Short Duration Fixed Income Model Portfolio: Keep the Income, Lose the Volatility

Last year was the worst on record for U.S. bond investors.

But we believe there are two important consequences for portfolio construction that came from this challenging market environment.

First, there is “income back in fixed income,” and with what we believe to be the era of negative interest rates behind us, investors and advisors can once again use bonds as a potential source of yield and return generation in portfolios.

Second, investors are rethinking their approach to the fixed income market. One noteworthy theme of this “re-think” we have observed is a growing demand for bond portfolios with reduced duration risk, or sensitivity to changes in interest rates.

2022: A Harsh Reminder of Duration Risk

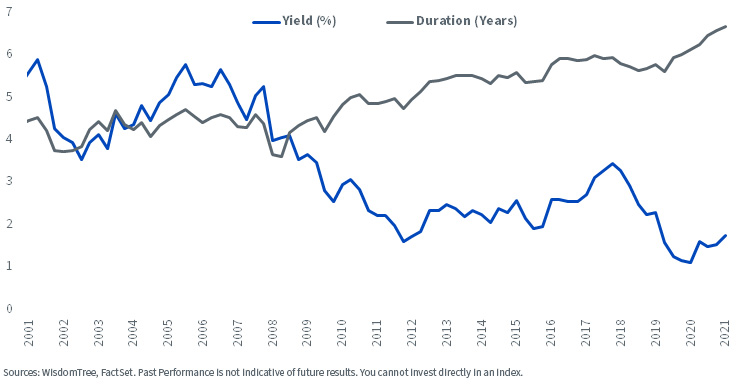

For the 20-year period ending in 2022, U.S. bond yields generally went one direction, as they were continuously drawn closer to their zero bound.

Over this same period, the interest rate risk of most conventional core bond portfolios quietly ticked higher as bond issuers locked in low interest rates for longer maturities.

Between 2002 and 2022, the duration of the Bloomberg U.S. Aggregate Bond Index rose from 4.5 years to 6.7 years, nearly a 50% increase in interest rate risk!

Bloomberg U.S. Aggregate Bond Index—Yield and Duration

After decades of steady, positive returns from falling yields, the steep losses seen in fixed income portfolios last year certainly caught many investors off guard.

We continue to believe that a diversified, strategic fixed income allocation has a place in most portfolios.

That said, given this recent experience and the maturity profile of mainstream fixed income benchmarks, it’s understandable that many advisors are interested in a modified core bond solution with less duration risk.

The Case for a Short Duration Fixed Income Model Portfolio

Depending on one’s investment objectives and risk tolerance, fixed income can play a variety of different roles in a portfolio. Most investors view the asset class as a ballast in times of market stress and a steady, low-volatility income producer in “normal” environments.

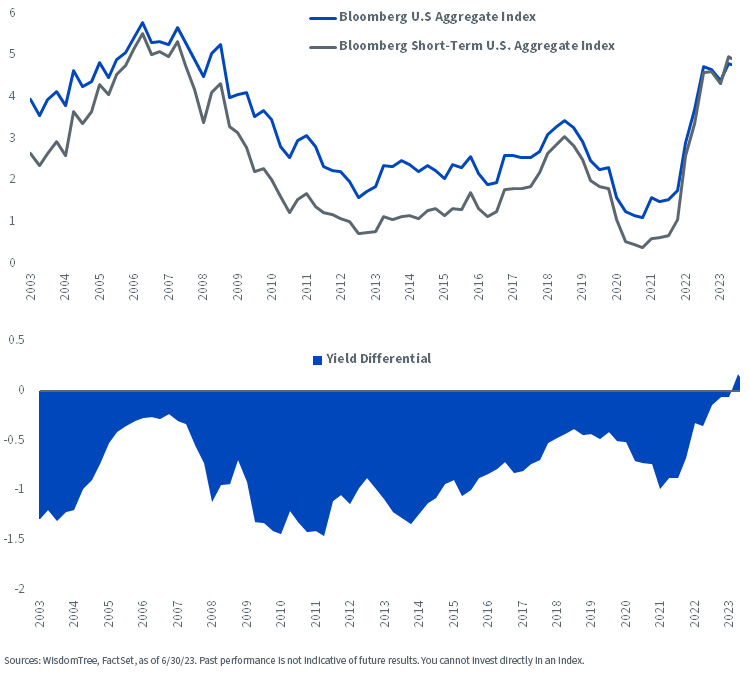

Since the global financial crisis, fixed income’s role as a reliable income-generator has been challenged. Investors searching for yield were forced to go down in credit quality and/or extend duration (hence, take on incremental interest rate risk) to achieve a reasonable yield within their fixed income portfolios.

However, due primarily to the Fed’s increasingly restrictive monetary policy actions over the past year and a half, yields on short duration bonds now meet or exceed those seen at longer maturities.

Yield to Worst (%): Bloomberg U.S. Aggregate Bond and Short-Term U.S. Aggregate Indexes

This means that investors today can achieve a reasonable level of income without taking on undue credit or interest rate risk.

This development is a breath of fresh air, and it is logical to see money in motion as investors and advisors reposition their portfolios accordingly.

For those contemplating a change in strategy, the WisdomTree Short Duration Fixed Income Model Portfolio can deliver an attractive level of income with significantly less interest rate risk than a conventional core bond strategy.

As a “building block” model, investors and advisors can utilize the strategy as a stand-alone fixed income portfolio or as a bond allocation within a broader multi-asset portfolio.

Diversification, Flexibility and Efficiency

Beyond interest rate risk and income generation, there are fundamental characteristics of a well-designed portfolio that should remain top of mind for investors re-thinking their bond allocation: diversification, flexibility, cost and tax efficiency.

While there is no shortage of attractive fixed income opportunities today, going forward this opportunity set will evolve alongside changes in Fed policy, economic regimes and credit cycles.

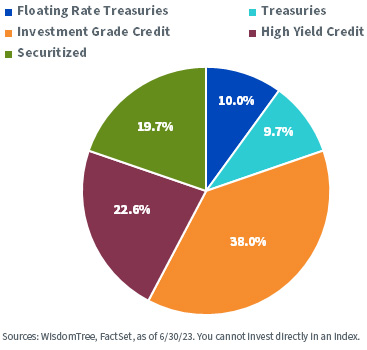

We believe that prudent diversification across fixed income asset classes and credit sectors is essential to help reduce concentration risk in any one segment of the market and improve long-term returns.

As we illustrate below, our short duration fixed income Model Portfolio is diversified accordingly.

Sector Allocation

Flexibility to adjust exposures as market conditions change is another benefit to utilizing a model portfolio. Investors in the WisdomTree Short Duration Fixed Income Model Portfolio will automatically gain access to the expertise and market views of our entire investment team.

Finally, our Model Portfolios are ETF-focused to optimize both expenses and taxes, and do not charge a strategist fee.

Performance and Our Fixed Income Outlook

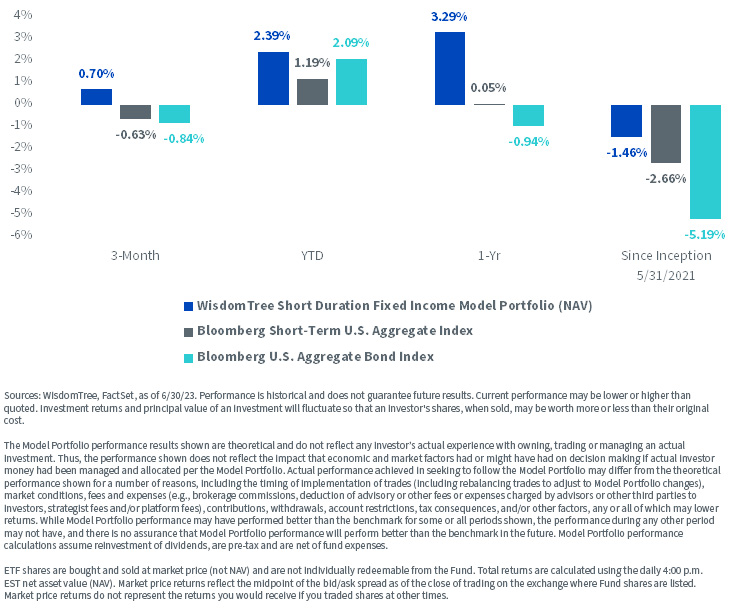

Since its launch in May 2021, the WisdomTree Short Duration Fixed Income Model Portfolio has delivered on its objective, outperforming both the Bloomberg U.S. Aggregate Bond Index and Bloomberg Short-Term U.S. Aggregate Index across all periods.

Performance as of June 30, 2023

For underlying Fund performance, including standardized performance and 30-day SEC yield, please click here.

Looking forward, the outlook for Fed policy remains uncertain. While most market participants believe the Fed has wrapped up its latest rate hike cycle, Powell & Co. have expressed their desire to remain in a wait-and-see mode and assess the upcoming economic and inflation data accordingly.

This persistently hawkish posturing, alongside the fact that core inflation remains well above the Fed’s desired target, put us in the “higher-for-longer” camp.

In this environment, interest rate volatility likely persists for the foreseeable future.

For existing core bond investors understandably focused on this significant source of portfolio volatility, the WisdomTree Short Duration Fixed Income Model Portfolio seeks to help mitigate duration risk while achieving similar or even greater levels of income.

Contact Us

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial professionals: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.