2023 Japan Index Rebalances

The Tokyo Stock Exchange (TSE) created a buzz earlier this year when it pushed listed companies to raise price-to-book ratios above one, warning that the securities of companies that fail to do so could face classification as “securities under supervision” or even delisting.

Though it is too soon to evaluate the results of the TSE’s efforts to improve corporate governance and capital efficiency, Japanese equities had a strong year of performance.

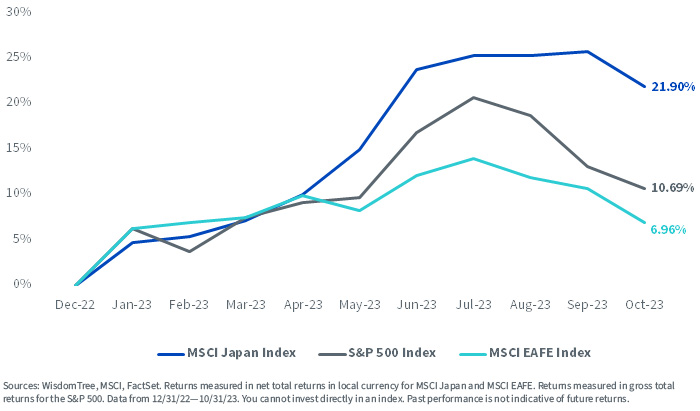

In local currencies, the MSCI Japan Index returned 21.90%, outpacing the S&P 500 Index by more than 11% and the MSCI EAFE Index by almost 15%.

Country/Region Returns, Japan vs. U.S. vs. EAFE

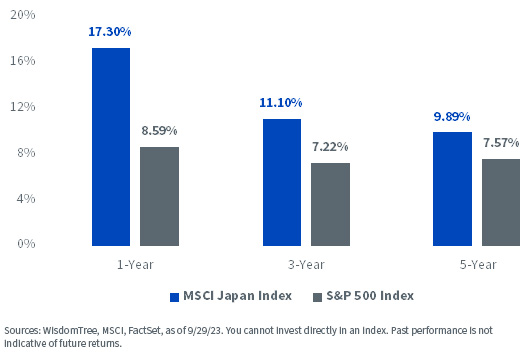

One area of emphasis for activist investors in Japanese equities is getting companies to return excess cash to shareholders. This push seems to be working.

The weighted-average dividend growth for the MSCI Japan Index has consistently outpaced that of the S&P 500 Index over one-year, three-year and five-year periods.

Weighted Average Annualized Dividend Growth, MSCI Japan Index vs. S&P 500 Index

2023 Index Reconstitution: Japanese Equity Indexes

The reconstitution of the underlying Indexes of the WisdomTree Japan Hedged Equity Fund (DXJ), the WisdomTree Japan Hedged SmallCap Equity Fund (DXJS) and DXJS’s unhedged counterpart, the WisdomTree Japan SmallCap Dividend Fund (DFJ), was effective at the close of November 8.

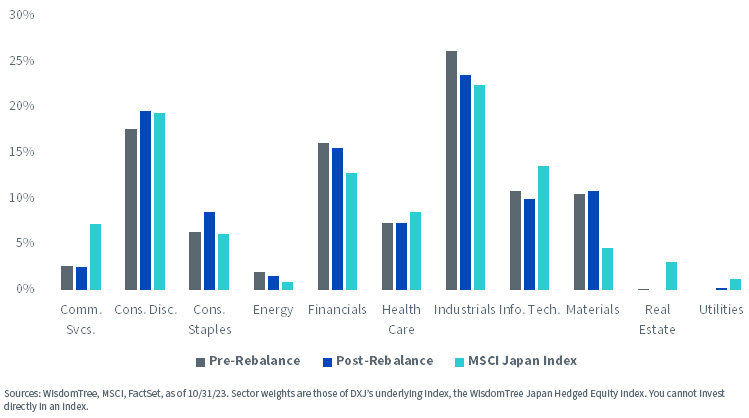

Following the rebalance, DXJ’s Index, the WisdomTree Japan Hedged Equity Index (WTIDJH) largely maintained its sector under- and over-weights relative to the MSCI Japan Index.

Japanese equities performed well year-to-date across most sectors, and WTIDJH increased allocations to the Consumer Discretionary, Consumer Staples and Materials sectors. The Index decreased its exposure to Energy and Industrials.

The DXJ Rebalance: What Changed in the Index

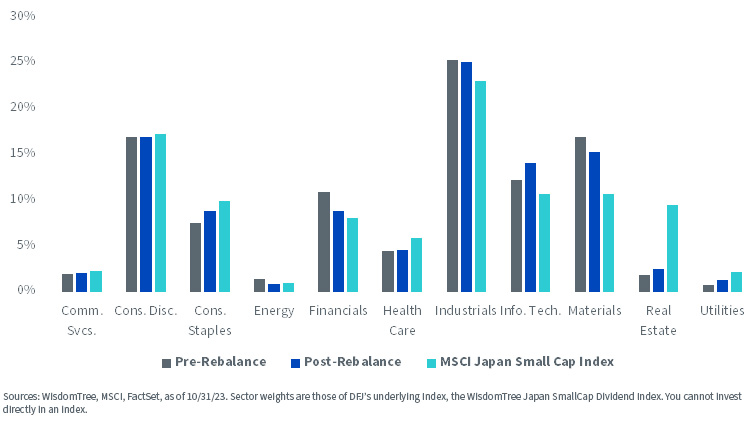

Looking at small caps, DFJ's Index, the WisdomTree Japan SmallCap Dividend Index (WTJSC), increased allocations to Information Technology companies and dropped allocations to Financials, Energy and Materials, relative to the MSCI Japan Small Cap Index.

The DFJ Rebalance: What Changed in the Index

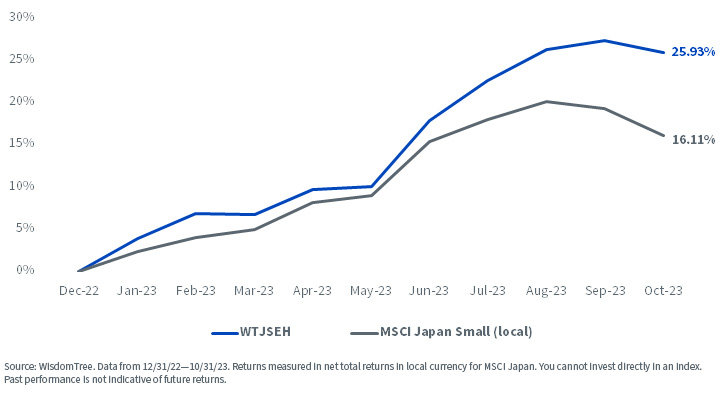

Year to date, the WisdomTree Japan Hedged Equity Index outperformed the MSCI Japan Index by almost 13%, and the WisdomTree Japan Hedged SmallCap Equity Index (WTJSEH) outperformed the MSCI Japan Small Cap Index by almost 10%. The WisdomTree Japan SmallCap Dividend Index outperformed the MSCI Japan Small Cap Index by more than 3%.

WisdomTree Japan Hedged Equity Index (WTIDJH) vs. MSCI Japan YTD Returns

-vs,-d-,-msci-japan-ytd-returns.jpg?h=401&w=707&hash=EE970C9E36311C95A98EC541679641B6)

WisdomTree Japan Hedged SmallCap Equity Index (WTJSEH) vs. MSCI Japan Small Cap YTD Returns

WisdomTree Japan SmallCap Dividend Index (WTJSC) vs. MSCI Japan Small Cap YTD Returns

-vs,-d-,-msci-japan-small-cap-ytd-returns.jpg?h=392&w=705&hash=057D2B8ADF960F16369EAF390DF29EBC)

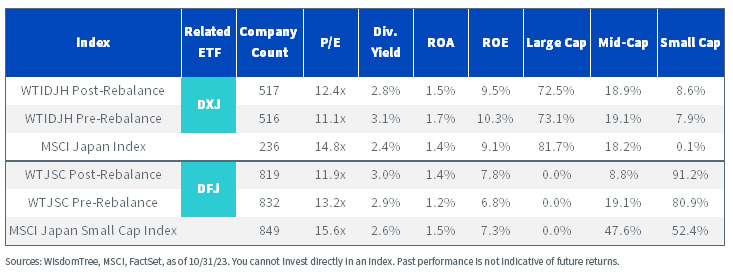

Following the annual rebalance, profitability metrics and distributions of the WisdomTree Japan Hedged Equity Index remain higher than those of its benchmark, the MSCI Japan Index. The WisdomTree Japan SmallCap Dividend Index saw improvements to its dividend yield, return on assets and return on equity following its rebalance, and its price-to-earnings decreased from 13.2x to 11.9x post-rebalance.

Rebalance Fundamentals Comparison

For definitions of terms in the table above, please visit the glossary.

For additional detail on the rebalance of each of the Indexes, please go to their respective Index pages on the WisdomTree website:

- WisdomTree Japan Hedged Equity Index (the WisdomTree Japan Hedged Equity Fund (DXJ) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree Japan Hedged SmallCap Equity Index (the WisdomTree Japan Hedged SmallCap Equity Fund (DXJS) seeks to track the price and yield performance, before fees and expenses, of this Index)

- WisdomTree Japan SmallCap Dividend Index (the WisdomTree Japan SmallCap Dividend Fund (DFJ) seeks to track the price and yield performance, before fees and expenses, of this Index

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.