Check Your Coverage

One of the more interesting aspects to the U.S. fixed income markets thus far in 2023 has been the notable shift in economic expectations.

Heading into this year, perhaps the most widely anticipated recession dominated the conversation, but now, the focus has turned to just how resilient the U.S. economy has been, and perhaps a downturn can be avoided.

While there is no doubt that higher interest rates have served as headwinds for housing, commercial real estate and manufacturing, to name a few sectors, another important component to the Federal Reserve’s aggressive rate hike cycle has been the outlook on the financing side of the ledger.

Indeed, higher funding costs have emerged as a key component for fixed income investing in U.S. corporate bonds, especially within the high-yield (HY) arena.

Interest Coverage Ratio as a Barometer for Issuer Health

One of the key barometers used in gauging the strength or weakness of corporate debt issuers is the interest coverage ratio (ICR).

In its simplest form, the ICR allows investors to assess the underlying health of the issuer’s balance sheet by determining how easily they can pay interest expenses on their company’s debt. The general rule is the higher the ratio, the better the issuer’s financial position to make their interest payments, while a lower ratio points to potential difficulties servicing the debt, which could lead to default.

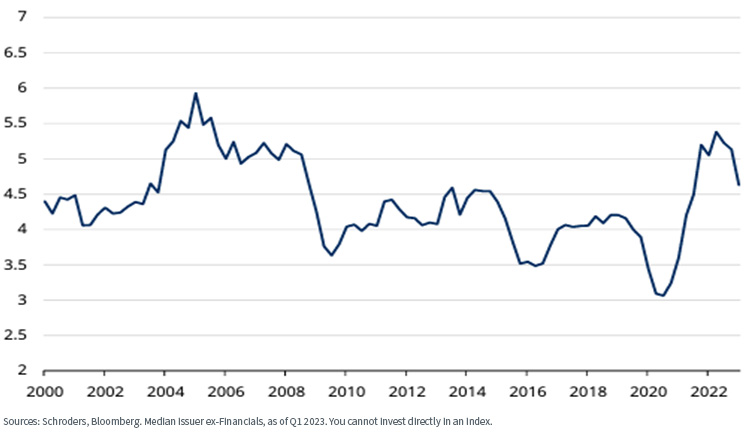

While current ICR levels for the U.S. HY market remain above long-term historical averages, they have recently declined as the impact of higher market yields works its way into interest expense.

U.S. High-Yield Market – Interest Coverage Ratio

Winning by Not Losing

For investors concerned with corporate funding costs amid this move into a higher-yield environment, this recent deterioration in fundamentals may be grounds for reconsidering a broad, market capitalization-weighted allocation to the HY market.

The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) can provide investors a more targeted HY exposure.

Through a systematic, multi-step process, the strategy screens the HY universe to reduce or eliminate exposure to fundamentally weaker credits, then tilts to those remaining issuers, which may offer more attractive income.

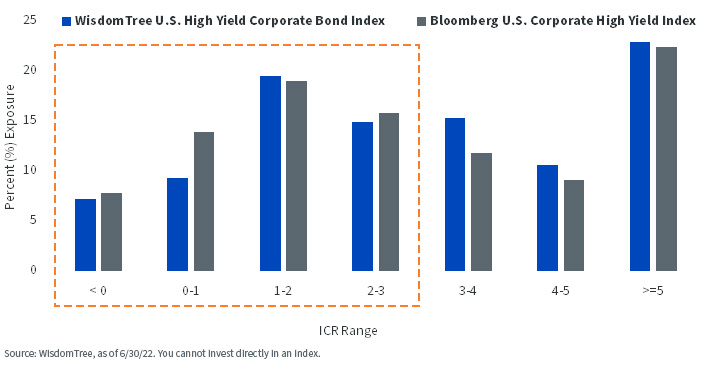

The result of this process can be seen through the lens of ICR. The WisdomTree U.S. High Yield Corporate Bond Index, which WFHY is designed to track, currently has less exposure to issuers on the lower end of the ICR range.

% Exposure to Issuer ICR

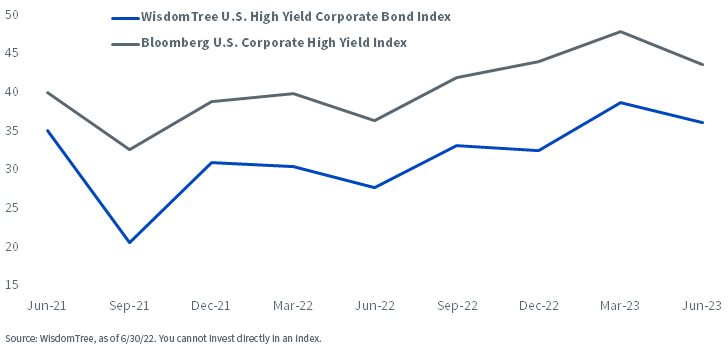

This can also be seen when comparing relative exposure to issuers with lower ICRs over time.

% Exposure to Issuers with ICR below 2

By seeking to protect investors from issuers most vulnerable to rising funding costs, WFHY aims to win by not losing. As we have previously highlighted, this strategy has been rather effective at limiting the cumulative number of defaults relative to the broader market.

With ongoing uncertainty regarding inflation, interest rates and corporate profit margins, emphasizing fundamentally sound companies with strong cash flows can be a prudent way to access HY credit in today’s macro environment.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.