Post-Nvidia’s Q2 2023 Earnings—Will the ‘AI Hype’ Keep Driving Equity Performance?

On August 23, we saw another set of incredible results from Nvidia.

The company’s data center business grew revenues by more than three times in six months, hitting $10.323 billion and a year-over-year growth figure of more than 171%. Guidance for the current quarter is now $16 billion, while consensus was for around $12.6 billion.1

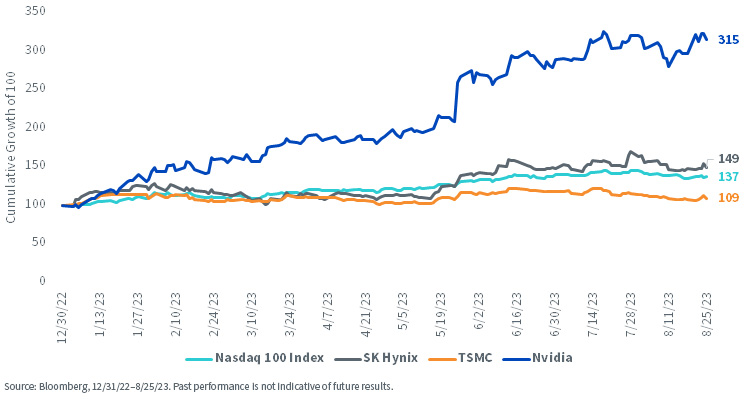

Take a look at figure 1, where we see Nvidia’s year-to-date return alongside Taiwan Semiconductor Manufacturing Co. (TSMC), SK Hynix and the Nasdaq 100 Index.

At WisdomTree, when we build the semiconductor exposure in the WisdomTree Artificial Intelligence and Innovation Fund (WTAI), this is the type of thing we are thinking about—for AI accelerators to work, it’s not solely Nvidia, it’s an ecosystem.

Figure 1: Year-to-Date Performance, Select Companies in the AI Semiconductor Ecosystem

It’s clear that the train of AI adoption has left the station, but it’s possible that the journey itself is still in the early stages.

As investors consider Nvidia’s valuation in the fall of 2023, it is rational to think of two primary factors. One is whether this forecast—that the total market size for AI-accelerating semiconductors in 2027 will be around $150 billion,2—will prove true. It might be too high…or too low. The other regards how much market share Nvidia itself will be able to maintain.

From what we can see today, the biggest risk to Nvidia’s continued domination of AI computational resources are the Big 3 cloud providers 1) designing their own chips and 2) incentivizing their customers to use them for their AI workloads. We say this because it is difficult to picture either AMD or Intel, on their own, making a significant dent.

While Nvidia might be perceived as being at the center of the AI megatrend, exemplifying its hopes and predictions of many, Nvidia GPUs do not operate in isolation. Nvidia doesn’t even fabricate the physical chips.

TSMC fabricates the actual H100 chips that firms are presently racing to buy. TSMC is the most significant fabricator of semiconductors in the world. With all the attention on AI, one would assume that TSMC would be on fire as Nvidia has been, but that has not been the case.

Even if AI-related semiconductors are dominating the headlines, they do not dominate, yet, the full global market for semiconductors.

Consider this—in 2023, are people or companies racing to buy new smartphones or personal computers?

These are two important areas to monitor if one is thinking about the totality of the semiconductor market, and while they have been hot in recent years, in the ongoing cyclical trend, 2023 is one of the colder years for this type of demand.

Some might be surprised to learn that AI chips are only responsible for about 6% of TSMC’s total revenue. This is one of the signals that tell us that we are still early in our AI adoption journey. However, TMSC has also stated that this figure should compound at roughly 50% per year for the next five years, and in 2027, AI-related chips should be roughly 13% of TSMC’s total revenue.3

Another consideration regards the relative sizes of TSMC’s customers, as it helps in understanding the revenue picture that much better. With all the Nvidia attention, we might be tempted to assume that it is TSMC’s biggest customer, but that honor actually goes to Apple. In fact, if we add up the estimated share coming from Qualcomm, AMD and Nvidia together, it would be very similar to Apple’s estimated revenue contribution.4

TSMC does get some attention by virtue of being in Taiwan amid the “US vs. China” geopolitical tensions, but Nvidia’s H100 also needs high bandwidth memory to function. SK Hynix is the primary provider. Its next generation chips can process the equivalent of 230 high definition, full-length movies in a second. The dynamic random-access memory (DRAM) market that relates to AI is about 16% of revenue today, but should grow to roughly 41% of the total by 2025.5

How Might Performance of the AI-Theme Evolve from Here?

As we approach the latter part of 2023, we know that AI has been a catalyst for some of the world’s largest tech companies to drive U.S. equity markets higher for the better part of the year so far. After a rough 2022, the change in performance from negative to positive was welcome. However, we know that investors overestimate the short term and underestimate the long term, so there is a chance that the AI journey will take longer and we’ll have some ups and downs, performance-wise. The funny thing is that we’re already seeing a diverse performance experience across the space.

Conclusion: Riding the Multi-Year Trend in AI

It’s interesting to consider that AI research and advancement occurs all the time. In a year like 2022, it was nearly impossible to talk about it due to poor market performance and a rough macro backdrop, and then in 2023, it’s nearly impossible not to talk about it and people are reaching for exposure in myriad ways. We can think about it like this:

1. Nvidia has moved a lot and may continue to move, but in the second half of 2023, it is difficult to rationalize chasing Nvidia as a single stock too much further in the near term. We have seen a lot of interest in strategies focused on semiconductors, but there is really only one Nvidia.

2. The Nasdaq 100 Index is extremely top-heavy in terms of putting lots of weight in a narrow set of very large tech companies. Many of these companies have developed or are developing large language models to push AI forward. It’s possible that AI is the catalyst that keeps growth in favor within U.S. equities in the coming decade and leads to these companies continuing in the veritable equity driver’s seat.

3. Software is an interesting area for consideration. During the first part of 2023, many were thinking about a potential recession later in the year. Spending on software was not necessarily in an upward trend. In the second half of 2023, while the idea of a recession is fading away, the idea of spending on software has shifted more towards spending on AI. One of the areas we continue to look at is cybersecurity, in that any time customers are expanding access to new technologies, it needs to be accompanied by increased focus on security.

1 Source: Moore et al., “NVDA Reports Another Exceptional Quarter as AI Spending Surges,” Morgan Stanley Research, 8/24/23.

2 Source: Martin Baccardax, “AMD Leaps as Chipmaker Takes on Nvidia in $150 Billion AI Market,” TheStreet.com, 6/14/23.

3 Source: Chan et al., “Correction: AI Semi Demand Outshines; Keep OW,” Morgan Stanley Research, 7/20/23.

4 Source: Chan, 2023.

5 Source: Jiyoung Sohn and Yang Jie, “This Company Is Nvidia’s AI Chip Partner—and Its Stock Is Soaring,” Wall Street Journal, 8/27/23.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.