Growth or Profitability – What Is More Important for Software Firms?

Six months before the COVID-19 pandemic began in earnest and right before work-from-home-related stocks really took off, WisdomTree launched the WisdomTree Cloud Computing Fund (WCLD), which is designed to track the returns, after fees, of the BVP Nasdaq Emerging Cloud Index. WCLD served as my introduction to the dynamics of growth-oriented companies early in their life cycles.

Traditional valuation measures like the price-to-earnings (P/E) ratio are not useful because many of the firms do not have positive earnings. Does the lack of positive earnings make them poor investments? What I learned was…not necessarily.

A key issue for early-stage companies is finding “product-market fit.” ChatGPT achieved the milestone of 100 million users in roughly one month —that is product-market fit. The product is what you build, the market is all of the possible users you can conceive, and the “fit” comes when it is crystal clear that they want and are using what you built in large numbers.

Unfortunately, for most companies, achieving 100 million users in about a month is completely unrealistic—the journey is often much slower. But the concept of generating scale, meaning a continually increasing base of users to a significant size, is important.

At the same time, there is the consideration of profitability.

Think of what it might take to scale:

- Lots and lots of marketing (product awareness)

- Robust software (effective engineers)

- A sales team for bigger deals (salespeople)

- Better and better products (research and development)

Employees, sales, marketing and R&D can be big expenses. Is it incorrect to funnel revenues away from the bottom line and toward these things? Amazon, famously, did not show positive net income for many years. While we can view that as a unique, special case, it does clearly show that earnings do not always tell the entire story.

Free cash flow is an accounting term that represents the money a business generates after accounting for its operating and capital expenditures. Free cash flow margin, therefore, tells us the percentage of revenues left over after accounting for these things.

- A higher free cash flow margin tells us that a greater percentage of revenues is left after accounting for key expenses.

- A negative free cash flow margin tells us that operating and capital expenditures are actually greater than revenues.

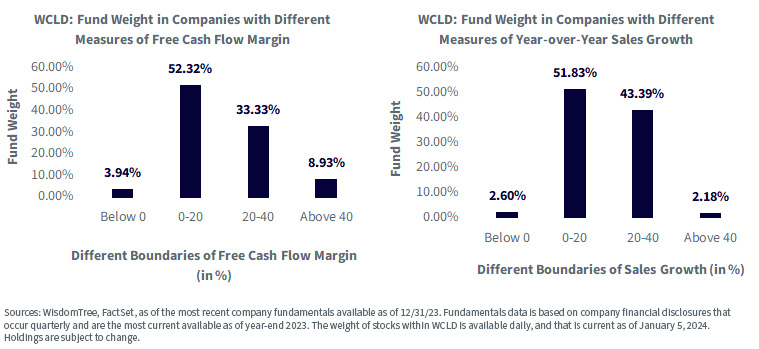

Let’s look at the distribution of different levels of sales growth and free cash flow margin for WCLD. In figure 1:

- Roughly 85%–86% of the weight of WCLD is between 0% and 40% free cash flow margin. Almost 4% is below zero, and nearly 9% is above 40%.

- Similarly, about 85% of the weight of WCLD is between 0% and 40% year-over-year sales growth. Less than 3% of weight was in companies with negative sales growth, and a little more than 2% was in companies with above 40% sales growth.

Figure 1: Free Cash Flow Margin and Year-over-Year Sales Growth Distribution within WCLD

In January 2021, WisdomTree launched the WisdomTree Cybersecurity Fund (WCBR). As is the case with the constituents of WCLD, WCBR's focus is on companies that provide software solutions. These businesses, based on their fundamentals and how they are run, lend themselves to this type of analysis.

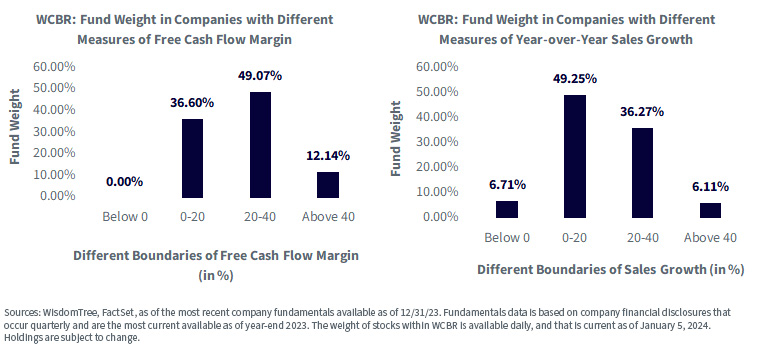

Figure 2 shows:

- WCBR has roughly 86% of its weight in firms with 0%–40% free cash flow margins. No companies were negative, and slightly more than 12% of the weight was in firms with free cash flow margins above 40%.

- WCBR has roughly 85% of its weight in firms with 0%–40% sales growth. There was 6% of weight exposed to firms above 40% sales growth (actually one firm, SentinelOne) and 6.71% of weight in firms with sales growth showing as negative (Varonis and A10 Networks).

Figure 2: Free Cash Flow Margin and Year-over-Year Sales Growth Distribution within WCBR

In a recent piece, Bessemer Venture Partners sought to shift the focus from viewing things through the lens of “the Rule of 40,” which combines sales growth and free cash flow margins into what they termed a “Rule of X.”

The Growth Stock Rules

A simplified take for tech investors: if you add the free cash flow margin figure to the year-over-year revenue growth figure, and you get a number that is 40% or higher, this is relatively good, and if you are below 40%, this is clearly “not as good.”

With the standard Rule of 40 approach, free cash flow margin and year-over-year sales growth are treated equally. Consider a case where one company is not growing sales at all but has a 40% free cash flow margin, and compare that to a company with a 40% year-over-year sales growth but a 0% free cash flow margin.

The extremes are illustrative. In software companies, growth is always crucial—even in some of the more mature areas of the market, we continually look at revenue growth, subscription growth and all kinds of growth figures.

With the Rule of X, BVP postulates one cannot equally consider growth versus profitability—growth is more important. The question is, then, how much more important is growth in a relative sense? Their work indicates growth is roughly twice as important. That means:

- Instead of “free cash flow margin”+ “year-over-year revenue growth”=

- One can do “free cash flow margin”+ “2*year-over-year revenue growth”=

We see that we are multiplying revenue growth by two while keeping the free cash flow margin the same.

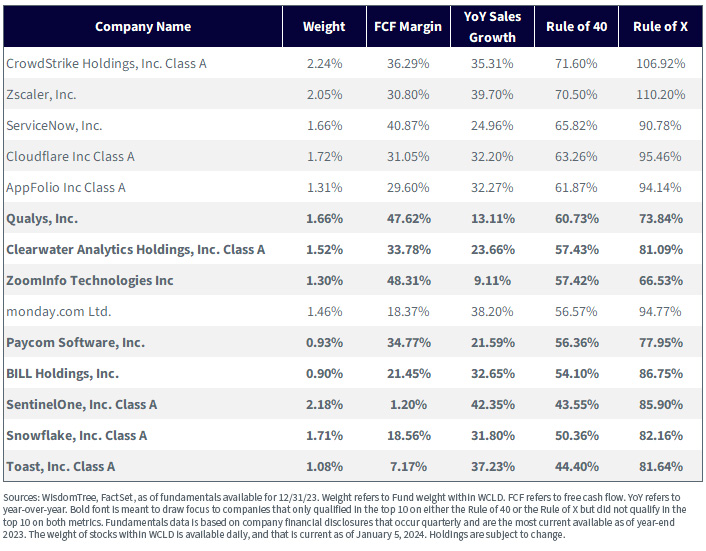

One thing that we did in figures 3 and 4 is showcase, for WCLD and WCBR, what the “top 10 companies” looked like, both on a Rule of 40 basis and a Rule of X basis. This allows people to draw out the differences between the two and actually see the higher-free-cash-flow-margin, lower-growth companies that did not qualify in the top 10 based on a Rule of X calculation.

For figure 3:

- Qualys, Clearwater Analytics, ZoomInfo and Paycom represented the high-free-cash-flow-margin-but-lower-growth companies that qualified in the top 10 of WCLD by the Rule of 40 versus the Rule of X. ZoomInfo was the outlier, with a free cash flow margin above 48% but a revenue growth figure below 10%.

- Shifting the Rule of X shined a light on BILL, SentinelOne, Snowflake and Toast. Consider SentinelOne—the free cash flow margin was only 1.20%, but the revenue growth was 42%. This was the fastest revenue growth registered by any company in WCLD.

Figure 3: WCLD: Top 10 Companies by Rule of 40 and Rule of X

For current Fund holdings, click here.

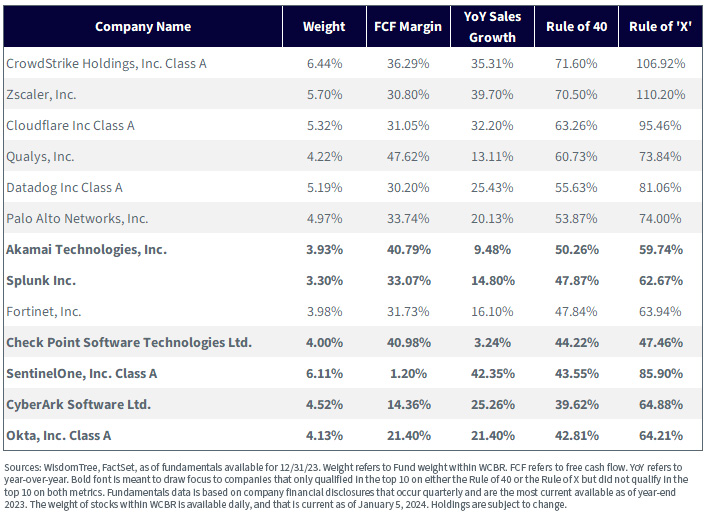

In figure 4:

- WCBR had three companies, Akamai, Splunk and Check Point, that had higher free cash flow margins but lower revenue growth. These firms made the top 10 in the traditional sense of the Rule of 40.

- Shifting to the Rule of X, those firms were replaced with SentinelOne, CyberArk and Okta. As was the case in WCLD in figure 3, SentinelOne is the number one firm on a sales growth basis.

- If you look at the weight in SentinelOne, you see 6.11%. This was the number two holding in the strategy. We can note that revenue growth is a component of the selection and weighting process for the WisdomTree Team8 Cybersecurity Index, which WCBR is tracking after fees. Companies with a strong focus on cybersecurity plus high revenue growth can see their way to greater weight. Free cash flow margin is not a component of this Index’s methodology.

Figure 4: WCBR: Top 10 Companies by Rule of 40 and Rule of X

For current Fund holdings, click here.

Conclusion: Pure-Play Companies That Are Growing Represent Interesting Thematic Equity Exposures

When investors put all the pieces together and consider thematic equities, the first thing they tend to focus on is the degree of purity exposure to the theme. Many appreciate a shorter list of companies that are differentiated and do not have high overlaps with the larger benchmarks, be it the S&P 500 Information Technology Index or the Nasdaq 100 Index, to name just two. Showcasing companies that have become public more recently is also something that people tend to appreciate.

SentinelOne is an interesting one—it almost fits our “extreme” narrative of 0% free cash flow margin and 40ish percent revenue growth. It is our opinion that thematic investors tend to appreciate this type of firm that has a high future potential rather than a company with more near-term profitability but less growth.

Important Risks Related to this Article

For current Fund holdings, please click the respective ticker: WCLD, WCBR. Holdings are subject to risk and change.

WCLD: There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCBR: There are risks associated with investing, including the possible loss of principal. The Fund invests in cybersecurity companies, which generate a meaningful part of their revenue from security protocols that prevent intrusion and attacks to systems, networks, applications, computers and mobile devices. Cybersecurity companies are particularly vulnerable to rapid changes in technology, rapid obsolescence of products and services, the loss of patent, copyright and trademark protections, government regulation and competition, both domestically and internationally. Cybersecurity company stocks, especially those which are internet-related, have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. These companies may also be smaller and less experienced companies, with limited product or service lines, markets or financial resources and fewer experienced management or marketing personnel. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.