2023 U.S. Dividend Rebalances: Value Positioning via Dividends

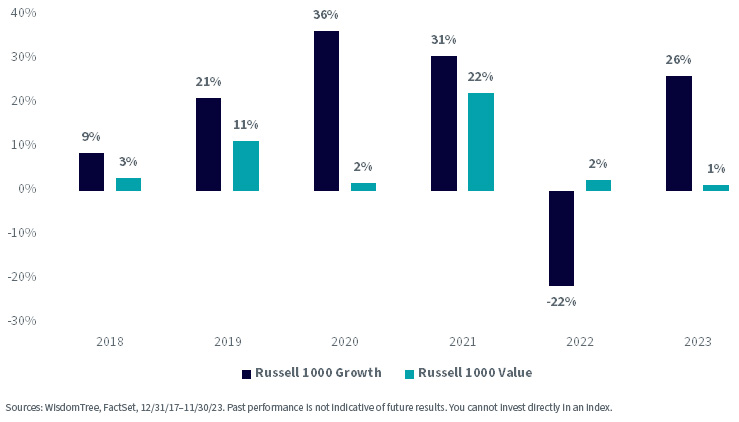

Following its moment in the sun in 2022, value returned to the background in 2023, lagging growth for the fifth year in the past six.

Growth (proxied by the Russell 1000 Growth Index) finished the year strong and ahead of value (proxied by the Russell 1000 Value Index), primarily driven by the Magnificent Seven, a handful of mega-cap tech giants at the forefront of the artificial intelligence (AI) boom.

Growth vs. Value Performance over the Years

The Federal Reserve is expected to cut rates in 2024, signaling an end to its most aggressive rate hike campaign since the early 1980s. The long-awaited policy pivot may shift market sentiment in favor of this year’s laggards, such as dividend-paying companies and broader value.

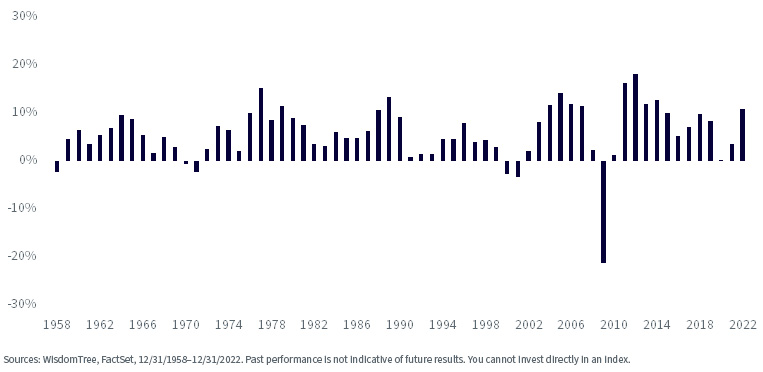

In the last 64 years, only six years saw declining dividend levels, and only one year saw a decline of over 5%. Taking a dividend approach to value could provide more downside support through reliable income than pure value strategies.

Annual Growth of S&P 500 Dividends

As growth stock valuations soar with historically high multiples, dividend indexes typically maintain a less top-heavy allocation than traditional market cap-weighted indexes, increasing weights to companies with strong fundamentals and defensive qualities, while reducing weights to companies considered overvalued (read: having the potential to fall short of lofty expectations).

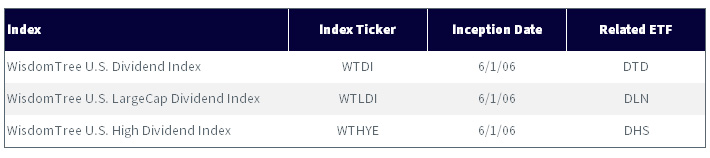

WisdomTree U.S. Dividend Reconstitution

The WisdomTree U.S. Dividend Index (WTDI) is a fundamentally weighted Index that tracks dividend-paying U.S. companies, wherein each company’s weight is derived from its share of the Index’s total Dividend Stream®.

The WisdomTree U.S. LargeCap Dividend Index (WTLDI) is comprised of dividend-paying companies from the large-cap segment of the U.S. Dividend Index, and the WisdomTree U.S. High Dividend Index (WTHYE) is comprised of the top 30% of dividend payers in the U.S. Dividend Index.

The WisdomTree U.S. Dividend family, including the above Indexes, underwent its annual reconstitution in early December. For eligibility in these Indexes, companies must have a market capitalization of at least $100 million and shares must have a median daily dollar volume of at least $100,000. Companies are also judged on quality and momentum factors to eliminate potentially higher-risk companies.

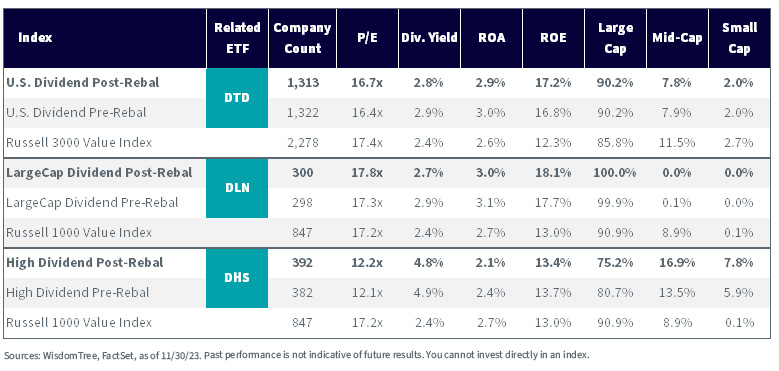

After its rebalance, the WisdomTree U.S. Dividend Index maintained a lower price-to-earnings ratio than the Russell 3000 Value Index as well as higher dividend yield and quality metrics, such as return on assets (ROA) and return on equity (ROE).

Though the WisdomTree U.S. LargeCap Dividend Index trades at a slight premium valuation to the Russell 1000 Value Index, it has a 5% greater ROE and higher dividend yields and ROA to compensate for the greater multiple.

High dividends were out of favor this year, and a lack of exposure to fast-growing mega-cap giants like the Magnificent Seven caused the WisdomTree U.S. High Dividend Index to underperform the Russell 1000 Value Index. However, we believe this was merely a result of a style mismatch with what markets rewarded during a year marked by narrow equity leadership and minimal breadth. Nonetheless, the Index still trades at attractive discounts to its benchmark with double the dividend yield.

Rebalance Fundamentals

For definitions of terms in the table above, please visit the glossary.

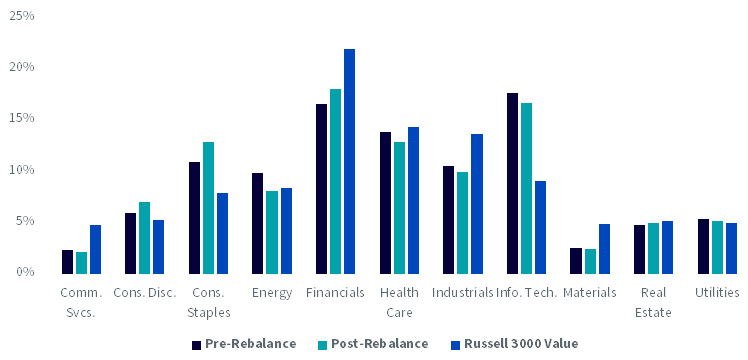

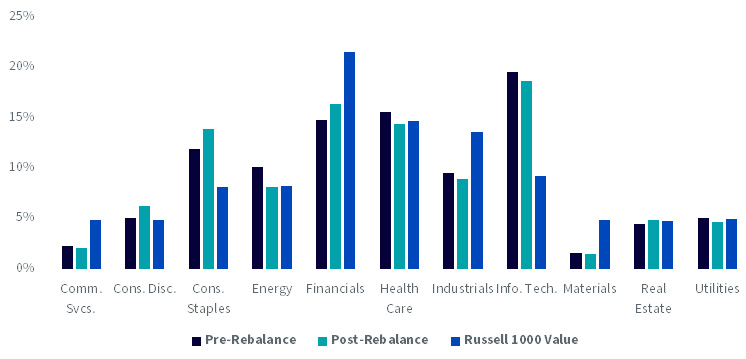

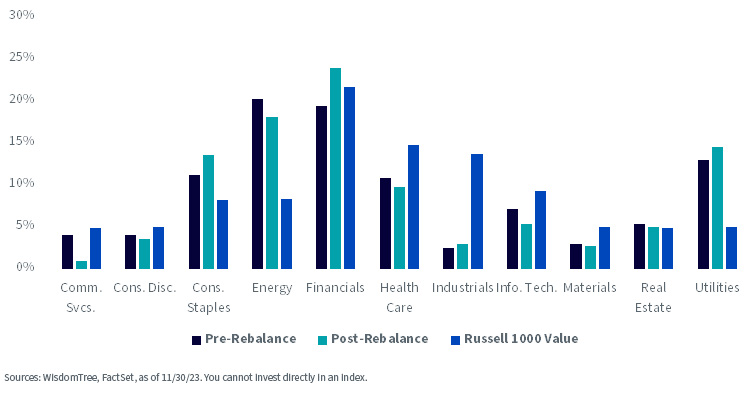

In terms of sector allocation changes, the WisdomTree U.S. Dividend Index and WisdomTree U.S. LargeCap Index largely maintained their sector under- and over-weight allocations relative to the Russell 3000 Value Index and Russell 1000 Value Index, respectively.

WisdomTree U.S. Dividend Index vs. Benchmark

WisdomTree U.S. LargeCap Dividend Index vs. Benchmark

WisdomTree U.S. High Dividend Index vs. Benchmark

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.