A Conversation with Wood Mackenzie on the State of the Battery Value Chain

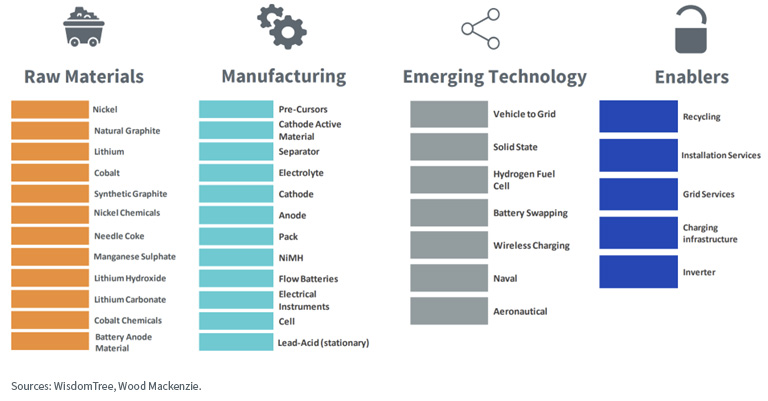

On March 30, 2023, we had the opportunity to speak with Adam Woods, Senior Research Analyst, Global Coal Markets for Wood Mackenzie. By way of background, Wood Mackenzie is a leader in the power and renewable and commodity research and consultancy space. The ecosystem that represents the battery value chain contains a lot more than the big vehicle manufacturers that we hear about all the time. Figure 1 is a good representation:

- There are the four higher-level focal areas, Raw Materials, Manufacturing, Emerging Technology and Enablers.

- Within each of the four higher-level areas are various “sub-sectors.” The sub-sectors represent specific value-added activities within the broader groupings. It is helpful to have these more specific categorizations when it comes down to defining the relative purity of different companies that are thought to represent the themes.

- We made the decision with Wood Mackenzie not to include a direct focus on automotive manufacturers. A company like Tesla may still qualify due to its activities that touch some of the other areas but not due solely to the fact that it makes electric vehicles.

Figure 1: WisdomTree and Wood Mackenzie’s Representation of the Battery Value Chain

Geopolitical Dynamics of the Battery Value Chain

As of March 2023, the raw materials that underlie the battery value chain are those that go into lithium-ion batteries, even if we hear about certain other chemistries or new ones are being researched at present. Some of the ingredients include, of course, lithium, but then also nickel, cobalt and graphite—these are the big ones. Where geopolitics comes in regards where these different metals come from and how they are processed.

Some of the core concerns come from environmental, social and governance (ESG) factors. An example is the Democratic Republic of the Congo, where a lot of the world’s cobalt supply is sourced. There are concerns around labor, water usage and the overall sustainability of certain mining processes there. One of the responses to these difficulties is that researchers are exploring ways to use less cobalt, replacing it with other metals.

Other concerns come from the recently passed Inflation Reduction Act (IRA) in the U.S. A core part of the legislation that includes tax credits available for domestically made cells and packs is dependent on where those materials are sourced and the political climate in the U.S. at present is positioned very much against China, so China would not be able to reap any benefits from the IRA. However, we’d note that China is not a major area for all sorts of different raw materials besides graphite. China’s strength in the battery value chain is in the processing of raw materials, in that even if certain metals come from Australia, Argentina, Chile or Indonesia, they tend to have to go to China for processing before then being able to be used as ingredients in cells and packs.

Can the World Make Batteries AND Avoid China?

We had to get Wood Mackenzie’s perspective on this very important question since so much of what we see in the news these days regards a greater and greater adversarial relationship between the U.S. and China. A way to frame the answer could very well hinge on asking one further word—when? When do you intend to avoid China in the battery value chain?

If the answer is “now,” then it is not possible. A very large majority of battery production processes related to getting the different raw materials ready to be used in batteries only happens, at least at scale, in China. China positioned itself as a key player in these processes, where other regions might have tended to let concerns about environmental impact or other details deter them.

If the answer is that it is important enough to have less of a dependence on activities occurring in China’s neck of the woods, like we are seeing in semiconductors, then it’s possible that sustained investments can be made. In something approximating 10 years, it would be possible to have a new battery value chain that takes the activities formerly dominated by Chinese players somewhere else.

What About All These Different Battery Chemistries?

Lithium-ion batteries are certainly not all the same, for numerous reasons—including our aforementioned case of using less cobalt—and the implications of different chemistries taking off into widespread use could be significant when considering the overall value chain.

The two main chemistries in use with lithium-ion batteries at present are lithium-iron-phosphate (LFP) and nickel-cobalt-manganese (NCM). Each chemistry has different trade-offs, and it would be incorrect to think we have found a so-called “perfect” chemistry. While we prefer to use less cobalt because of sourcing concerns, for example, the reason that all batteries are not simply LFP is that NCM batteries have greater “energy density.” One can think of this as the energy in a given fuel source per unit of weight. The energy density of gasoline sets a very high bar, and neither NCM nor LFP technologies today are able to match it. Part of the reason we keep experimenting and attempting different chemistries is that we are seeking to match the bar set by traditional fossil fuels.

This focus on energy density is one of the reasons why solid-state batteries are particularly exciting, although we note that it is currently an emerging technology—not available at scale in electric vehicles at present. When we spoke with Wood Mackenzie, they agreed that a commercially available solid-state battery would be a game-changer, but it’s something more likely to be years away than immediately around the corner.

Bottom Line: Investing in the Battery Value Chain

Every six months, in May and in November, WisdomTree and Wood Mackenzie rebalance the WisdomTree Battery Value Chain & Innovation Index1, which seeks to track, after fees and expenses, by the WisdomTree Battery Value Chain & Innovation Fund (WBAT). The concept behind the strategy, which we hinted at in the description of figure 1, is to recognize that the underpinnings of the battery value chain are very broad and represent many different activities. This megatrend is likely to have multiple phases, in that it’s clear we are seeing a strong uptake in electric vehicles, but that doesn’t mean that 10 years from now, we might not see more battery recycling or hydrogen fuel cells. Certain elements are growing today, and others, like solid state, are more nascent but could be quite large tomorrow.

We, along with Wood Mackenzie, are excited to see how the story unfolds.

1 The WisdomTree Battery Value Chain and Innovation Index is designed to track the performance of companies primarily involved in Battery and Energy Storage Solutions (“BESS”) that meet Index eligibility requirements.

Important Risks Related to this Article

Click here for a full list of Fund holdings. Holdings are subject to change.

There are risks associated with investing, including possible loss of principal. The Fund invests in equity securities of exchange-listed companies globally involved in the investment themes of Battery and Energy Storage Solutions (“BESS”) and Innovation. The value chain of BESS companies is divided into four categories: Raw Materials, Manufacturing, Enablers and Emerging Technologies. Innovation companies are those that introduce a new, creative or different technologically enabled product or service in seeking to potentially change an industry landscape, as well as companies that service those innovative technologies. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund may invest in a company that does not currently derive any revenue from innovation or developing technologies, and there is no assurance that a company will derive any revenue from innovation or developing technologies in the future. Battery value chain company stocks have experienced extreme price and volume fluctuations in the past that have often been unrelated to their operating performance. Battery value chain companies may be susceptible to fluctuations in the underlying commodities market. Additionally, energy storage solutions companies may be subject to the risks associated with the production, handling and disposal of hazardous components, and litigation arising out of environmental contamination. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. WisdomTree Battery Value Chain and Innovation Index: Designed to track the performance of companies primarily involved in Battery and Energy Storage Solutions (“BESS”) that meet Index eligibility requirements. BESS can be defined as technology that captures electrical energy in chemical form.

Related Content

+ Can We Westernize the Battery Supply Chain? A Conversation with Wood Mackenzie

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.