Amid the Frenzy for Nvidia, Don’t Forget the Data Centers

Will 2023 be the ‘year of artificial intelligence’? As we sit, roughly six-months in, it’s looking quite possible.

Whenever a singular topic gains this level of attention, it’s instructive to look at how investors develop different types of tunnel vision. If the wave continues, there’s a good chance that while the average person may not know what a graphics processing unit (GPU) is or how it connects to AI, they might very well know that Nvidia ‘makes them’ and that Nvidia is basically the ‘AI company.’

Frequently, we find ourselves trying to remember to step back and think about the broader set of infrastructure that is required for Nvidia’s GPUs to actually be effective at training and running AI models. Nvidia, effectively, designs merely one part of a much longer value chain that builds into the AI ecosystem. It is an important part, and Nvidia is able to extract a significant percentage of the overall economic value, but if the other parts ceased to exist it is also true that Nvidia’s GPUs, by themselves, are not very useful.

Data Centers: Where Are the AI Models Trained and Run?

The software aspect of AI is often conceptualized, but it’s important not to forget the physical aspect. Giant server farms, strategically deployed across the globe, allow the internet to work as we have come to expect, and this infrastructure also allows the largest AI models to be trained and run.

Data centers represent the specific, purpose-built real estate that supports this infrastructure. All the time, there is a race to both expand the computational resourcing per square foot in the existing data centers as well as to expand the overall data center footprint.

Why is this? Well, when was the last time you thought about data storage? We’re all taking more pictures, generating more content and not even paying a second’s thought to storage. We just assume that when we need it, more will always be there.

At WisdomTree, we work closely with CenterSquare, an investment management firm that specializes in real estate assets. They recently put out a short briefing note with a focus on data centers, and we wanted to bring some of that information to our own audience.

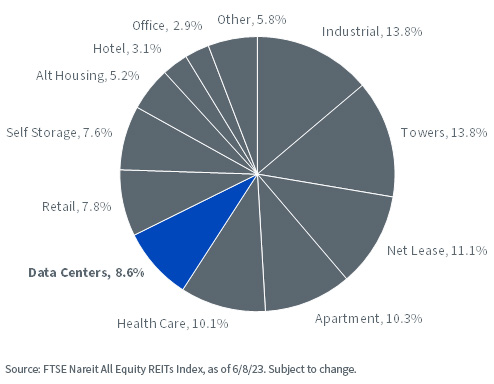

Figure 1 provides important context on what the current real estate market looks like, roughly halfway through 20231:

- Data centers represent 8.6% of the pie.

- Many people might expect the share of ‘Office’ to be larger, but it is only 2.9%.

- We draw attention as well to ‘Towers, 13.8%’—while we are talking about AI and data centers in this piece, a critical reason why we are doing so regards the speed with which we can send data to different places—cell phone towers and the overall upgrade to 5G infrastructure is an important link in this chain.

Figure 1: A Snapshot of the Current Real Estate Market (U.S. Real Estate Investment Trust [REIT] Investable Universe)

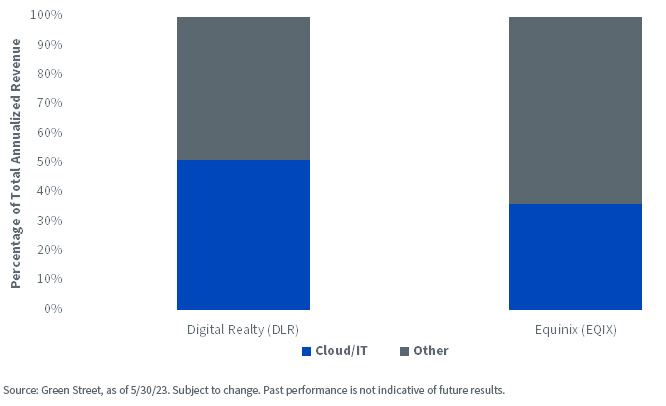

Figure 2 takes the two largest data center real estate investment trusts (REITs), Digital Realty Trust and Equinix, and looks at the percentage of annualized rental revenue from cloud/IT providers. CenterSquare wanted to highlight this was due to their belief that it is really these companies that are driving AI and have a strong influence on the equity markets. Some of the names include:

- Amazon.com

- Alphabet

- Apple

- Meta Platforms

- Microsoft

- IBM

- Oracle

If we look at market indexes, like the S&P 500 Index or the Nasdaq 100 Index, many of these firms are responsible for the bulk of their performance in the first half of 2023. Whether or not that exact trend continues, it’s clear that many investors believe these companies will be central in pushing AI forward. Figure 2 indicates how important these firms are to the revenues of the two largest data center REITS.

Figure 2: Companies Driving AI Forward Are Major Data Center Customers

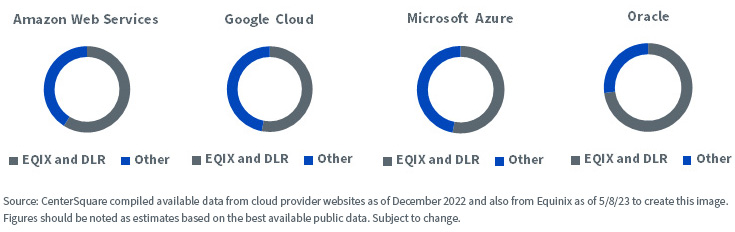

Figure 3 addresses the fact that the hyperscale (i.e., most capable, best infrastructure) cloud providers depend on Equinix and Digital Realty Trust for the majority of their connectivity. It is a similar idea to a key trend in semiconductors, where many firms depend on Taiwan Semiconductor Manufacturing Co. (TSMC) to fabricate the most advanced chips. Space and prime locations for data centers are not unlimited, and even if the degree of specialization is not the same as the case of TSMC, there are benefits to these companies from being able to plug into existing infrastructure from firms that specialize in exactly that, as opposed to building each and every data center on their own.

Figure 3: The Hyperscale Cloud Providers Have a Major Reliance on Equinix and Digital Realty Trust

Bottom Line: New Economy Real Estate Represents a Totally Different Way to Think about Artificial Intelligence in 2023

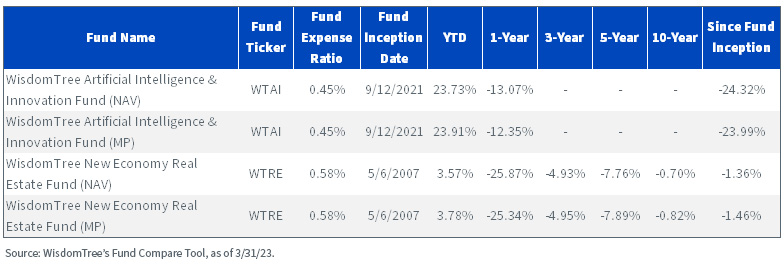

The WisdomTree Artificial Intelligence & Innovation Fund (WTAI) has returned nearly 40% from December 31, 2022, to June 16, 2023. The strategy, designed to track the returns of the WisdomTree Artificial Intelligence & Innovation Index, focuses on those companies that are more directly developing different types of AI and pushing increased capabilities across the market. In short, exactly the topics that have been considered among those ‘most in favor’ in the first half of 2023.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available here.

On the other hand, two of the larger exposures within the WisdomTree New Economy Real Estate Fund (WTRE) are focused on data center REITs and cell phone tower REITs—something around 40%. It is not likely these companies would or should ever generate the level of excitement of say, an Nvidia, but we simply caution investors against forgetting about them, in that we believe their functioning well does in fact make Nvidia’s product more valuable.

Additionally, we believe that some investors will be looking at the first half of 2023—still excited about AI—but hesitant after such strong returns in the more direct AI strategies. WTRE is clearly different, and it may be worth at least some consideration.

Figure 4a: Standardized Returns (as of March 31, 2023)

Figure 4b: Year-to-Date Returns of WTAI and WTRE

For those interested in exploring funds further, check out our Fund Comparison Tool.

1 Source: FTSE Nareit All Equity REITs Index, as of 6/8/23.

Important Risks Related to this Article

For current fund holdings, please click on the respective tickers: WTAI, WTRE.

Holdings are subject to risk and change. There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WTRE: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. A Fund focusing on a single country, sector and/or emphasizing investments in smaller companies may experience greater price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund's prospectus for specific details regarding the Fund's risk profile

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00pm net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

It is not possible to invest directly in an index.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.