A Stock Exchange Impetus to Improve Valuations

Almost a year has passed since the Japan Exchange Group doubled down on corporate governance enhancements.

The reforms were billed as the Tokyo Stock Exchange’s (TSE) biggest overhaul in 60 years and a clear attempt to reinvigorate enthusiasm for Japanese equities.1

These initiatives included the restructuring of TSE’s cash equity markets into three new segments: Prime Market, Standard Market and Growth Market—each segment having its own set of eligibility criteria.

The ultimate impact of the reshuffle was muted. After three years of deliberation, the eventual requirements for the Prime Section were substantially weakened.

Nonetheless, the reforms represented a step forward for Japanese corporate governance.

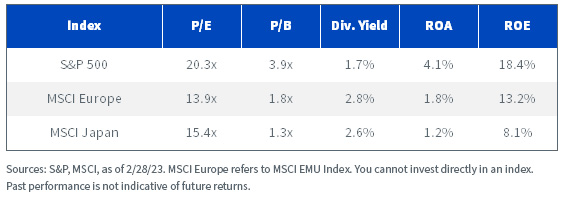

The TSE announced about half of its listed companies had a price-to-book ratio below 1x. According to the TSE, these companies are to disclose their policies and specific initiatives for improvement.

Japan has been called by many a value trap, teeming with companies that have low profitability metrics and return on capital. This wave of market reforms seeks to address such investor concerns.

Regional Index Valuations and Fundamentals

Echoes of Abenomics

The pressure on low-valuation companies to improve their practices and increase shareholder returns is reminiscent of previous initiatives during the Abenomics era, namely the launch of the JPX-Nikkei 400 Index in 2014.

Also known as the “shame” index, the JPX-Nikkei 400 included the largest and most liquid companies based on profitability metrics such as returns on equity. It got its nickname from the experience of excluded companies and their management.

Since Abenomics and the launch of the JPX-Nikkei 400, the aggregate return on equity for the MSCI Japan Index managed to creep up to over 10% before falling flat, as COVID-19 put global markets in turmoil.

Aggregate ROE, S&P 500 vs. MSCI Japan Index

WisdomTree Japan Equity Indexes

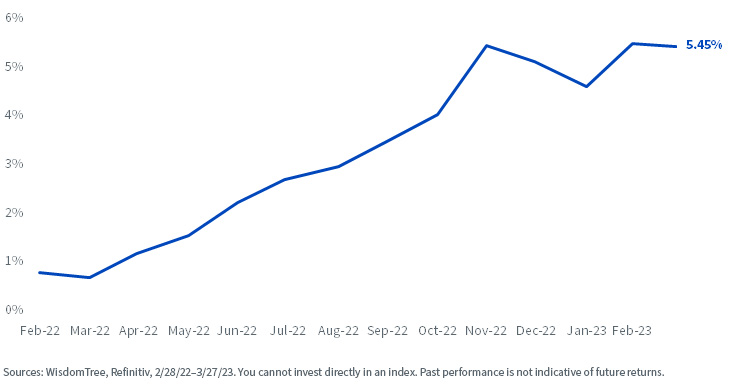

The WisdomTree Japan Hedged Equity Index provides exposure to Japanese equities while mitigating effects from negative movements in the Japanese yen against the dollar.

The Index selects dividend-paying, export-oriented Japanese companies. Its currency-hedged strategy also adds an interest rate differential between the U.S. and Japan, which has been increasing the amount paid to hedge over the last year. The latest ‘carry’ earned from hedging the yen has approached 5% a year.

Annualized Carry, Yen Hedge

The Japan Hedged Equity Index is value- and quality-tilted, and many of its constituents have low valuations.

The WisdomTree Japan SmallCap Dividend Index is another Japan-focused WisdomTree strategy that provides exposure to the small-cap universe of dividend-paying Japanese equities without the currency hedge.

The result of the dividend-weighting employed by the Index is a basket of securities on which the effects of the TSE reform may be especially magnified.

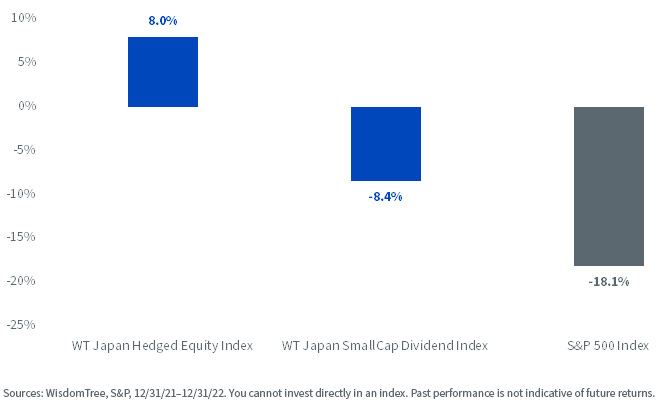

2022 Total Returns

According to the TSE, all Japanese exchange-listed companies are required to meet the inclusion requirements of the market segments for which they are listed by 2025 or risk being labeled as securities under supervision or even delisting.

This means many historically cash-heavy Japanese companies face increasing pressure to improve their numbers, possibly by funneling historically high excess cash reserves into increased buybacks or dividends.

The conservative cash balances of Japanese equities are also important factors that contribute to lower volatility amid major drawdowns in other markets and saw the MSCI Japan Index outperform other regional indexes through a tumultuous 2022.

Cash as a Percentage of Market Cap

According to an earlier Man Institute report, half the stocks on the Tokyo Stock Price Index (TOPIX) traded below their book values by the end of February.2

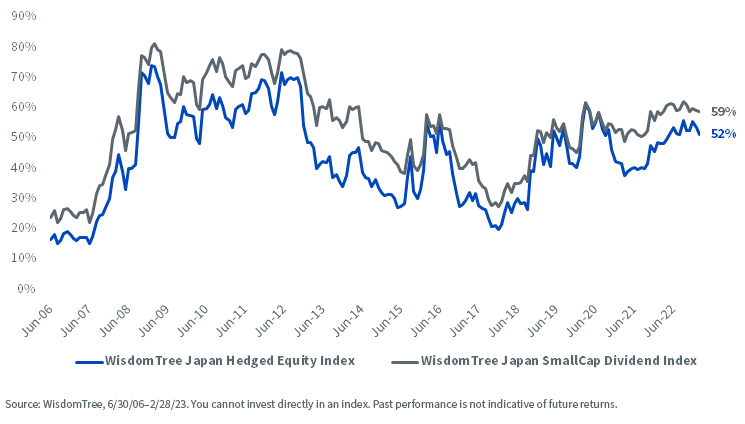

Currently, 52% of WisdomTree Japan Hedged Equity Index constituents and 59% of WisdomTree Japan SmallCap Dividend Index constituents trade below their book values. That is, more than half the companies included in these Indexes will have to improve their corporate governance and shareholder value in the next two years or potentially answer for their performances.

Percentage of Index Constituents with Price-to-Book under 1.0

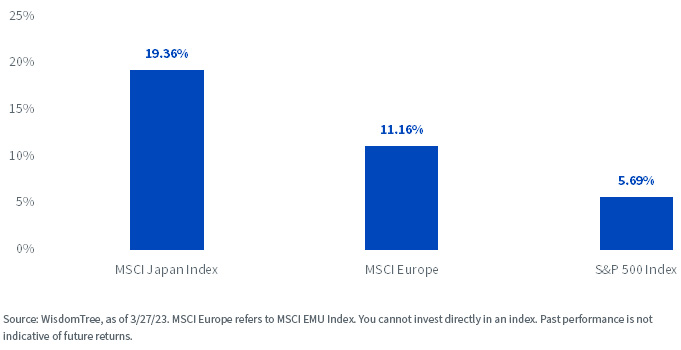

It’s an exciting time for Japanese equities.

Under the shadow of an increasingly volatile yen, it’s an even more exciting time for currency-hedged Japanese equities. While the TSE’s initiatives to reform what they see as bloated and stagnating dinosaurs will be painful for managers and executives, shareholders are among the first in line to benefit.

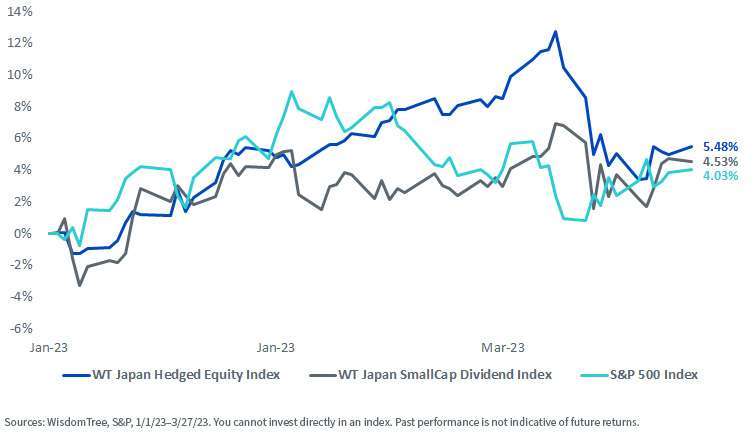

Year-to-Date Total Returns

1 Eri Sugiura and Leo Lewis, “Overhauled Tokyo Stock Exchange Makes Debut,” The Financial Times, 4/4/22.

2 Badger, Emily, “This Time Is Different: Japan Value and Corporate Governance: Man Institute.” Man Institute | Man Group, 1 Mar. 2023, https://www.man.com/maninstitute/this-time-is-different.