India: The Forgotten Emerging Market

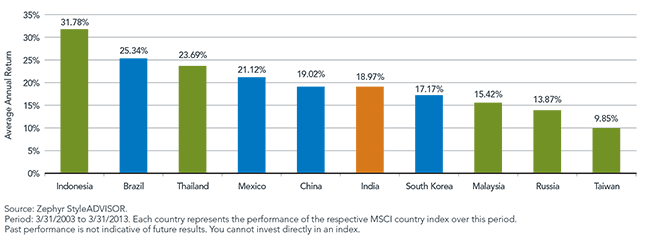

For index definitions, please visit our Glossary. In accordance with a blog I posted last week, the blue bars indicate the countries with relatively larger assets under management tracking the performance of their equity indexes, while the green bars indicate the countries with relatively smaller assets under management.

• Indonesia Tops the List: Oddly, the country that came in ninth out of the top 10 in terms of AUM came in first in terms of average annual returns over the past decade. In fact, Indonesia was the only equity market to crack 30% on an average annual basis.

• Brazil: Brazil ranked second in AUM and had the second-strongest average annual returns of the MSCI country indexes shown. It may be a natural question whether Brazil’s performance advantage can continue going forward.

• China and Mexico: Interestingly, Mexico’s performance was ahead of that of China, and Thailand’s was ahead of both Mexico and China.

• India Ranks Sixth: India comes in sixth with average annual returns of approximately 19% per year, a figure placing it ahead of South Korea by this metric.

So, a pure analysis of average annual returns over the past 10 years does bear some relationship to the AUM picture we presented in an earlier blog, but it doesn’t tell the full story.

Risk Avoidance Behavior Could Provide Additional Color

Maybe India’s equities are the most risky, or at least significantly more risky than those of Brazil, South Korea, Mexico and China, which would explain its relatively lower AUM.

For this analysis, we adhered to the same convention used in the earlier figure: looking at the past 10 years of data and utilizing the respective MSCI country index to measure the average annual standard deviation of each equity market.

• Malaysia Exhibited the Lowest Risk: Malaysia AUM (ranked 10th out of 10) exhibited the lowest average annual standard deviation over the past 10 years—a level that was less than 3% higher than that of the S&P 500 Index. Clearly, investors are not flocking toward the lowest-risk equity market on this list, at least judging by average annual standard deviation over the past 10 years.

• Brazil vs. India: Brazil had the second-highest average annual standard deviation of all the countries shown. India is widely known as being a high-volatility equity market, and while investors may use this as part of their rationale to avoid it, Brazil AUM—even given its higher risk levels over the past decade—is about three times higher.

Of course, this is merely one way to view “risk” in the context of investing, and these emerging market economies certainly are subject to other factors that might be of more concern to certain countries and of less concern to others. Since we’re focusing on India, many investors are concerned with what has been characterized as a difficult policy environment. It has been suggested that a more accommodative monetary or fiscal policy could potentially be helpful to encourage investment. Unfortunately, inflation remains stubbornly high—largely due to food prices—and the government already faces a fiscal deficit that inhibits its ability to spend further to stimulate consumption. There is also a current account deficit in India, which relates to the fact that the country tends to import more than it exports. Ultimately, these factors create a tricky macroeconomic picture in that many announcements of government policy, though positive, a not quite positive or clear enough to inspire immediate investment action and a market rally.

That’s not to say that the other countries on this list have the perfect solution—they all have their own unique economic issues that market participants need to be aware of.

The Potential for Diversification

The combination of risk and return over past periods can be said to give a sense of the diversification potential of a particular exposure. One way to measure this is through correlation, with lower correlations indicating a greater tendency for two sets of returns to move in different directions at any specific time. Of course, correlation doesn’t tell us whether this will occur in any future period, but we believe it is useful to consider its past behavior.

Over the past few years, U.S. equities (shown through the S&P 500 Index) have performed very well, and it is no secret that many U.S. investors have equity portfolios that are heavily biased toward domestic stocks. Therefore, when they consider their exposures outside the U.S., noting the correlation statistic of another index to the S&P 500 Index could be of particular interest. A lower figure could indicate a greater diversification potential had existed over the period in question.

• Of the countries shown earlier through the MSCI country-specific equity indexes, India had the lowest correlation to the S&P 500 Index over the past three years ending March 31, 2013. That’s not to say that these correlation figures are static and that India always has the lowest correlation to the S&P 500 Index of all these other indexes, but we find it interesting that this was the case during a period of particular strength in U.S. equities.

• Mexico is notable for its high correlation to U.S. equities. This doesn’t necessarily surprise us, given the proximity of the two countries, but it does indicate a potentially lower diversification capability, at least compared to other emerging market regions.

Conclusion

Similar to what we wrote in our blog focused on the economic characteristics of these countries, it is difficult to argue that Brazil’s vastly greater AUM is fully explained by these statistics. We could certainly see arguing for India getting a greater share, and we also believe that, if people are interested in the “surprises” that we found in this study, Malaysia and Indonesia could be of special interest. Our full study can be accessed by clicking here.

For index definitions, please visit our Glossary. In accordance with a blog I posted last week, the blue bars indicate the countries with relatively larger assets under management tracking the performance of their equity indexes, while the green bars indicate the countries with relatively smaller assets under management.

• Indonesia Tops the List: Oddly, the country that came in ninth out of the top 10 in terms of AUM came in first in terms of average annual returns over the past decade. In fact, Indonesia was the only equity market to crack 30% on an average annual basis.

• Brazil: Brazil ranked second in AUM and had the second-strongest average annual returns of the MSCI country indexes shown. It may be a natural question whether Brazil’s performance advantage can continue going forward.

• China and Mexico: Interestingly, Mexico’s performance was ahead of that of China, and Thailand’s was ahead of both Mexico and China.

• India Ranks Sixth: India comes in sixth with average annual returns of approximately 19% per year, a figure placing it ahead of South Korea by this metric.

So, a pure analysis of average annual returns over the past 10 years does bear some relationship to the AUM picture we presented in an earlier blog, but it doesn’t tell the full story.

Risk Avoidance Behavior Could Provide Additional Color

Maybe India’s equities are the most risky, or at least significantly more risky than those of Brazil, South Korea, Mexico and China, which would explain its relatively lower AUM.

For this analysis, we adhered to the same convention used in the earlier figure: looking at the past 10 years of data and utilizing the respective MSCI country index to measure the average annual standard deviation of each equity market.

• Malaysia Exhibited the Lowest Risk: Malaysia AUM (ranked 10th out of 10) exhibited the lowest average annual standard deviation over the past 10 years—a level that was less than 3% higher than that of the S&P 500 Index. Clearly, investors are not flocking toward the lowest-risk equity market on this list, at least judging by average annual standard deviation over the past 10 years.

• Brazil vs. India: Brazil had the second-highest average annual standard deviation of all the countries shown. India is widely known as being a high-volatility equity market, and while investors may use this as part of their rationale to avoid it, Brazil AUM—even given its higher risk levels over the past decade—is about three times higher.

Of course, this is merely one way to view “risk” in the context of investing, and these emerging market economies certainly are subject to other factors that might be of more concern to certain countries and of less concern to others. Since we’re focusing on India, many investors are concerned with what has been characterized as a difficult policy environment. It has been suggested that a more accommodative monetary or fiscal policy could potentially be helpful to encourage investment. Unfortunately, inflation remains stubbornly high—largely due to food prices—and the government already faces a fiscal deficit that inhibits its ability to spend further to stimulate consumption. There is also a current account deficit in India, which relates to the fact that the country tends to import more than it exports. Ultimately, these factors create a tricky macroeconomic picture in that many announcements of government policy, though positive, a not quite positive or clear enough to inspire immediate investment action and a market rally.

That’s not to say that the other countries on this list have the perfect solution—they all have their own unique economic issues that market participants need to be aware of.

The Potential for Diversification

The combination of risk and return over past periods can be said to give a sense of the diversification potential of a particular exposure. One way to measure this is through correlation, with lower correlations indicating a greater tendency for two sets of returns to move in different directions at any specific time. Of course, correlation doesn’t tell us whether this will occur in any future period, but we believe it is useful to consider its past behavior.

Over the past few years, U.S. equities (shown through the S&P 500 Index) have performed very well, and it is no secret that many U.S. investors have equity portfolios that are heavily biased toward domestic stocks. Therefore, when they consider their exposures outside the U.S., noting the correlation statistic of another index to the S&P 500 Index could be of particular interest. A lower figure could indicate a greater diversification potential had existed over the period in question.

• Of the countries shown earlier through the MSCI country-specific equity indexes, India had the lowest correlation to the S&P 500 Index over the past three years ending March 31, 2013. That’s not to say that these correlation figures are static and that India always has the lowest correlation to the S&P 500 Index of all these other indexes, but we find it interesting that this was the case during a period of particular strength in U.S. equities.

• Mexico is notable for its high correlation to U.S. equities. This doesn’t necessarily surprise us, given the proximity of the two countries, but it does indicate a potentially lower diversification capability, at least compared to other emerging market regions.

Conclusion

Similar to what we wrote in our blog focused on the economic characteristics of these countries, it is difficult to argue that Brazil’s vastly greater AUM is fully explained by these statistics. We could certainly see arguing for India getting a greater share, and we also believe that, if people are interested in the “surprises” that we found in this study, Malaysia and Indonesia could be of special interest. Our full study can be accessed by clicking here.Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment losses. There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on a single sector and/or smaller companies generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.