Investor Insights from the Coronavirus Crash of 2020 that Advisors Should Apply Today

In 2019, WisdomTree conducted a significant study on the perceptions and applications of third-party model portfolios.1 We interviewed thousands of advisors and individual investors across the country.

Shortly after, global equity markets began to crash thanks to the panic caused by the COVID-19 pandemic. We were interested in seeing if this market crash impacted the insights we had learned from the study. So we went back a few months later and re-interviewed the study participants.

We found the coronavirus crash of 2020 had varying degrees of influence on the attitudes of individual investors toward advisors and financial advice. We’ll refer to the period before the crash as “pre-volatility” and compare it to the “post-volatility” period after the initial crash.2

Let’s examine the study’s findings regarding the individual investors and the key takeaways advisors should consider implementing in their practices today.

How did the coronavirus crash of 2020 impact investors’ behaviors and perspectives on risk?

We found that how often investors checked their portfolios’ performance did not increase significantly post-volatility. Perhaps more importantly, we found that investor satisfaction with the frequency of interactions with their advisors increased significantly post-volatility.

We also discovered that there were no major shifts in risk tolerance.

Across the generations, we saw minor shifts here and there, but perhaps surprisingly, more Boomers considered themselves “moderately aggressive” post-volatility, and fewer Gen Xers and Millennials considered themselves to have “conservative” risk tolerances.

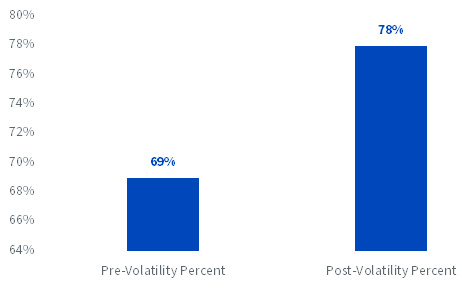

Additionally, the number of investors who agreed they could tolerate fluctuations without selling increased post-volatility.

If My Investments Lose Money over the Course of a Year, I Can Easily Resist the Temptation to Sell

Overall, investors in our study generally stayed the course during the market crash, in part due to increased communication with their advisors and reassurance about their long-term investment strategies.

Key takeaways for financial advisors:

- Providing clients and prospects with useful content that helps them become better informed investors can be a smart way to build a mutually beneficial relationship. Access our weekly market commentary on demand and share with your clients.

- WisdomTree’s Behavioral Finance Assessment Tool can help you to more deeply understand clients’ financial preferences and tendencies and support your clients’ confidence in achieving their long-term financial goals.

How did the coronavirus crash of 2020 impact investors’ perception of advisors leveraging third-party expertise?

The pandemic increased investors’ appreciation of third-party models and the benefits associated with them.

Pre-volatility, 86% of investors believed an advisor utilizing third-party model portfolios is “absolutely acceptable.”3 Consider that post-volatility:

- 90% of consumers welcomed third-party model portfolios (versus 86% pre-volatility), including 83% of Boomers.

- 70% of investors believed that using models will have a positive impact on their overall portfolio (versus 63% pre-volatility).

- 68% of investors believed that financial advisors using third-party models are providing a more sophisticated asset allocation approach backed by the extensive research and technology of an asset manager’s team (versus 63% pre-volatility).

Interestingly, the importance investors put on advisors having a proven track record of performance decreased post-volatility.

Key takeaways for financial advisors:

- Investors view their advisor as the expert in the relationship. They expect the advisor to leverage technology, resources and third-party expertise to provide them with the best investment options.

- The pandemic noticeably increased investors’ appreciation of third-party models and the benefits associated with them.

- Start your due diligence on WisdomTree’s Model Portfolio Investment Committee and reference An Advisor’s Guide to Rolling out Model Portfolios in their Practice

How did the coronavirus crash of 2020 impact investors’ needs and expectations?

Volatility or not, investors still see financial advisors as critical to their success, and they value the expertise advisors bring.

In fact, when we asked about the benefits of working with an advisor, both pre- and post-volatility, clients identified financial expertise and advice as the number one benefit.

Perhaps unsurprisingly, clients put more emphasis post-volatility on responsiveness—both in making investment changes and in communications. The importance investors put on their advisor’s ability to shift things quickly if needed jumped by nearly 20%. And the importance clients place on advisors being responsive with communications and services also jumped nearly 20% post-volatility.

Another notable uptick was in the importance clients placed on advisors having the resources and support of a well-known firm—another nod to the appreciation of third-party models.

We also reviewed what clients “need” from their advisors.

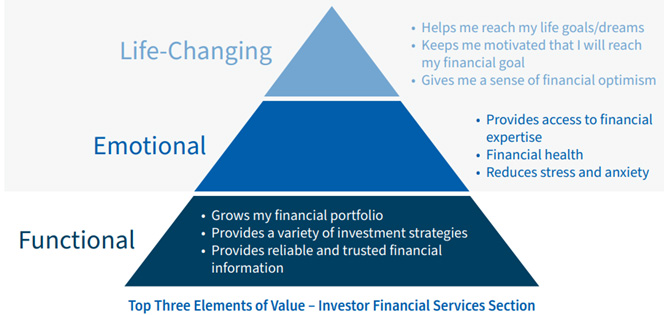

Maslow’s hierarchy of needs serves as a basis for understanding human motivations.4 It can also be adapted and applied to consumer interactions and to an investor’s needs, as seen below in the Advisor Value Pyramid. This illustrates the value clients put on the products and services advisors offer.

Based on our research, investors value elements at each level of the pyramid. As you might expect, when we compared these “needs” pre- and post-volatility, investors had a much stronger need for the life-changing value of “keeps me motivated that I will reach my financial goal.”

Key takeaways for financial advisors:

- Advisors leveraging third-party model portfolios and the vast expertise model portfolio providers bring can help them meet their clients’ functional needs, providing them with the time to deliver the emotional and lifechanging services clients value most.

- Develop a models-based communication framework with WisdomTree. We provide frequent and easy to understand communication on the markets and our Model Portfolios. Some of the content can be customized and white-labeled by you so that you can share it with your clients.

Summing up, individual investors’ perceptions and expectations of financial advice and the advisors they work with has evolved since the coronavirus crash of 2020.

With ever-growing uncertainty in financial markets, the global banking system and geo-politics—these insights are highly relevant to the challenges advisors face today.

Communicating with clients has always been important. Volatility and the pandemic have only increased this importance. Investors don’t need their financial advisors to know all of the answers, but they need to know that their advisors are there for them, and they need reassurance about their long-term investment strategies.

Advisors, WisdomTree can help you better communicate with your clients about your value, their investments and what’s going on in the markets. Fill out the form below if interested in learning more.

Contact Us

1 WisdomTree’s Models Research Initiative maintained a +/-2.3% margin of error among consumer investors across generations and a +/-6.2% error rate among financial advisors. A mixed methodology was applied that included a robust base of more than 2,000 constituents in the models’ value chain, as well as in-depth interviews and online panel-based conversations that were conducted on the topic. Interviews were conducted 10/16/19–11/19/19 and 5/1/20–7/21/20.

2 Interviews conducted 10/16/19–11/19/19 referred to as “pre-volatility” and 5/1/20–7/21/20 referred to as “post-volatility.”

3 WisdomTree Research Study 2020

4 Maslow’s hierarchy of needs is a motivational theory in psychology comprising a five-tier model of human needs, often depicted as hierarchical levels within a pyramid.

Important Risks Related to This Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

Related Content

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.