Thinking International: Return Relationships that Bolster Long-Term Performance

This blog post is the second installment of a four-part series that examines the tactical and strategic case for investing internationally despite a multi-year period of U.S. equity outperformance.

In addition to the dangers of performance-chasing we referenced in part one, another key reason why investors should consider increasing exposure to developed international equities has to do with managing risk. Concentrated portfolios look great during bull markets, but can quickly devolve into over concentrated bets that look more like speculation than prudent asset allocation. When new dollars are put to work, we believe they should do more for a portfolio than double down on the S&P 500 Index moving higher. Enter developed international.

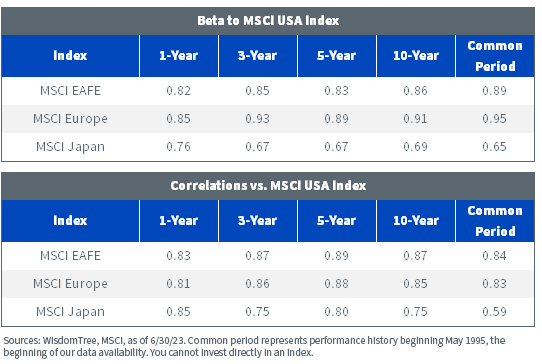

Across market cycles, international equities have shown slightly reduced sensitivity to U.S. market performance. Between Europe, Japan and the broader EAFE (Europe, Australasia and the Far East) region, betas to U.S. equities have remained steadily below 1, implying that domestic returns are less influential for those overseas.

Over recent periods, however, correlations remain highly positive to U.S. markets. This is a byproduct of the increasingly globalized and interconnected world we now live in.

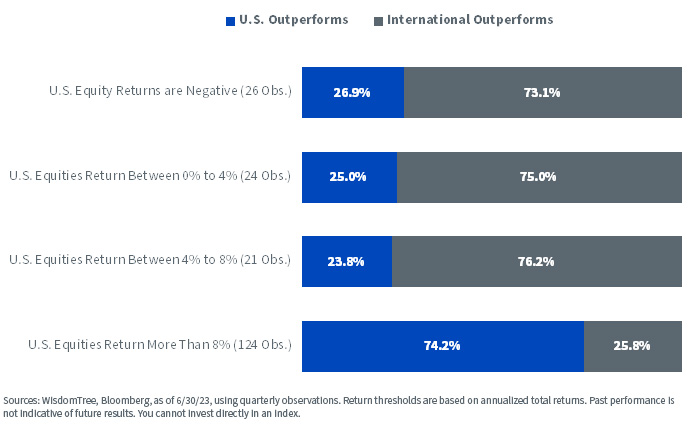

However, diversification benefits are more evident over the longer term, especially during periods of modest U.S. equity returns and outright declines. On a rolling five-year basis, developed markets have outperformed the U.S. about three-quarters of the time in low-to-moderate return environments (including market declines).

Rolling 5-Year Returns, MSCI USA vs. MSCI EAFE, 1970–Present

U.S. equities have had more success in high return environments of 8% or greater, beating EAFE stocks roughly 75% of the time. But this trend is skewed by the recent bull market after the global financial crisis (GFC).

Of the 124 quarterly observations, 38 of them occurred in the last 10 years, and the U.S. outperformed EAFE every single time. Seventy-seven observations occurred over the past 30 years, with the U.S. outperforming EAFE during 73 of them, or 95% of the time.

Performance records like this are compelling and did little to discourage over-weight allocations in U.S. equities over the past several years. But they are also unsustainable over the long term, which is why we believe the future for international equities may not look like the past. We believe the WisdomTree International Quality Dividend Growth Fund (IQDG) may be poised to benefit as a result, and so may be of interest to investors looking to increase allocations to developed international.

For access to the complete developed international market insight, click here.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Heightened sector exposure increases the Fund’s vulnerability to any single economic, regulatory or other development impacting that sector. This may result in greater share price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.