Exponential Adoption Comes with High Risk—Considering Nvidia’s Path from Here

Nvidia has done an incredible job of becoming synonymous with the term “artificial intelligence.” That is the combined effect of great messaging, great marketing, great vision and amazing technology. Efforts made and decisions taken years ago are, through the magic of compounding and Moore’s Law, bearing fruit today.

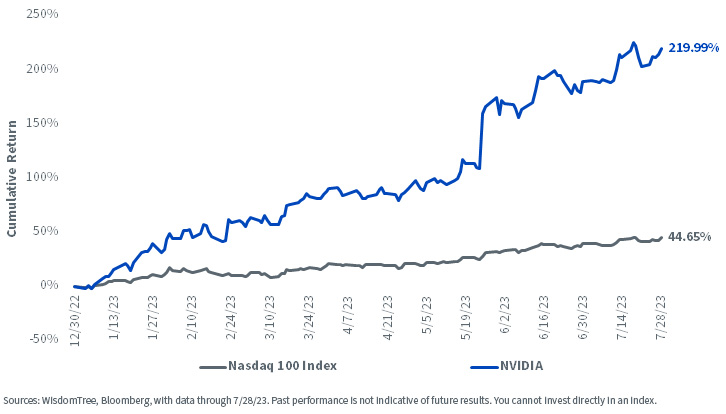

And yet, there are still two sides of the veritable coin. If we consider figure 1, the year-to-date (YTD) return of Nvidia’s share price relative to the Nasdaq 100 Index, we see massive outperformance. As investors, we have to start wondering if the excitement around all the great things that Nvidia has done and may continue to do is baked into this performance already. We have to think—what types of things can it potentially announce to create the possibility of a positive surprise from here? High investor expectations is one of the toughest hurdles for companies to overcome.

Figure 1: Nvidia in 2023 vs. Nasdaq 100 Index

Many of us are familiar with the premise:

In the short run, the market is a voting machine, but in the long run, the market is a weighing machine.1

In the first half of 2023, we know that it was enough to speak in anecdotes. Did you hear how ChatGPT gained 100 million users in two months? Isn’t that the fastest an application has ever hit that milestone?2 These types of statements were enough to create excitement, but that is not very different from a popularity contest.

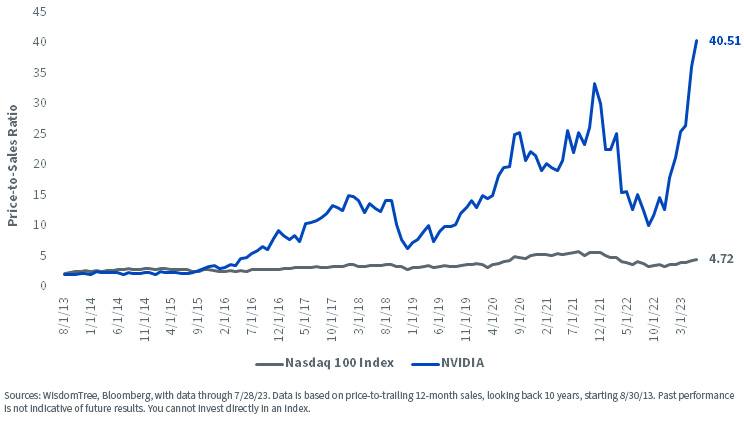

There is a reason why Gartner’s Hype cycle goes from the Peak of Inflated Expectations down to the Trough of Disillusionment.3 The rubber starts to meet the road, and companies need to transition from “this idea seems pretty cool” to “this idea will drive a material increase in revenues.” We can see this in how much investors are willing to pay for Nvidia’s sales, set to come over the next year—typically, the price-to-sales (P/S) ratio, which is plotted in figure 2:

- Investors will not continue to pay more and more for that next incremental dollar of revenues forever. The usual pattern is that investors get too excited for bright, shiny new ideas in the short run, and then they make the opposite mistake of not being excited enough in the long run. Exponential growth curves can look fairly slow in the short run and then can accelerate very quickly in the long run.

- We recently wrote here about the history of companies with the highest P/S ratios. Nvidia’s run in the first half of 2023 saw it rewarded with among the highest P/S ratios across all large-cap U.S. companies. It is a distinction of dubious forward-looking value, similar to the concept of a company’s founder or CEO being on the cover of a major publication. The data suggests that there may be some further strong performance, but the high valuation becomes similar to the force of gravity—it is harder and harder for the business results to keep supporting further multiple expansion. It’s not impossible, but very, very few companies have proven they can do it. History tells us that if there is the option to invest in the stock with the highest P/S ratio or the broad market, the broad market has tended to outperform in nearly all cases.

Figure 2: Nvidia’s Price-to-Sales Ratio vs. Nasdaq 100 Index

Bottom Line: How Much Nvidia Risk Do You Want to Take in 2023’s Second Half?

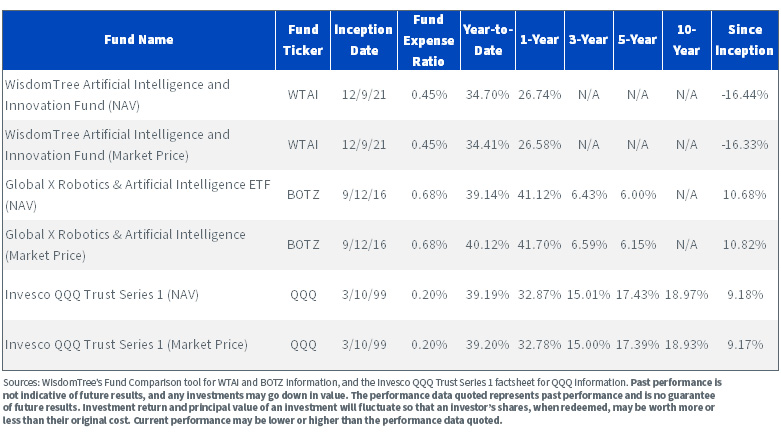

All of that leads us to think about investors seeking exposure to artificial intelligence in the second half of 2023. As we have been following the different ETF options that investors face among U.S.-listed vehicles, we cannot help but notice that the largest fund by assets under management focused on AI, the Global X Robotics & Artificial Intelligence ETF (BOTZ), has held a very large percentage of its weight in Nvidia during 2023 so far. As Nvidia delivered its stellar returns during the first half of 2023, this positioning was quite helpful. If the trend changes and Nvidia’s valuation contributes to underperformance in the second half of 2023, this could be a significant risk.

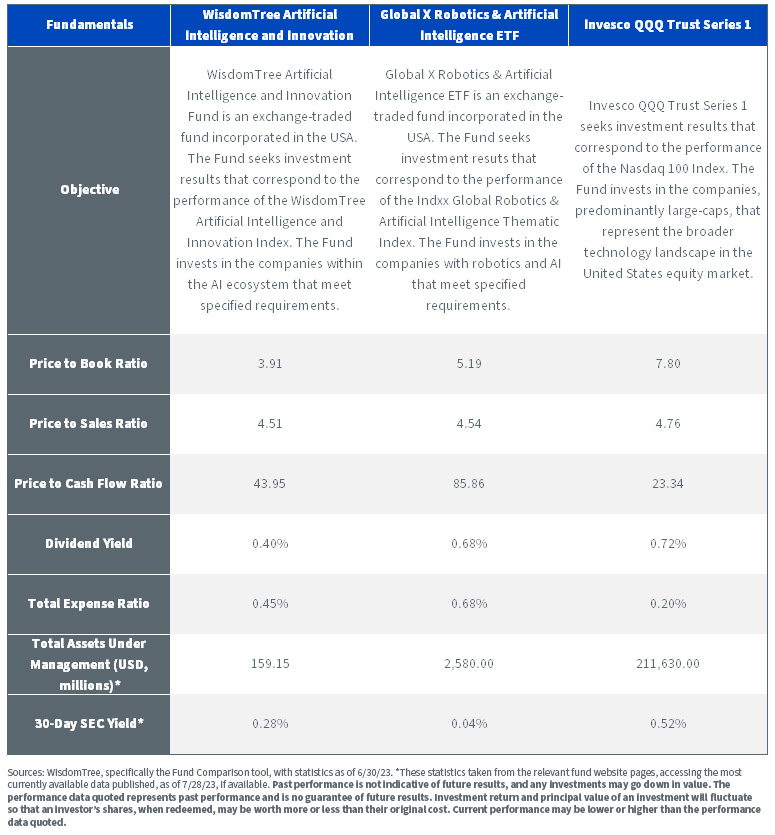

When evaluating thematic ETFs, we advocate always making sure to look at the underlying positions—particularly the top 10. In a simple way, this can give an investor a lot of information about the distribution of weight across companies. If the top position is above 10%, for example, we view this as quite different to another strategy where the top position might be below 5%. No one knows what the forward-looking performance will be of any fund—but we would just note that 10% or more in any stock leads to a lot of the portfolio’s volatility coming from that stock over future periods.

The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) held a 2.53% weight in Nvidia, as of June 30, 2023, which was below the stock’s 6.57% weight in Invesco QQQ Trust Series 1 (QQQ). Because QQQ is tracking the Nasdaq 100 Index, this 6.57% could be viewed as something of a marker of where Nvidia’s exposure might sit in a key equity benchmark.

BOTZ, on the other hand, held a position of 11.68% in Nvidia as of this same date.

We know that holdings of any strategy can change in the future, but if Nvidia’s performance begins to lag, it could have an outsized impact on the returns of BOTZ, even if the broader AI theme keeps up at least some of its momentum.

Figure 3a: Standardized Performance (as of June 30, 2023)

Figure 3b: Comparison of Top 10 Holdings (as of June 30, 2023)

Figure 3c: Important Fund Information (as of June 30, 2023)

This information must be preceded or accompanied by a prospectus. For the most recent month-end and standardized performance and to download the respective fund prospectuses, click the following tickers: WTAI, BOTZ, QQQ.

1 Source: Warren Buffett, “Chairman’s Letter,” 1987, www.berkshirehathaway.com/letters/1987.html.

2 Source: Krystal Hu, “ChatGPT Sets Record for Fastest-Growing User Base – Analyst Note,” Reuters, 2/2/23.

3 Source: “Gartner Hype Cycle Research Methodology,” Gartner, www.gartner.com/en/research/methodologies/gartner-hype-cycle.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.