The WisdomTree Q2 2023 Asset Allocation and Portfolio Positioning Summary

We recently published a blog post summarizing our general economic and market outlook as we move through 2023. You can also find a more comprehensive review in our Q2 2023 Economic & Markets Chart Deck.

In this post, we take those outlooks and translate them to our current Model Portfolio allocations and positions. Before we get to that, a quick reminder of our general framework with respect to our asset allocation and portfolio construction:

- We are a strategic allocator in most of our Models, with the ability to make dynamic changes as market conditions dictate, but we will generally remain within +/-5% of our target allocations

- Unless mandated otherwise, we build and manage global equity portfolios with regional allocations roughly in line with the global MSCI ACWI index (i.e., approximately 60% U.S. and 40% non-U.S.)

- We take a “core plus” approach to our fixed income allocations, guided by duration management and quality-screened credit

- We are “open architecture,” meaning our Models include both WisdomTree and third-party products

- We are ETF-centric in our Portfolio construction to optimize fees and tax efficiency

- We charge no strategist fee—our revenue is derived from the expense ratios of any WisdomTree products within a given Portfolio

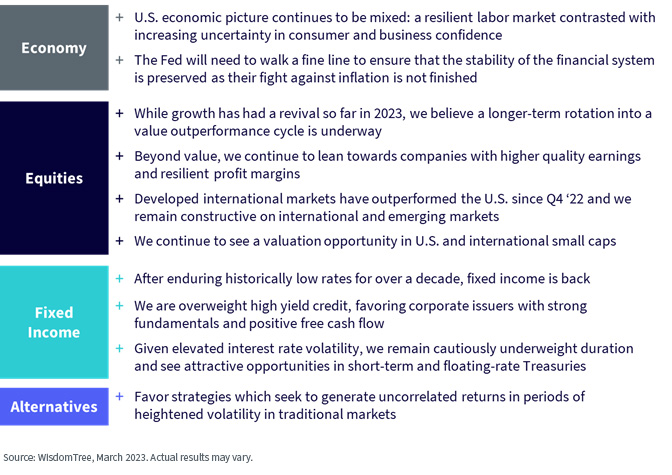

Now let’s summarize our current economic and market outlook:

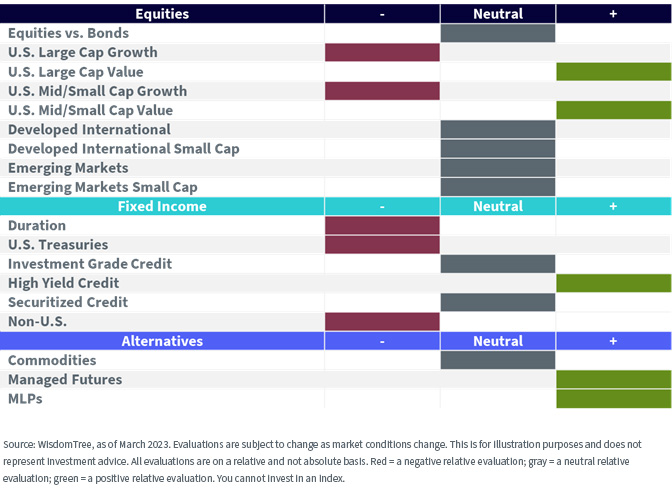

Finally, let’s summarize our general asset class outlook:

Equities

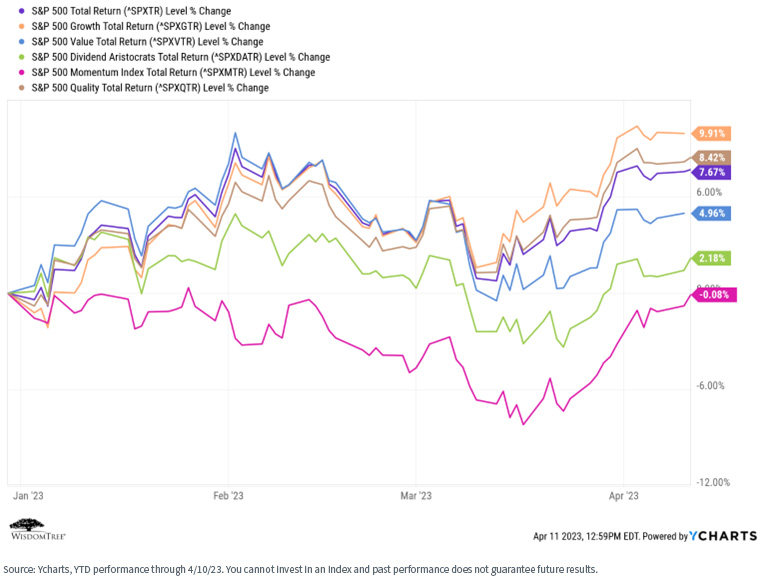

Many of WisdomTree’s ETF strategies (and, therefore, our Model Portfolios) have explicit factor tilts toward dividends, value, size and quality. These factors underperformed (except for quality) in Q1 as large-cap, growth and “mega-tech” stocks rallied strongly on the back of a declining rate environment.

For definitions of terms/indices in the chart above please visit the glossary.

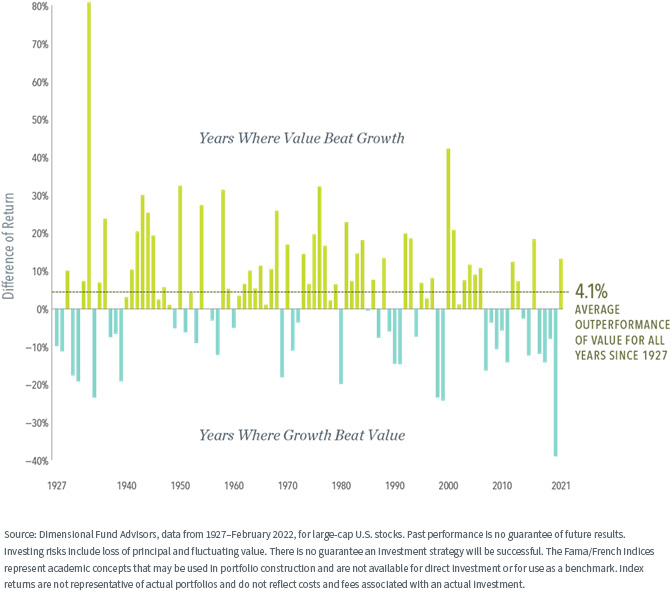

Despite this setback for the factors in which we have over-weight allocations, when viewed historically, we see that a factor rotation from growth to value, such as we saw in 2022, is not a single-year phenomenon—it tends to be a multi-year cycle. So, we believe the Q1 outperformance by growth will not continue over the medium to longer term.

And, given the outperformance by growth stocks in Q1, value stocks are even more attractively valued than growth stocks.

We see a similar YTD performance story in large caps compared to small caps…

For definitions of terms/indices in the chart above please visit the glossary.

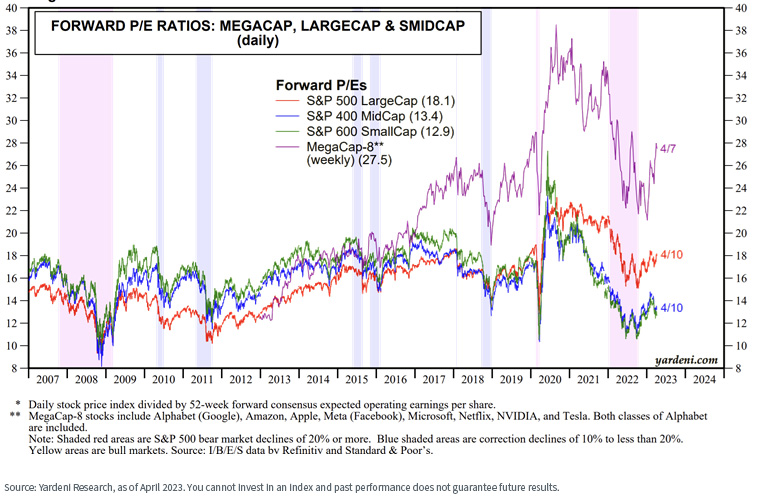

…resulting in a similar current valuation attractiveness in mid- and small-cap stocks relative to large-cap stocks. The massive rally in mega-tech stocks resulted in skyrocketing valuations.

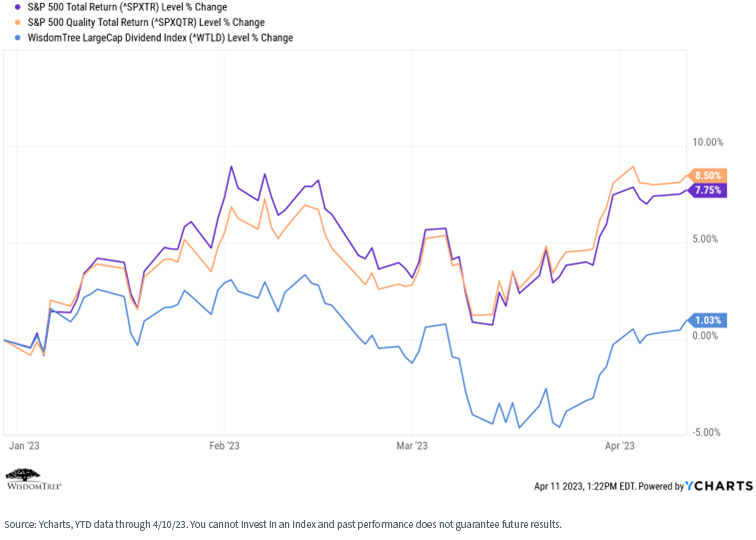

Now let’s look at how dividends and quality have performed so far this year. We see that quality is holding up, but dividends lagged badly as interest rates fell and investors turned more toward growth stocks—a trend we do not expect to be long-lasting.

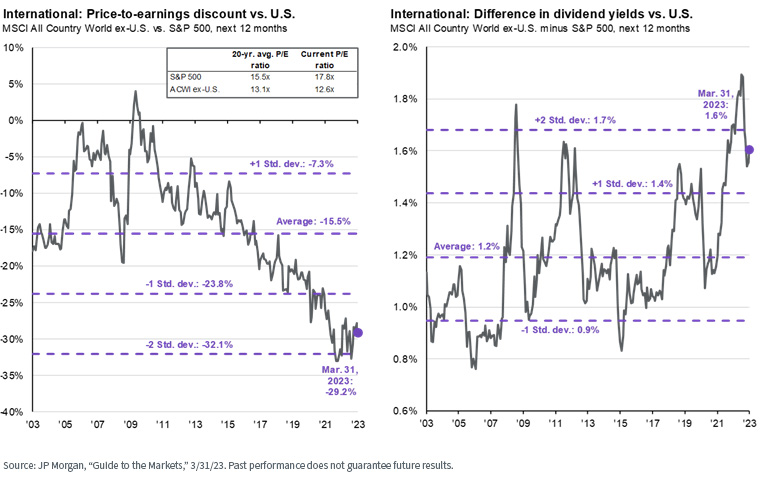

Finally, let’s examine current valuations between U.S. and non-U.S. stocks. Combined with the higher dividend yield typically available outside the U.S. and what we believe may be a downward trending dollar, we believe it is time for U.S. investors to re-think their allocations to non-U.S. stocks.

Bottom line: Our Model Portfolios have distinct factor tilts toward value, dividends, size and quality, and we maintain a roughly neutral allocation to non-U.S. relative to the MSCI ACWI index. Our Portfolios sailed into headwinds during the Q1 large-cap growth rally, but we continue to believe we are in the “early innings” of the rotational trades toward our tilts, and we remain comfortable with our current positioning.

Fixed Income

One of our narratives for 2023 is, “There is income back in fixed income.” We believe investors can now build fixed income portfolios that can deliver a reasonable level of real yield without taking on excessive duration or credit risk.

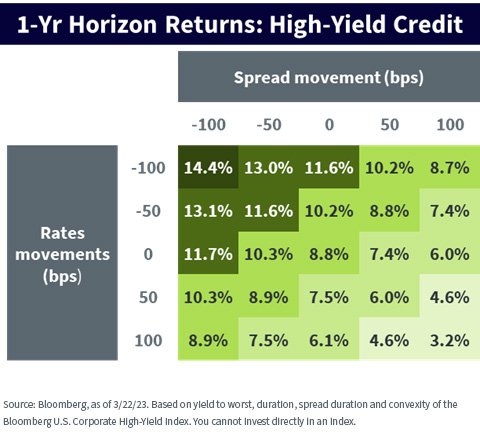

In addition to our continued conviction in U.S. floating rate Treasuries, we also continue to see interesting relative value in high-yield and have an over-weight allocation (with a quality tilt) in this sector within our Model Portfolios. Look at the “buffer” high yield is offering against a rise in either interest rates or credit spreads as we move through 2023.

Real Asset and Alternatives

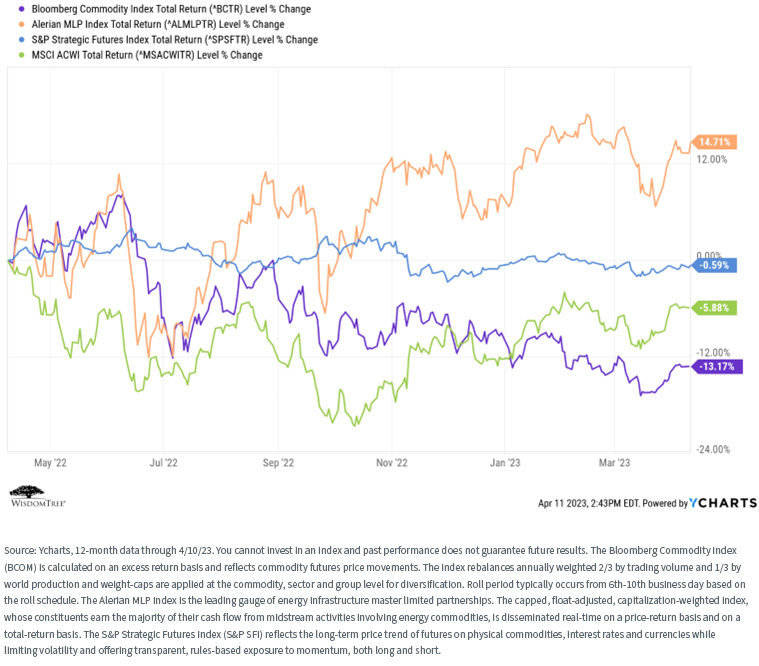

Finally, for those advisors and investors for whom it made sense, we have advocated considering allocations to real assets and alternatives for most of the past two years.

Certainly, the inclusion of these types of strategies, depending on the strategies and exposures, benefited many investors as they provided lower correlation diversification to the abysmal stock and bond performances of 2022.

Commodities have suffered for the past six months (and we moved to a neutral stance in our asset allocation positioning), but we still maintain our conviction in the benefits of diversification within our Portfolios that have that investment objective.

Conclusion

Trying to predict future market performance is a fool’s errand and a loser’s game. But, given historical performances and trends, we like how our Portfolios are positioned. But it is also why we continue to recommend longer-term time horizons and appropriate diversification.

Advisors, WisdomTree can help you better communicate with your clients about your value, their investments and what’s going on in the markets. Fill out the form below if interested in learning more.

Contact Us

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Neither diversification nor asset allocation strategies assure a profit or protect against loss. Investors should consider their investment time frame, risk tolerance level and investment goals.

Related Content