Just Hold On a Minute

After last week’s slew of (mostly) second-tier data, it seemed as if the Treasury (UST) market had made up its mind—the economy is finally turning over and headed toward a recession sooner rather than later. Now, a negative quarter or two of real GDP may very well still be in the offing, but the March jobs data should give the money and bond markets a little dose of ‘just hold on a minute.’

Job growth did slow from the unexpectedly robust average pace of 399,00 seen in the first two months of the year, but total nonfarm payrolls still rose by a solid 236,000 in March, and the unemployment rate actually dropped by 0.1pp to 3.5%. In fact, for the seven-year period prior to the COVID lockdown in March 2020, the average monthly job gain was pegged at about 200,000.

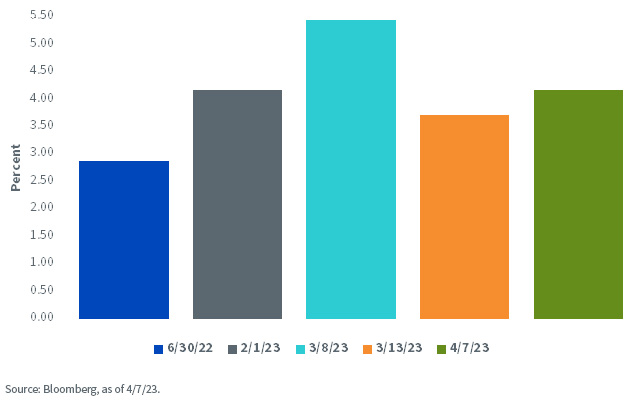

Implied Fed Funds Rates—January 2024

Will the latest jobs data impact the Fed outlook? In a bit of an overstatement, expectations for the Fed have shifted dramatically. As I’ve written in the past, this is nothing new when it comes to Fed Funds Futures. The track record for actually predicting the final outcome is spotty, at best. However, the more recent shifts in this arena have also been at some arguably unusual levels.

To provide some perspective, I’ve outlined in the bar chart how the implied Fed Funds Rate for January 2024 has vacillated since June, but perhaps more importantly, just within the last few weeks/months alone. As you can see, back in June the implied rate for January 2024 was at only 2.87%, way off the mark as compared to the current target, where the upper end of the Fed Funds range is at 5%.

Up until March 8 of this year, pre-banking turmoil headlines, the implied rate surged to its peak reading of 5.44%, but then fell in a precipitous fashion to 3.70% on March 13, an incredible decline of roughly 175 basis points (bps). In other words, in just five days, the market had changed its outlook to suggest the Fed would cut rates dramatically by the beginning of next year.

So where do we stand now? Well, post-jobs, the market is still looking for rate cuts for this time frame, just not such aggressive ones. Indeed, the implied rate came in at 4.16%, or essentially unchanged from where it stood at the February 1 FOMC meeting. To put it another way, it’s as if nothing happened over the last two months!

Conclusion

In my opinion, the March jobs data, in itself, could keep a May FOMC 25 bps rate hike on the table. That being said, it does appear as if we’re either at, or close to, the end of rate hikes. BUT the key going forward is the timing of rate cuts. In order to get to the aforementioned level of a little over 4% for Fed Funds in January of next year, this would require multiple rate cuts. Even if the Fed does not raise rates in May, or thereafter for that matter, an extended period of where policy is on hold appears to be the more likely scenario at this juncture.