCap Dividend Index – 15.3%

WisdomTree International SmallCap Dividend Index – 0.09%

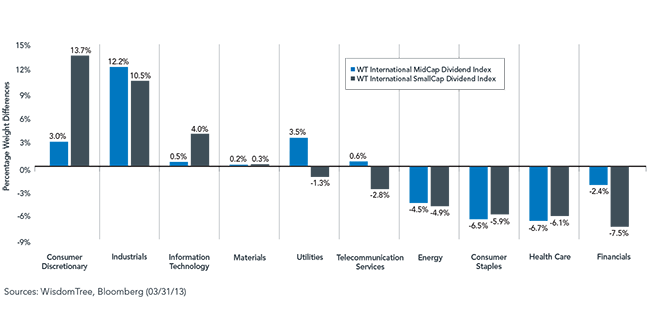

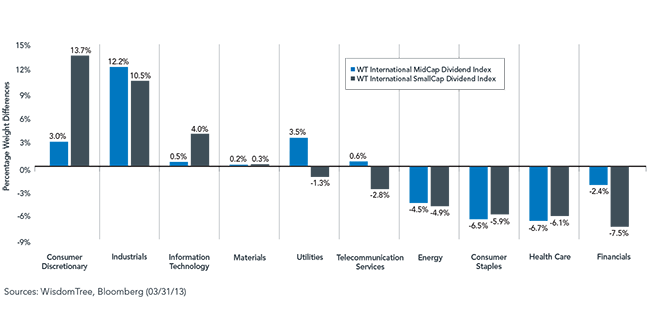

Moreover, the mid and small caps display different characteristics than large-cap stocks, as illustrated by their sector differentials. In figure 1, we will examine the sector differences between the WisdomTree International MidCap and SmallCap Dividend Indexes compared to the MSCI EAFE Index.

Figure 1: Analysis of Sector Differentials across Size Segments (compared to MSCI EAFE)

For definitions of the Indexes, please visit our Glossary.

For definitions of the Indexes, please visit our Glossary.

•

Cyclical Sector Over-weights – The WisdomTree International MidCap and SmallCap Dividend Indexes tend to have more exposure to two of the more cyclical sectors of the markets—Consumer Discretionary and Industrials.

•

Defensive Sector Under-weights – Unlike traditional dividend-paying stocks, the WisdomTree International MidCap and SmallCap Dividend Indexes tend to be under-weight in a number of the traditional dividend-paing sectors (Consumer Staples, Health Care and Telecommunication Services).

•

Low Sector Similarities – Only the Materials sector has less than a 1% difference for both the WisdomTree International Dividend Index and the WisdomTree SmallCap Dividend Index when compared to the MSCI EAFE. Half the sectors have at least a 3% weight difference for both WisdomTree Indexes.

Potential Diversification Benefits

Based on a dividend analysis, we feel the opportunity set in the international markets is often overlooked by U.S. investors, especially the mid- and small-cap segment. In our opinion, exposure to international equities is important for providing diversification benefits and increased potential return. Specifically, we think that increased exposure to international mid- and small-cap dividend-paying companies can help increase potential diversification and dividend income.

For more information on the subject, read our research here.

1Sources: WisdomTree, Bloomberg (03/31/13).

Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment loss. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments in smaller companies may experience greater price volatility.