The WisdomTree Q2 Portfolio Review, Part Two: Outcome-Focused Models

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

We began this “miniseries” of blog posts with a review of our Strategic models. Now let’s turn our attention to our “outcome-focused” models.

Our outcome-focused models can be and are used as stand-alone models by some of our advisor clients. But most advisors view them as complementary “sleeves” to an already existing portfolio to achieve specific investment mandates.

Let’s review them in the order they appear on our Model Adoption Center.

Global Dividend

Exactly as it sounds, this is a global all-equity portfolio that focuses on generating an optimal level of risk-adjusted dividends for those investors seeking to “goose” the yield of their overall portfolio. Most of the WisdomTree products in this portfolio also have a quality screen. What this means is not just chasing the highest dividend payers but focusing on those companies we believe have the most sustainable dividends (or dividend growth), regardless of the market regime.

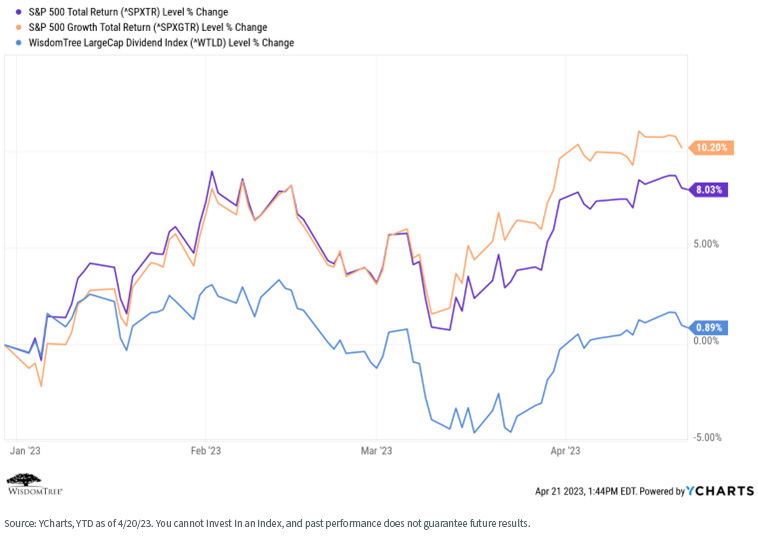

Q1 was a tough quarter for dividend payers relative to the broader, cap-weighted market as interest rates fell and investors piled back into large-cap growth stocks.

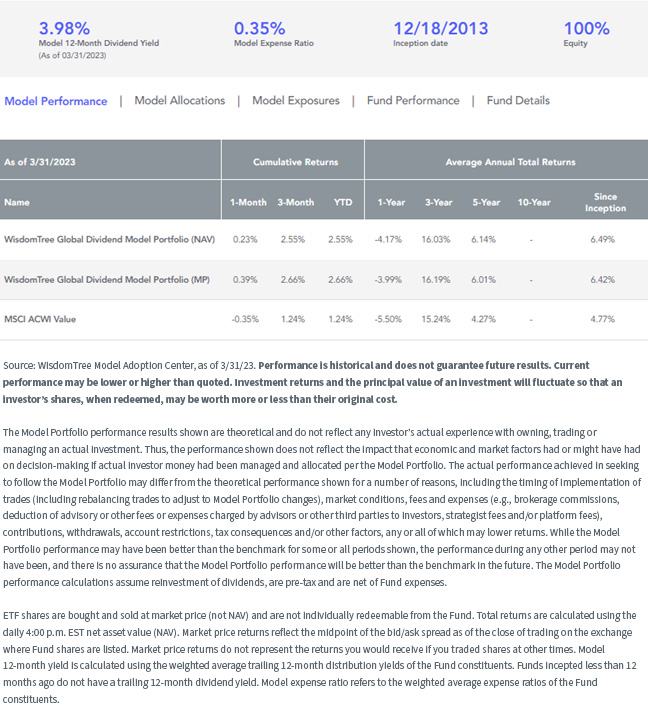

As of March 31, 2023, the 12-month dividend yield on this portfolio was 3.98%. This compares favorably to a dividend yield of 3.52% on the benchmark MSCI ACWI Value Index on that same date.1 At the same time, its total return performance of 2.55% (NAV) resoundingly beat its benchmark by ~125 basis points (bps). In other words, the model met its mandate—delivering comparable or better total returns with an enhanced dividend yield relative to its underlying benchmark.

WisdomTree Global Dividend Model Portfolio

For the most recent month-end performance, please click here.

Global Multi-Asset Income

Similar to the global dividend model, this model seeks to optimize quality income but invests across multiple asset classes to do so. In addition to dividend-oriented stocks and fixed income, this portfolio currently allocates to MLPs, a traditionally higher-yielding asset.

MLPs as an asset class somewhat stabilized in Q1 after a torrid rally for most of 2022. Our allocation added modestly to the total return performance (though it did not keep up with the S&P 500 Index), but it did help to enhance the overall income profile.

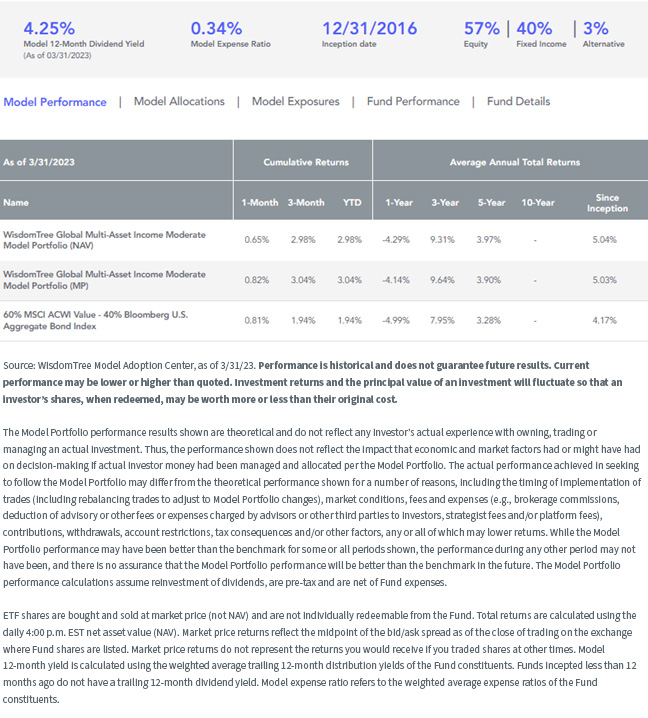

If we use our “moderate risk” version of this portfolio as an example (which tracks most closely to a traditional 60/40 stock/bond portfolio), as of March 31, 2023, the 12-month forward dividend yield on this portfolio was 4.25%, while our total return performance solidly beat its underlying Index (60% MSCI ACWI Value + 40% Bloomberg U.S. Aggregate). Once again, this portfolio met its mandate—tracking or beating the total return performance of the benchmark while delivering enhanced yield.

WisdomTree Global Multi-Asset Income Moderate Model Portfolio

For the most recent month-end performance, please click here.

Multifactor

The multifactor model is a different animal than the global dividend or global multi-asset income models. This portfolio is designed to improve the risk factor diversification of an overall portfolio, while still attempting to deliver a superior total return.

We offer a U.S., developed international and emerging markets version of the multifactor model. Since it is the most widely used, we will focus on the U.S. version.

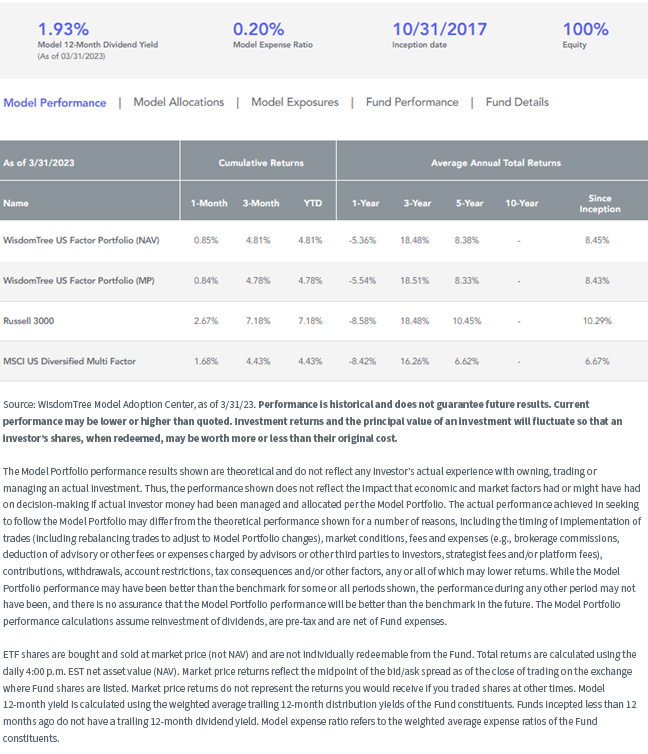

The underlying allocations within this portfolio all have various factor tilts, focusing primarily on value, quality, earnings, momentum and size. As you might imagine, these tilts did not help us in Q1, a quarter driven by large-cap growth and tech stocks.

This portfolio underperformed its primary benchmark, the Russell 3000 Index (a broad market U.S. Index incorporating large-, mid- and small-cap stocks) by roughly 240 bps (2.4%), though it beat its secondary benchmark, the MSCI U.S. Multifactor Index, by roughly 40 bps.

While we use it as a secondary benchmark since it is less well-known, we believe the MSCI U.S. Diversified Multifactor Index is more representative of our actual investment approach with this model, so we were pleased with our modest outperformance.

We saw similar underperformance by the developed international model, but our emerging markets model outperformed its benchmark by almost 200 bps.

WisdomTree U.S. Factor Portfolio

For the most recent month-end performance, please click here.

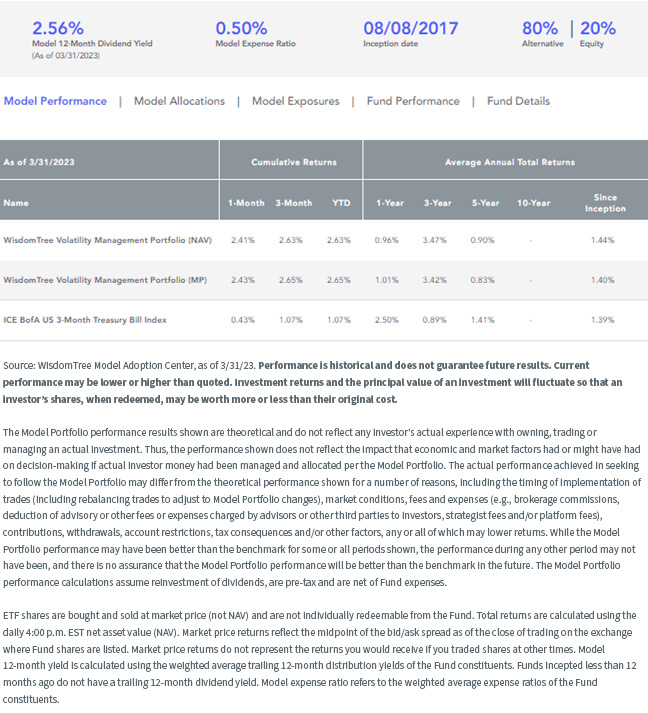

Volatility Management

Last but by no means least, we come to our volatility management portfolio. This portfolio consists of several nontraditional or alternative strategies, including diversified arbitrage, hedged equity, short bias, managed futures and equity long/short. The portfolio was constructed to have lower correlations to both stocks and bonds and to be diversified between the strategies themselves.

The mandate is to deliver a diversifying “sleeve” within an overall portfolio in an attempt to lower portfolio volatility and improve performance consistency regardless of the market regime, but especially in down markets (remember the power of compounding—if you don’t lose as much in down markets, you don’t have to make as much in up markets to still come out ahead).

In part one of this series, we reviewed our endowment model, which includes both real assets and alternatives. In essence, the volatility management model is designed as a complement to a more traditional stock/bond portfolio to allow advisors to deliver a more “endowment-like” experience.

We use the 3-Month Treasury Bill as a proxy benchmark for this portfolio, under an assumption that advisors could simply move to cash if they are looking to “de-risk” the portfolio. The difference is that the volatility management model gives the advisor some potential for upside versus simply moving to cash.

This model performed well in Q1—up 2.63% versus a 3-Month Treasury Bill return of 1.07%. Furthermore, this “sleeve” portfolio performed admirably in 2022—advisors who included it were very happy they did so, as it helped to build a more “all-weather” allocation in an otherwise horrible year.

Our short-biased and diversified arbitrage strategies did not help us in Q1, but our allocations to hedged equity and managed futures were positive contributors. The addition of this model to a broader model would have served its purpose—dampen volatility and “smooth out” overall performance.

WisdomTree Volatility Management Portfolio

For the most recent month-end performance, please click here.

Conclusion

We built our outcome-focused models to serve specific purposes for advisors seeking specific investment outcomes. On a relative basis, Q1 2023 was a relatively good showing—they did their jobs in a unique market environment.

In part three and the final of this series, we will examine the performances of our collaboration models.

1 Source: MSCI, “MSCI ACWI Value Index (USD),” https://www.msci.com/documents/10199/9446b2a4-0820-495e-87e1-6291f7530293

Contact Us

Important Risks Related to this Article

For Financial Advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For Retail Investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.