Declining PPIs Perpetuate Japan's TINA Trade

Sometimes you just get a little lucky. That is increasingly looking like the case for not only the WisdomTree Japan Hedged Equity Fund (DXJ) but also for the Bank of Japan itself. Things were looking tough for the BoJ as recently as this summer, when the country’s core CPI bolted north of 4%, far beyond the 2% inflation target that major central banks view as ideal.

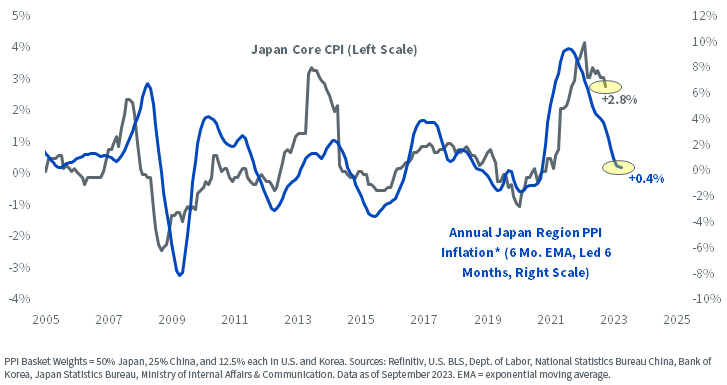

At least for now, those CPI prints from a few months ago look like they marked the worst of it. Japan’s core CPI has tapered down to a not outlandish +2.8% YoY growth rate. Trends in producer price inflation (PPI) suggest more downside could be coming.

Using Japan’s own PPI, along with the PPIs of major trade partners China, Korea and the United States, factory gate prices from this collective are downright disinflationary. Using our smoothed series, the PPI basket is barely positive over the last year. We would not be surprised in the slightest if Japan witnesses sub-2% core CPI within the next few months.

Figure 1: Key PPIs Point to Japanese CPI Downside

The Bank of Japan is being reactive to an inflation threat that may very well be in the rearview mirror. For many years, its yield curve control (YCC) policy set a band of +/-25 basis points (bps) around zero percent for 10-year JGBs. As the global inflation scare sent debt yields spiraling higher in places like the U.S. and Germany, the BoJ’s hand got pushed into widening the band to +/-50 bps around the zero bound. But if you pulled a quote on a random day in this year’s first half, it was common to see the 10-year JGB yield in the 0.30%–0.40% range. It wasn’t as if the 0.50% ceiling was being strongly threatened by bond vigilantes.

But then global bonds sold off even more, so the BoJ tightened policy once again. That policy move had the central bank putting emphasis not on a 0.50% yield but on a new 1% quasi-cap that it would seemingly defend if the bond market remained in bear mode.

That was where things stood until late October, when the BoJ changed policy yet again. This most recent change is ambiguous and open to interpretation.

Here is what we think the BoJ is now saying.

The central bank is “promising” to treat 1% as a target rate on 10-year JGBs, with a relatively hard vow to defend that level if trades start coming across around 1.10%, maybe 1.20%. I’m pulling those numbers from the sky because it is based on my Lasik-corrected vision focusing on an intentionally ambiguous bar chart that the BoJ just released. It’s one of those things where they don’t want to give you a hard-and-fast number, so we have to guess a little. I’m thinking their leeway for intervention is 10–20 bps beyond the 1% level.

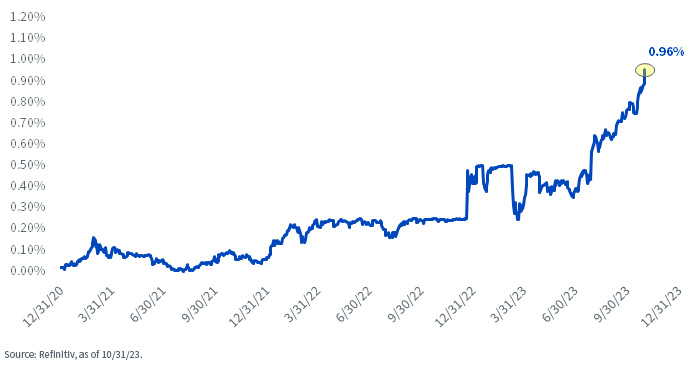

Fortunately, because we anticipate downside in Japan’s consumer price inflation, the bond market may luck into a situation where 1% yields are about as high as they get anytime soon. As of now, the 1% bound has not been breached, or even threatened for that matter. The yield is still 0.96%, and we will call that roughly three-and-a-half percentage points south of the yield on same-maturity U.S. Treasuries in any given session, give or take (figure 2).

Figure 2: 10-Year Japanese Government Bond Yield (%)

The S&P 500 is facing more competition from rising bond yields; until recently, much of the late summer and autumn was characterized by the bears pouncing on the death of the USD TINA trade. TINA said we should buy stocks because “There Is No Alternative” in a world where bonds yield nothing.

In the U.S., Canada and Europe, TINA should really be renamed TWNA, as we change “is” to “was.” The zero-yielding world is long gone. There was no alternative to buying so-called risk assets…until the bond market rolled over and started giving us a viable asset class once again.

Some are now questioning U.S. equity valuations when they can clip something in the mid-5s in the money markets. I started calling this TAMMY, which stands for “there are money market yields.” The acronym applies to money markets, but there are plenty of people using some variation of TAMMY as it applies to intermediate and long-term bonds too.

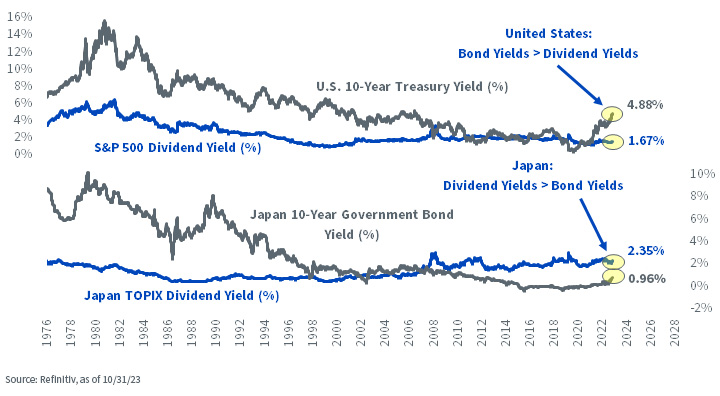

If TINA is dead in the United States, it remains alive and well in Japan. Using dividend yields, the 4.84% on offer in 10-Year T-notes is 317 bps north of the S&P 500’s proverbial “coupon.” That is a complete upending of the TINA trade that persisted since the days of Ben Bernanke’s Lehman-era firehose.

In contrast, Japan’s TINA situation may not be as robust as it was before the JGB sell-off, but the picture is much rosier than it is elsewhere. The Topix throws off an admittedly non-exciting 2.35%, but the alternative is 0.96% in JGBs, so the spread is 139 bps in favor of stocks. That is a far cry from the three percentage point gap in the other direction in the U.S.

Figure 3: The TINA Trade, United States vs. Japan

The Topix is cap-weighted, so it doesn’t have the screen for dividends that you find in many of our mandates. For DXJ, we rebalance in November, so there is a refresh on valuations as I write.

DXJ sells consistently around 11 to 12 times earnings, which corresponds to an 8%–9% earnings yield. This is a substantial premium to government bond yields, presenting a much better margin of safety than that which exists in U.S. markets.

DXJ's SEC 30-day Yield = 2.30% as of 11/9/23. The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please click here.

As for the yen, many think the currency is cheap—and there are plenty of fair value measures that suggest upside in the yen. But remember this: since the Bank of Japan keeps interest rates pegged below the zero bound, there is a substantial carry of nearly 6% that is earned by Americans when they hedge the yen. We think the case is strong: the stocks are cheap and the carry is sizeable.

I’ll speak about Japanese stock market catalysts on our Office Hours webinars in the coming weeks and months, so please make sure to check out the calendar, which you can find here.

Unless otherwise stated, all data as of October 31, 2023.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.