For the Next Risk-On Rally, Think Mid-Cap Value

For the past two years, U.S. mid-caps have endured a struggle familiar to many asset classes.

Since the Federal Reserve began their rate hike cycle in earnest at the start of 2022, the Russell Midcap Index remained down 10% through the end of November. Neither the value nor growth investment style offered much relief, with the former down 8% and the latter down 14%.

Meanwhile, investors in beta products tracking market cap-weighted mid-cap indexes have had a disappointing experience, with virtually no silver linings like the success of the large-cap Magnificent 7 in 2023.

So where do mid-cap investors turn after two years nursing double-digit losses? We believe there’s value to uncover in mid-cap strategies based on fundamentals rather than exclusive broad market ownership.

For those curious about fundamentals, we recently conducted an annual rebalance for our U.S. MidCap Dividend Index (WTMDI), which is tracked by the WisdomTree U.S. MidCap Dividend Fund (DON). Let’s assess how its composition and fundamentals changed during the screening and reconstitution processes.

WisdomTree U.S. MidCap Dividend Index (WTMDI)

The WisdomTree U.S. MidCap Dividend Index (WTMDI) is comprised of dividend-paying U.S. mid-cap companies. It contains the top 75% of remaining market capitalization from the WisdomTree U.S. Dividend Index (WTDI) after the 300 largest companies have been removed to form the WisdomTree U.S. LargeCap Dividend Index (WTLDI). WTMDI is dividend-weighted so that each company is positioned based on its pro rata cash dividend contribution to the aggregate U.S. mid-cap Dividend Stream™.

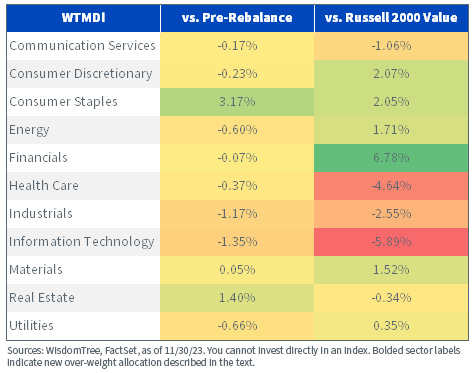

The sector composition of the dividend-paying mid-cap market exhibited marginal changes after the rebalance, as WTMDI tilted slightly more toward Consumer Staples and Real Estate, primarily at the expense of Industrials and Information Technology.

Sector Composition – Post Rebalance Comparison

Relative to the Russell Midcap Value Index, however, the sector changes were more pronounced. The addition to Consumer Staples resulted in a new relative over-weight allocation, while reductions in Health Care, Industrials and Information Technology increased existing under-weight allocation. Another existing under-weight, in Real Estate, was trimmed by adding weight, while modest reductions pared a prior over-weight in Energy.

Though Financials remained virtually unchanged after the rebalance, WTMDI remains roughly 7% over-weight in the sector relative to the Russell Midcap Index, illustrating the sector’s tendency to pay cash dividends out to shareholders. Financials are traditionally considered part of the value investing style due to lower valuation ratios and a propensity for dividend payments.

Its over-weight allocation comes at the expense of two growth-biased sectors, Information Technology and Health Care. Technology and Health Care companies (especially smaller biotechnology firms in the latter) generally prefer to retain cash for operations, reinvestment, and research and development (R&D) expenditures rather than pay dividends, which explains the routine under-weights to the sectors relative to the market.

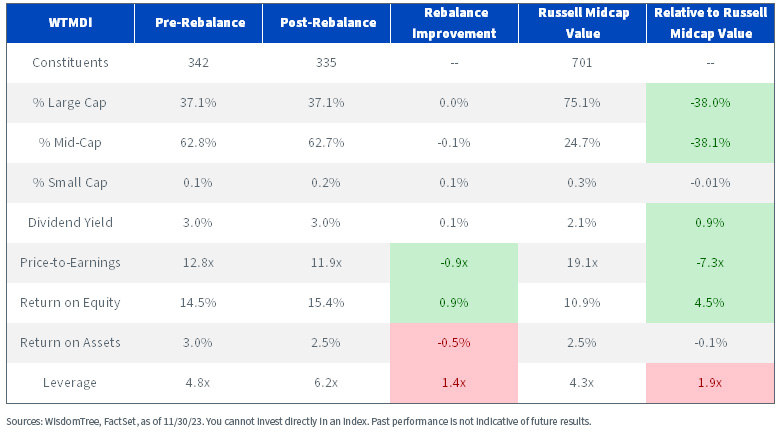

The annual rebalance also enhanced the fundamentals of the Index, as WisdomTree’s screening parameters and weighting technique directly improved exposures, valuations and yields. WTMDI is closer to a pure-play mid-cap Index, as it essentially cut the mid-cap market in half with about 335 constituents and 63% of true mid-cap ($2 billion–$10 billion in market capitalization) exposure. The Russell Midcap Value index skews larger in both constituency and size, with roughly 700 names and only 25% in true mid-cap weight.

These differences added almost 1% in trailing dividend yield relative to the market while improving upon return on equity by 4.5% and keeping return on assets steady at 2.5%. Normally, investors would expect to pay a larger valuation premium for improved metrics, but the opposite is true with WTMDI. After rebalancing, it shaved a point off its trailing price-to-earnings (P/E) multiple, leaving it seven points below that of the Russell Midcap Value Index.

Fundamental Comparison after Rebalance

For definitions of terms in the table above, please visit the glossary.

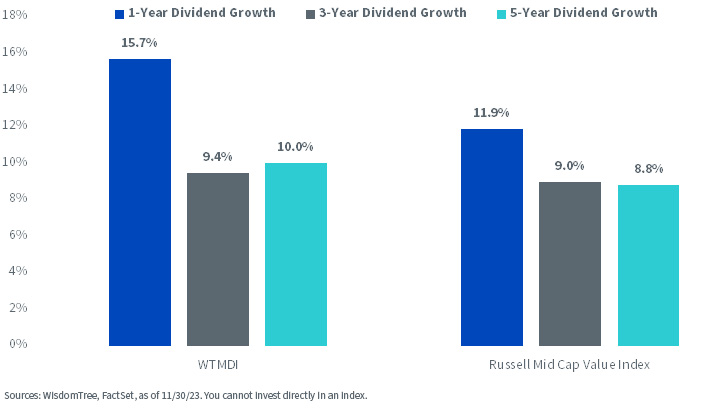

The dividend emphasis also improved dividend growth over the market for the past one-, three- and five-year periods.

Dividend Growth Rates Lead the Broader Mid-Cap Value Market

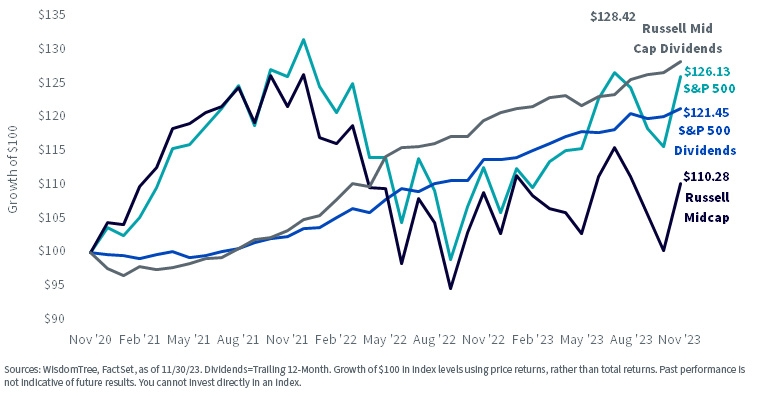

This may be a good sign if prevailing trends in large-cap equities filter down to the mid-cap market. For the past three years, S&P 500 price returns have kept pace with the growth in dividend levels, a phenomenon absent in the mid-cap market.

The Fundamental Disconnect: Mid-Cap Prices Down while Dividends Up >25% over the Last 3 Years

Onto 2024…

Heading into next year, we believe dividend-weighted mid-caps can provide compelling opportunities for whatever equity market environment lies ahead, especially once sentiment reverses in favor of risk assets.

Between sectoral shifts, fundamental improvements and positive trends among dividend-paying companies, we are encouraged that dividend-weighting the U.S. mid-cap equity markets may continue to be additive.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.