Has the Future Spending on Generative AI-Related Chips from Nvidia Been Underestimated?

As we have recorded the June 2, 2023, edition of Behind the Markets, we remind listeners that the usual path of human estimates is to be too optimistic in the short term and not optimistic enough in the long term.

With respect to generative artificial intelligence (AI), this translates to investors likely being too optimistic about how it could impact certain companies, like Nvidia, in 2023, but not recognizing massive potential growth 5 or 10 years into the future.

But, nothing is ever certain, and that is why it was a pleasure to be able to leverage the expertise of Eric Rothman, Portfolio Manager, Real Estate Securities, with CenterSquare. CenterSquare is a dedicated real estate investment manager, with about $14 billion under management, and Eric has been with them for 17 years. We note that WisdomTree has licensed the CenterSquare New Economy Real Estate Index, which is tracked by the WisdomTree New Economy Real Estate Fund (WTRE).

Big Picture Macro—Housing

June 2, 2023, saw the June release of the monthly jobs data, so it made sense to start the discussion by looking at some of the big picture macroeconomic issues impacting real estate. Housing has to be at the top of that list. From a commercial perspective, the number-one reason someone moves out of an apartment is to buy a home. With affordability as challenged as it is presently, it is looking like many people will keep renting. In the U.S., it’s true that there has been an undersupply of new residential housing, particularly in the multi-family real estate space.

Based on demographics, millennials are entering their peak home-buying years, but there is an affordability issue, so the life situation of many millennials requires a different living arrangement.

Eric noted that CenterSquare has found an interesting opportunity in single-family homes available for rent. There are companies that own large pools of single-family homes, but they rent them, and this was something that arose out of the global financial crisis of 2008 and 2009.

Office Space—Is ‘Remote-First’ Here to Stay?

Eric noted that office real estate is in a very tough spot, and CenterSquare has been concerned for about three years. There was a question as to how many people would return to the office after the pandemic, and it looks like normalization has stalled with about two-thirds of people relative to 2019 levels going into office over last year and a half. Some cities may have seen up to 75% of people returning to the office. Elements of remote-first are starting to feel more permanent.

Now, even in those higher level cities, this doesn’t mean that there is a commensurate 25% reduction in demand—maybe you still have the office and it’s configured differently. Maybe the usage is changing. However, many people forget that ‘office space’ is very small when considering the broader real estate market. Maybe 15–20 years ago, it would have been somewhere around 15%–20% of the benchmark.1 In the private real estate market, it is still bigger. However, in today’s real estate investment trust (REIT) market, office represents about 3%. The main reason for this—new economy real estate has been growing.

New Economy Real Estate

What is new economy real estate? Eric explained there is so much beyond the traditional ‘four food groups’ of real estate, meaning retail, office, residential and industrial.

In CenterSquare’s definition of the ‘new economy real estate’ space, Eric noted that the larger components include data centers, cell phone towers and warehouses dedicated to new economy logistics—things like e-commerce fulfillment. Eric used the expression ‘not your grandfather’s warehouses’ because he wanted to emphasize that this is far from traditional industrial real estate.

Some of the smaller segments include life sciences, cold storage and office space that is uniquely tailored to technology tenants, typically located in specific cities with focused pools of technology talent. Such cities include Seattle, San Francisco and New York.

The Nvidia Story—$1 Trillion to Be Spent?

Today, in 2023, saying $1 trillion is a big number and a nice headline, but the first thing we recognize is that it is extremely difficult to forecast something like where generative AI will take us. Eric noted that DLR has forecast that generative AI will be even bigger than cloud computing, and that where we are today may be like where the cloud was 15 years ago. Some people say it is like inventing the wheel or the personal computer. Only time can tell us what will prove accurate.

If people are thinking about ‘data center REITs’ as an investment, they have to understand that data centers only provide power, cooling and connectivity. Data center REITs do not actually own the computers. The tenants invest in the computers. One thing that is absolutely true, however, is that as an owner, you love to see the tenants putting money into the space that they are renting. Why? This makes it less likely they are going to leave.

Eric’s conclusion, whether about the impact of generative AI on data center REITs or on cell phone tower REITs, was that the move in share prices so far hasn’t reflected where we could be going. Connectivity will be important, data centers will be important, but it’s not yet clear how or when investors are going to reflect that in real estate prices. Eric noted that investors frequently forget about the buildings until later in a cycle or a trend.

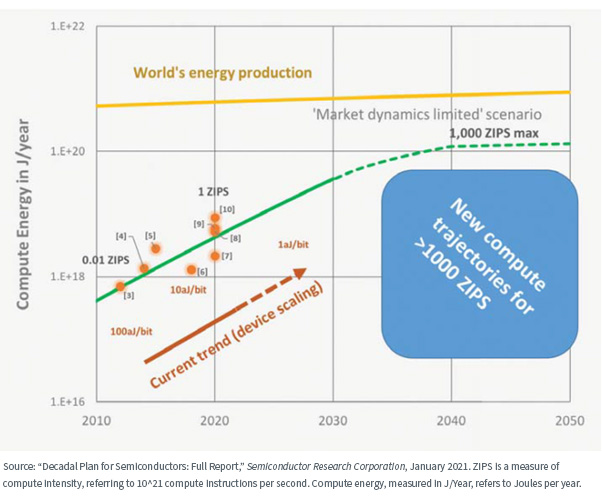

Another aspect that we discussed was energy usage. Eric estimated that newer AI-focused semiconductors draw more power—not just a little bit more power but a step change in power consumption.

In figure 1, we show a chart from the “Decadal Plan for Semiconductors,” a research report put out by Semiconductor Research Corporation. A critical point to keep in mind is the expression that ‘something’s gotta give,’ in the sense that simply continuing to add computational capacity without thinking of efficiency or energy resources will eventually hit a wall. However, if history is any guide, we should expect that as demand and investment in computational resources increases, there is the potential for gains in efficiency, improved model design and even different energy resources that may not yet exist today.

Figure 1: Comparing Compute Energy to the World’s Energy Production

Since many investors may be less familiar with cell phone towers, Eric made sure to mention just how strong a business model he believes this to be. Now, it’s true that these REITs have not performed well in the past 18 months, but we are right in the middle of the current 5G rollout. Tenants have long leases, there is lots of demand, and there are even CPI escalators that impact the rent that can be collected.

Conclusion—A Different Way to Think About Real Estate

It was great to be able to spend some time speaking with Eric and to learn about what’s happening, both in the broader real estate market as well as in the more specific, new economy, ‘tech-focused’ market.

Listen to the full discussion below:

1 Benchmark can refer to the FTSE EPRA/Nareit Developed Index.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. A Fund focusing on a single country, sector and/or emphasizing investments in smaller companies may experience greater price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.