India: What’s Working in Emerging Markets

If you only focused on the returns of the MSCI Emerging Markets (EM) Index, you’d think EM was dead money. If you looked at the MSCI Emerging Markets Ex-China Index, you’d basically be at breakeven over the last two years. But if you look at the WisdomTree India Earnings Fund (EPI), you might be surprised to see what’s possible in India. In this piece, we discuss the fundamental drivers of Indian equity performance and why those drivers may be poised to continue.

China Dominates EM Benchmarks

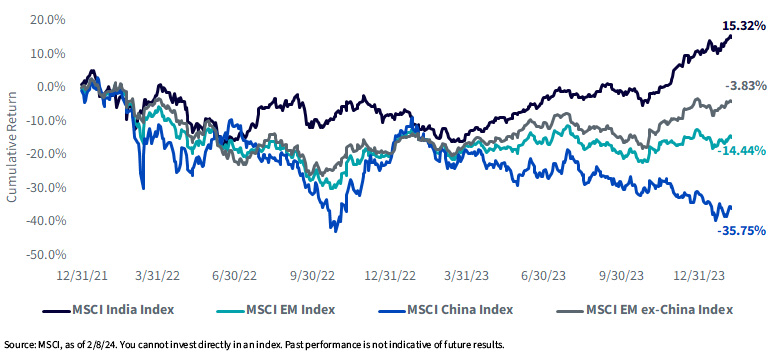

Over the last decade, China has made a concerted effort to broaden access to its capital markets. As a result, major benchmarks like the MSCI Emerging Markets Index have seen China rise in weight from less than 5% in the early 2000s to nearly 30% today. While China is a large market that deserves attention from investors, the challenge now is that the most commonly followed emerging markets benchmark is nearly completely beholden to Chinese equity market performance. As we show in the chart below, Chinese stocks have languished over the last two years, dragging down benchmark returns. However, even strategies that exclude China are slightly lower. We contrast these returns with Indian equities, which have delivered strong returns, particularly over the last year.

EM Equity Performance: 12/31/21–2/9/24

For definitions of terms in the graph above, please visit the glossary.

What’s Driving Returns

For investors who are open to the idea of not using a one-size-fits-all/broad-index-based approach to EM investing, your three best single-country options over the last five years have tended to be India, Taiwan and South Korea. However, what’s striking is the differentiation in drivers of total return.

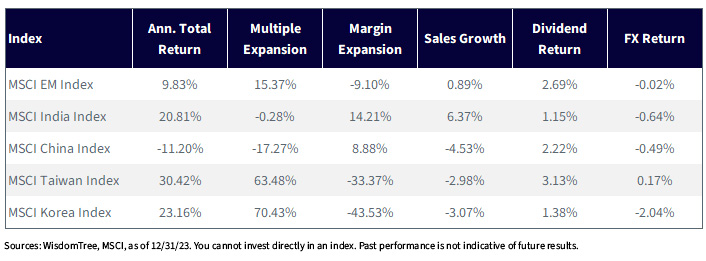

One Year

For definitions of terms in the table above, please visit the glossary.

As we mentioned before, as the largest weighting in emerging markets, concentration in China is weighing down broad index returns on account of dramatic multiple contraction as sales growth recedes. By contrast, India has experienced strong performance due to its strong fundamentals performance with multiple contraction over the last year. Although Taiwan has delivered nearly 1,000 basis points of excess returns, much of it has been driven by multiple expansion from its largest index holding, Taiwan Semiconductor. While TSMC has been a big beneficiary of the market’s focus on AI/the U.S. Chips Act, the question many investors face is: Are these types of results sustainable or repeatable going forward?

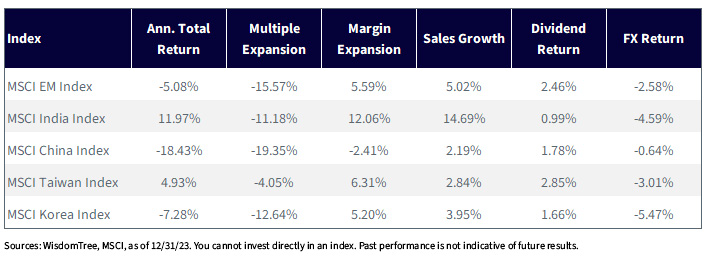

Three Years

Over the last three years, India has delivered best-in-class performance even when multiples have continued to contract. Despite this headwind, Indian companies have experienced double-digit sales and margin expansion. Additionally, FX headwinds in India could be abating, which could begin to unwind the nearly 5% erosion in total returns for U.S.-based investors.

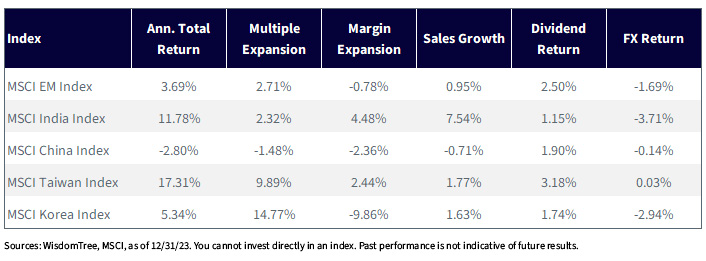

Five Years

Over the last five years, India has delivered strong fundamental performance, growing sales by nearly 8% per year. While multiples have expanded by 2.3% per year over during this period, they are far from overvalued, in our view. As long as India can continue to deliver solid growth versus other markets, we believe we may be in the early innings of a dramatic repricing of Indian assets versus China. We feel that China is currently on the verge of experiencing a lost decade. For many investors, India may be a strong option to counter a challenging macro environment and self-inflicted wounds from Chinese policy makers.

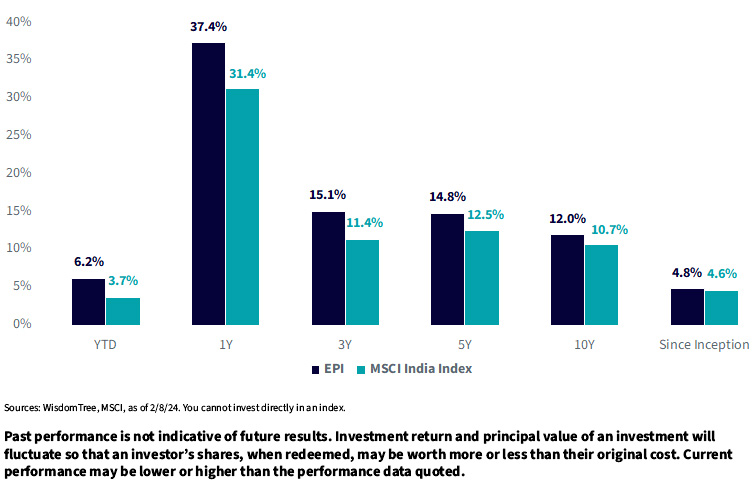

EPI vs. MSCI India Index Performance

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click here.

Adding Value vs. MSCI India

One of our primary views of investing is that market cap weighting is flawed. In India, this is no different. By focusing only on profitable companies, EPI tends to trade at a lower P/E multiple than MSCI India. Over time, this has had the impact of delivering excess returns during nearly every period we examined. While there are no guarantees that these trends will continue, we continue to advocate that strategies anchored to fundamentals can deliver long-term value to investors seeking growth from Indian equity exposure.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. This Fund focuses its investments in India, thereby increasing the impact of events and developments associated with the region that can adversely affect performance. Investments in emerging, offshore or frontier markets such as India are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. As this Fund has a high concentration in some sectors, the Fund can be adversely affected by changes in those sectors. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.