Navigating AI Investments: Diversification and Valuation within the AI Theme

As Q2 earnings announcements approach, it’s crucial for investors to revisit growth expectations and re-evaluate concentration risk when considering exposure to the artificial intelligence (AI) theme. With the market breadth remaining quite narrow year-to-date, ensuring proper diversification and being mindful of valuations are key to building a well-rounded portfolio within the AI industry.

Avoid Concentration Risk

One standout performer in the AI industry is Nvidia, which experienced explosive price appreciation since the latest earnings announcement when they forecasted $11B in sales for the upcoming quarter—more than 50% higher than analyst expectations. Consequently, valuation metrics such as the price-to-sales ratio soared. If Nvidia seemed expensive six months ago, it has become an even more challenging “buy” to justify for value-oriented investors. Some may even question, is it “growth at a reasonable price” at this point?

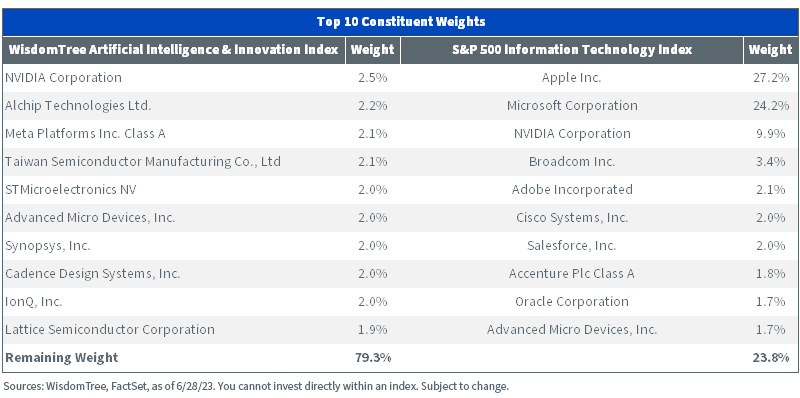

However, relying heavily on Nvidia as an AI exposure can lead to concentration risk. Many investors seeking exposure to the AI megatrend opt for a broad tech approach—sometimes assuming an allocation to the Nasdaq 100 Index or the S&P 500 Information Technology sector suffices for AI theme coverage, resulting in mega-cap tech firms comprising a significant percentage of their portfolios. This concentrated and expensive approach may not be ideal for those looking to mitigate risk and diversify their investments while seeking to gain exposure to the AI theme. Luckily, there are other avenues to gain exposure to this exciting technology.

Figure 1: Illustrating Possible Concentration Risk within Top 10 Holdings

Consider Other AI Exposures

Companies like MongoDB and Elastic are creating vector search databases, enabling improved efficiencies in querying large language models (LLMs) like OpenAI’s ChatGPT to be used for inference. These innovations power various use cases—such as similarity search, recommendation engines, Q&A systems, dynamic personalization and long-term memory for language models—enabling businesses to harness proprietary data with LLMs to increase their efficiency.

Firms like Autodesk, with its computer-aided design software, stand to benefit from generative learning algorithms—which can be used to increase design efficiency by generating potential solutions tuned to the input parameters of the user. This allows the user to augment their creative abilities, using AI-generated outputs to streamline the process from idea generation to finished product.

At WisdomTree, we take an approach that covers various aspects of the AI value chain, seeking broad exposure to AI. This exposure can be broken down into subgroups such as AI Software, Semiconductors, Other Hardware and Innovation. By diversifying across these subgroups, investors can capture many different aspects of the AI theme. For example, gaining exposure to AI computing chips within the Semiconductor group, generative AI applications within the Software and Innovation groups, and autonomous vehicles and robotics in Other Hardware—allowing for a more comprehensive exposure to the breadth of the AI theme.

Be Mindful of Growth and Valuations

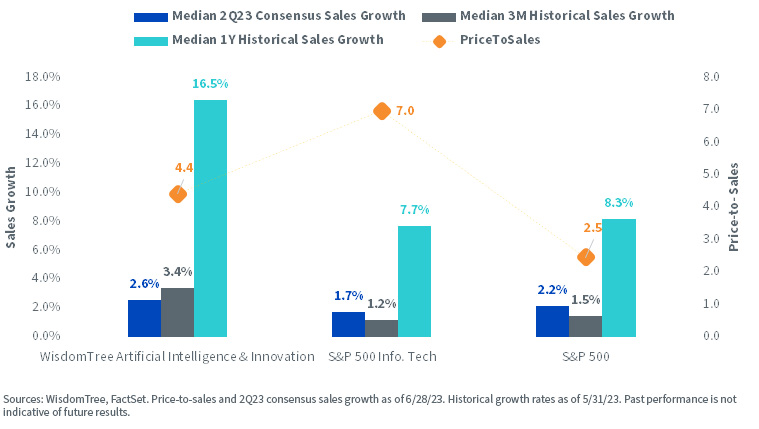

When seeking exposure to high-growth companies, valuation often comes at a cost. The significant run-up in prices of large-cap tech names at the beginning of the year has led to higher valuations and increased concentration within some of the broad market baskets. Through the fundamentally aware and diversified approach to the WisdomTree Artificial Intelligence & Innovation Index, the strategy seeks to blend strong forward-looking and historical growth with reasonable valuation statistics such as price-to-sales.

Figure 2: The Growth vs. Valuation Trade-Off

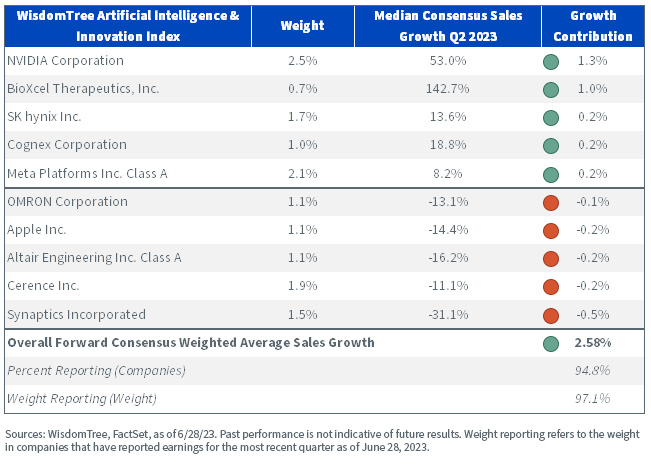

Breaking things down further on the growth side, it becomes evident that sales and earnings volatility persists in the AI industry, as demonstrated by Nvidia. When a large company like Nvidia forecasts a 50% growth in sales, the market reaction is significant, and the single stock impact on the broader portfolio can take effect—in terms of both allocation and aggregate statistics like growth rates. At the moment, for the holder, the price appreciation can be great, but as valuations steepen and another quarter nears, investors may anticipate impacts that the next earnings announcement may bring and question trimming the allocation to reduce risk. With each subsequent announcement, it becomes more and more challenging to give market participants a suitable “positive surprise” to keep pushing the share price even higher.

Figure 3a: The WisdomTree Artificial Intelligence & Innovation Index Sees Broad Contribution to Sales Growth from Many Companies, Limiting “Growth Concentration”

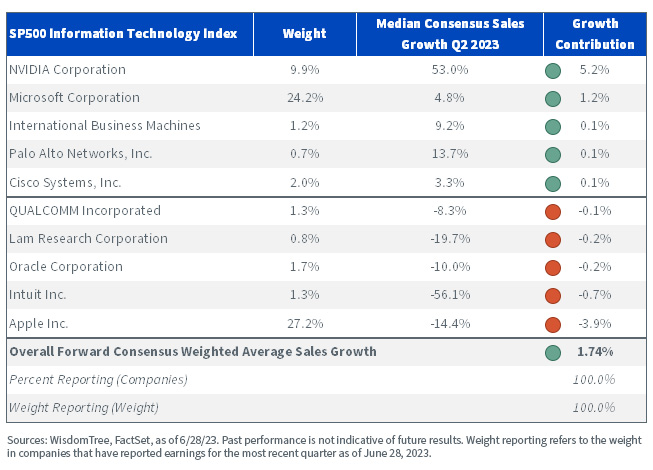

Figure 3b: The S&P 500 Information Technology Index Sees a Very Concentrated Contribution to Sales Growth from a Smaller Subset of Companies, Not Mitigating “Growth Concentration”

As you can see above, the WisdomTree Artificial Intelligence & Innovation Index growth profile is much more diversified than more concentrated alternatives. Those with large weights to mega-cap tech stars may show reasonable numbers but are much more reliant on these heavy allocations. The same can be said for their returns and volatility profile.

Investing in artificial intelligence requires a well-balanced portfolio that prioritizes diversification across the AI ecosystem. The WisdomTree Artificial Intelligence and Innovation Index provides a promising avenue for investors to tap into the potential of the AI industry while ensuring a balanced approach. By diversifying across different AI subgroups and adopting a strategy that emphasizes use cases as well as growth and valuation considerations, investors can effectively mitigate concentration risk while gaining exposure to artificial intelligence in a portfolio.

For those investors interested to learn more about WisdomTree’s approach, they may consider a further look at the WisdomTree Artificial Intelligence & Innovation Fund (WTAI), the Fund designed to track the returns of the WisdomTree Artificial Intelligence & Innovation Index.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending in research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Blake Heimann is a Senior Associate on the Quantitative Research & Multi Asset Solutions team at WisdomTree, based in Europe. He initially joined WisdomTree in 2020 as an Analyst on the Research team in the U.S. In his current role, he is responsible for supporting the creation, maintenance, and reconstitution of equity and digital asset indices.

Blake's finance career began in 2017 at TD Ameritrade, where he started as an Analyst before transitioning to a role as a Quantitative Analyst. During this time, he focused on research and development of machine learning applications in finance. Blake holds bachelor's degrees in Mathematics and Economics from Iowa State University, and he has completed his Master's in Computer Science with a specialization in Machine Learning at Georgia Tech.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.