Diversifying EM Exposure Using WisdomTree Strategies

Allocating to emerging markets has been a tall task recently.

Looking at the trailing 5-, 10- and 15-year periods, the broad MSCI Emerging Markets Index (MSCI EM) lagged the S&P 500 by more than 11%, 10% and 9% annually, respectively.1

But there have been pockets of companies within emerging markets that have experienced solid performance over these periods—usually driven by idiosyncratic considerations such as country, sector and factor exposures.

We believe in the long-term benefits of diversification and encourage investors to allocate across regions and asset classes.

Below, we lay out a capital-efficient way to allocate to emerging markets using WisdomTree’s Indexes.

WisdomTree Large-Cap Emerging Market Exposures

WisdomTree has two Indexes providing exposure to emerging market2 companies: the WisdomTree Emerging Markets Ex-State-Owned Enterprises (EMXSOE) and the WisdomTree Emerging Markets High Dividend Index (WTEMHY).

WTEMHY was launched in 2007 and provides exposure to the highest dividend-yielding companies in emerging markets. The Index reconstitutes annually and holds the highest (top 30%) dividend-yielding companies in EM, screening out those with the highest risk according to our Composite Risk Screen measure.

After the most recent rebalance, WTEMHY over-weights in the Energy, Materials and Financials sectors and under-weights both the Consumer and Health Care sectors compared to the MSCI EM. WTEMHY over-weights Brazil and Taiwan and is under-weight in China, India and South Korea with respect to MSCI EM.

EMXSOE was launched in August 2014, and its investment thesis is to identify state-owned companies (SOEs)—defined as those with 20% or more local government ownership—and exclude them from the investable universe.

The Index, which also reconstitutes annually, weights non-state-owned enterprises using their market capitalization and aims to maintain country neutrality and sectors within +/- 3% of the starting universe prior to removing SOEs. This results in consistent over-weights in both Consumer Staples and Discretionary, Info. Tech. and Health Care and under-weights in Energy, Financials and Utilities.

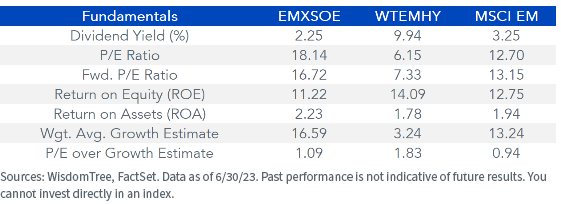

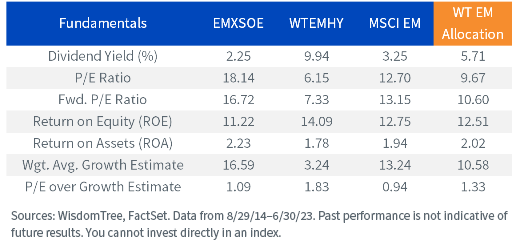

Looking at each portfolio’s fundamentals, it is clear how these Indexes provide different factor exposures to investors. EMXSOE tends to have high profitability metrics (ROE, ROA) and growth estimates resulting in exposure to quality and growth factors. Meanwhile, WTEMHY has a value and quality tilt with a high dividend yield, lower valuations and strong profitability metrics.

Aggregate Fundamentals (as of 6/30/23)

For definitions of terms in the table, please visit our glossary.

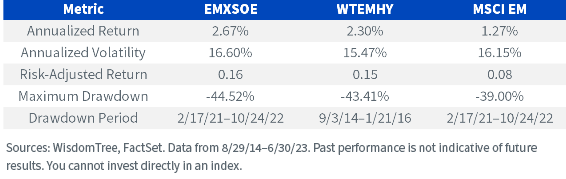

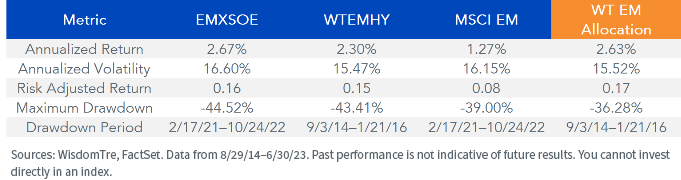

Since EMXSOE’s inception almost nine years ago, EMXSOE and WTEMHY have each outperformed the MSCI EM by more than 100 basis points (bps) annualized, almost doubling its risk-adjusted return.

We can see below how both Indexes achieved this with a different risk-return profile and driven by their underlying factor exposures.

EMXSOE outperformed during the years when growth companies in EM outperformed and experienced its maximum drawdown when value companies led as commodity prices rebounded in 2021 and 2022. WTEMHY experienced its highest drawdown at the start of the period, only to track closer to MSCI EM in the subsequent years and experience its stronger period of relative performance in the past 18 months, as dividend payers have outperformed.

Performance Metrics (8/29/14–6/30/23)

For definitions of terms in the table, please visit our glossary.

Growth of $100

The Power of Diversification

It can be difficult to make an investment decision by looking at the information presented above and without knowledge of how markets (and investment factors) will behave in the future.

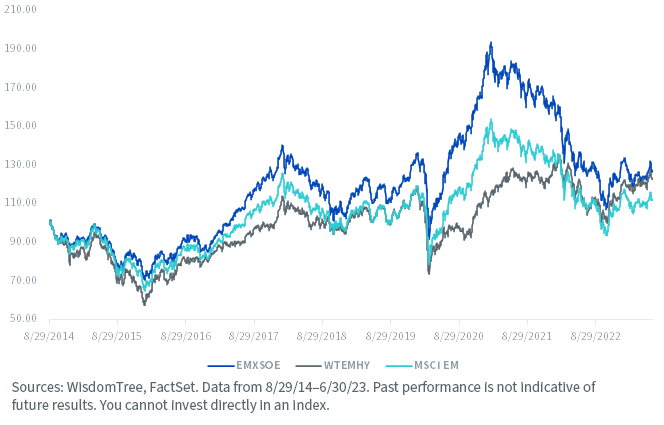

Modern Portfolio Theory (MPT)—first introduced by Nobel Prize winner Harry Markowitz in 1952—states that a portfolio’s idiosyncratic risk can be reduced by investing in assets that are not perfectly correlated. Applying this theory to WisdomTree’s two EM Indexes, the portfolio’s idiosyncratic risk is driven mainly by the sector, country and factor exposures resulting from the Index’s methodology. The chart below shows the rolling 12-month correlation between WTEMHY and EMXSOE.

Rolling Correlation: EMXSOE–WTEMHY

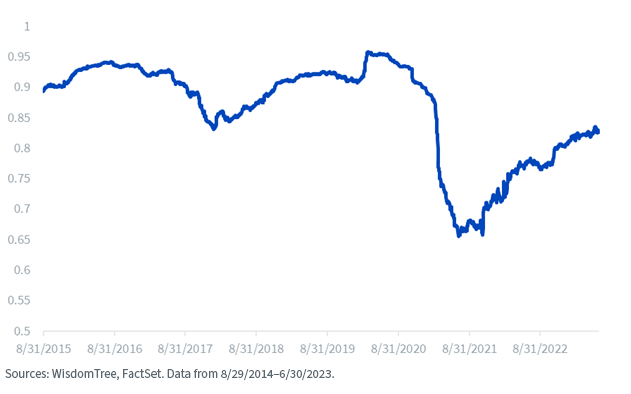

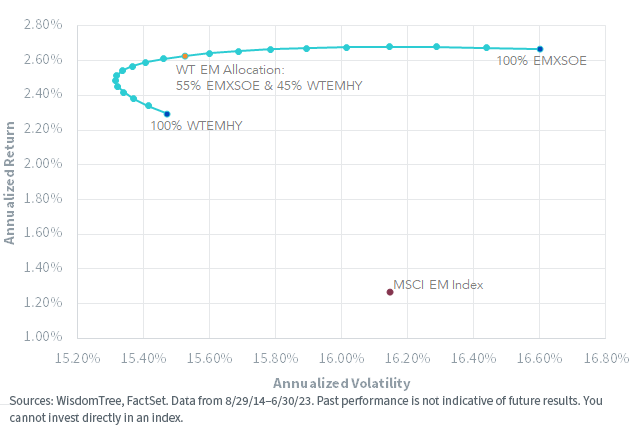

The lower correlation between these Indexes allows investors to build a more efficient EM asset allocation. The efficient frontier below shows the annualized return and volatility of portfolios built by combining EMXSOE and WTEMHY. The data used for this chart stems from August 29, 2014, to June 30, 2023, and assumes that the allocation is rebalanced quarterly at the end of February, May, August and November. Each dot on the curve shows a 5% shift in allocation from one asset to the other.

Asset Allocation: EMXSOE vs. WTEMHY

As we can see, the combination of EMXSOE with WTEMHY over the period would’ve allowed investors to obtain comparable levels of return while reducing volatility. It is also interesting to see how most points on the curve have higher returns than the MSCI EM, with lower volatility. The highlighted allocation (WT EM Allocation), which holds 55% in EMXSOE and 45% in WTEMHY, represents the point in the curve with the greatest risk-adjusted returns. If we look at the performance metrics in the table below, we can see the power of diversification, as the WT EM Allocation portfolio has increased risk-adjusted returns and lower drawdowns than EMXSOE and WTEMHY in isolation.

Performance Metrics (8/29/14–6/30/23)

The resulting fundamentals are also attractive compared to the broad MSCI EM in terms of valuations, dividend yield and profitability.

Aggregate Fundamentals (as of 6/30/23)

We, therefore, believe a combination of the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) and WisdomTree Emerging Markets High Dividend Fund (DEM), which track EMXSOE and WTEMHY, respectively, can be a good way to gain exposure to emerging markets in an investor’s portfolio.

1Source: FactSet. Data from 6/30/08–6/30/23.

2WisdomTree includes companies incorporated and listed in the following countries: Brazil, Chile, China, Czech Republic, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand and Turkey.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.