Emerging Markets Quality Dividend Growth Rebalance: Fall 2023

In May of this year, WisdomTree rebalanced the WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE) completely away from China, bringing its 29% weight in China at the time down to 0%.

The decision was made primarily to mitigate the Fund’s exposure to escalating geopolitical tensions between China and the U.S., and to give another asset allocation option for broad emerging markets exposure without a roughly one-third weighting to China.

For more background on this decision, read this blog post.

We rebalanced DGRE again this month, maintaining its zero exposure to China.

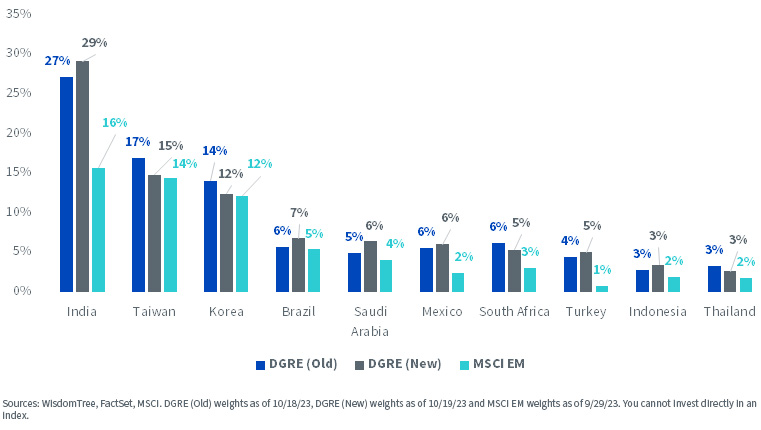

Without that exposure to China, the Fund’s biggest weight at 29% is in India, a nearly 15% over-weight in the country relative to its exposure in the MSCI Emerging Markets Index.

Supporting this active country exposure relative to the benchmark, my colleagues wrote an excellent piece this summer on why India may be at the cusp of an economic boom.

Top 10 Country Weights

The Investment Process

DGRE is a rules-based active ETF. The Model selects roughly 250–300 dividend-paying constituents based on characteristics of dividend sustainability (dividend coverage ratio greater than one), higher profitability metrics (quality) and premium trailing dividend growth.

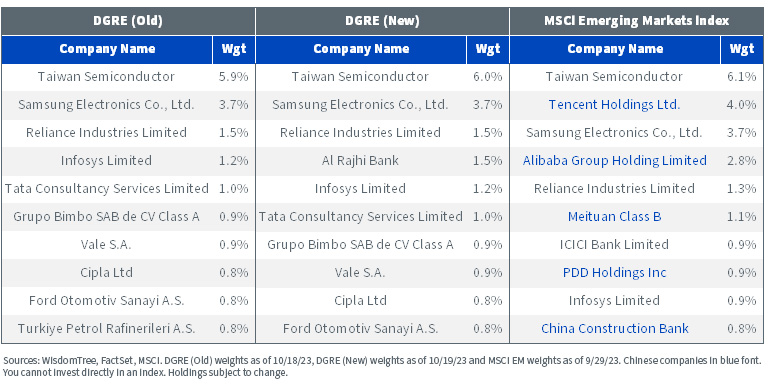

The below table shows the top 10 DGRE holdings before (old) and after (new) the rebalance.

As mentioned in a previous post, Taiwan Semiconductor—maintained as the top holding in DGRE—has consistently been one of the fastest dividend growers globally over the last several years, growing at 7% annualized over the last five years.

Top 10 Holdings

For current holdings, click here.

The weighting process for DGRE is modified market-cap to give greater weight to companies with higher scores on quality and dividend growth. To reduce turnover, constituents that are maintained in the basket are held at a weight that is roughly equal to what it was prior to the rebalance.

The one-way turnover for the Fund at the rebalance was just around 19%.

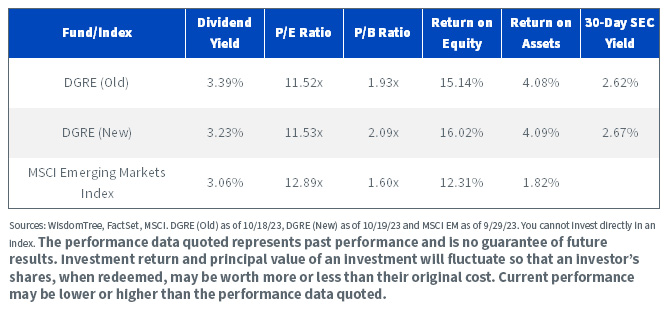

After the rebalance, DGRE's dividend yield is slightly lower, and its price-to-earnings ratio is almost unchanged at a little more than one times below that of the MSCI EM Index.

Further, as the process favors quality companies earning a high return on equity and assets, the return-on-equity advantage over the broad MSCI EM Index was improved while the return on assets was little changed.

Fundamentals Comparison

For the most recent month-end performance and 30-Day standardized yield click here.

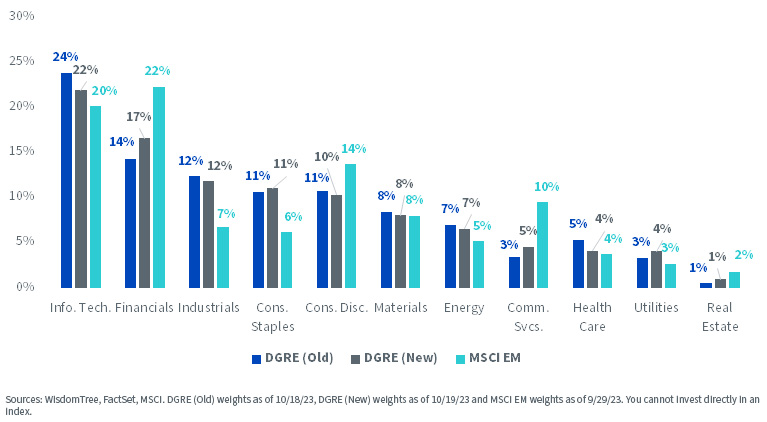

From a sector perspective, the rebalance increased the Fund’s weight in Financials (+3%) and Communication Services (+2%) and trimmed weight from Information Technology (-2%).

Sector Exposures

Conclusion

Emerging markets equities have repeatedly disappointed U.S. investors over the last decade.

The rising political tensions between the U.S. and China have made some investors wary of investing in emerging markets altogether given the outsized weight of China in broad benchmarks.

For investors aiming to mitigate that risk, DGRE offers a compelling solution by way of a basket of high-quality, dividend-paying companies.

Important Risks Related to this Article

There are risks associated with investing including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Fund's focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.