An Advisor’s Guide to Rolling Out Model Portfolios in Their Practice

For those fortunate enough to have a financial advisor—what a time to be alive.

Technology advancements have democratized institutional-caliber strategies once reserved for the super-wealthy.

These strategies are called third-party model portfolios, and their growth in recent years has been explosive. Broadridge estimates assets in all model portfolios have grown at least 18% annually over the past five years and are expected to exceed a total of $10.3T in AUM over the next five years.1

Despite this growth, advisors have voiced concerns over their ability to utilize third-party models in their practice. Examples of these concerns include “which of my clients are a good fit for third-party models” and “how do I communicate to them the use of an outside manager without hurting my credibility”?

Let’s break down each of these concerns using insights gathered from the WisdomTree Third-Party Model Portfolios Research Study.

Which of my clients are a good fit for third-party models?

The two most common ways I see advisors implement third-party model portfolios into their practice is by segmenting their book of business by account size and tax status (or a combination of both).

In practice, this means starting with “smaller accounts” in AUM and then graduating to nearly “all accounts” once the advisor is comfortable with how things are going with the manager.

Additionally, advisors will often look at their tax-exempt accounts to transition into models since the buys and sales required to transition into the new model can generate capital gains for the client.

But here’s a new idea: start with the clientele who embrace third-party model portfolios the most.

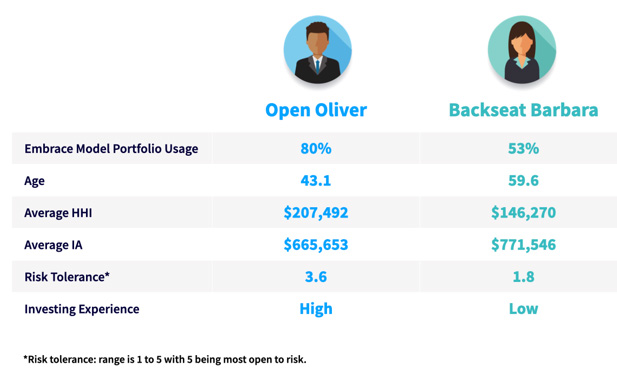

WisdomTree’s Model Portfolio Research Study used psychographic segmentation to understand which investors would most likely embrace their advisor who uses third-party model portfolios. Two groups of investors worth focusing on are those we will call “Open Olivers” and “Backseat Barbaras.”

Open Olivers represent not only an advisor’s most loyal clients but also those most open to risk. They are likely in their early to mid-40s, tend to have a household income of more than $200,000 per year and have more than $665,000 in investable assets. They are early adopters, are viewed as a valued resource to others and often recommend products and services to friends and family.

Backseat Barbaras are in their late 50s to early 60s and may already be retired. They prefer to let advisors take the lead and put even more importance on the advantages they believe advisors provide—such as financial expertise and advice, keeping up with the markets and looking out for their best interests. They are more conservative than Open Olivers, but with nearly $775,000 in investable assets, they do have a little more to lose.

More background on these segments is illustrated below:

You can see above that 80% of Open Olivers embrace the usage of third-party model portfolios. To be clear, “embrace” holds a much higher standard than “acceptable.” We found that 86% of investors believe it is “absolutely acceptable” to leverage third-party model portfolios.2 This number is probably higher than most people assume. The caveat is that the advisor is promoting the use of third-party model portfolios properly—which brings us to the next question.

How do I communicate to them the use of an outside manager without hurting my credibility?

We tested a lot of messaging with the thousands of people in the study and developed the key talking points that resonated with investors generally and Open Olivers and Backseat Barbaras more specifically.

We found analogies to be very helpful. Most investors equate an advisor understanding their financial needs and applying a model to a doctor conducting an assessment of their health—so this analogy can also be useful for advisors who are presenting third-party models to their clients.

We also saw the benefits of accentuating the positives.

Clients will take comfort in knowing that they will receive the benefit of the collective expertise of an asset management firm’s analysts, strategists and PhDs. Advisors should emphasize:

- That you’re leveraging the vast expertise and experience of a team that spends 100% of its time on asset allocation.

- That the third-party models you recommended provide a more sophisticated asset allocation approach.

- The trusted financial information and extensive expertise, research and technology that goes into each model. Consider talking about the number of people on the team or highlighting the number of analysts, strategists and PhDs and/or other advanced degrees of people on the asset allocation team.

- That you are combining your intimate knowledge of their needs with the valuable research and data from the model provider to create a tailored response to their unique situation and goals.

- That you will have more time for in-depth financial planning and to speak with them about their evolving goals.

We tested these messages with Open Olivers and Backseat Barbaras to uncover what resonated most.

For Backseat Barbaras, advisors should phrase the usage of third-party models in connection with what this group of investors values a financial advisor for the most. Sample phrasing includes:

“We are partnering with an institutional money manager that will increase the overall financial expertise overseeing your portfolio. This will better equip me to navigate choppy market conditions. And with this help, I have more time to focus on you and make sure your best interests are always getting addressed.”

At the end of the day, it’s about delivering the right message to the right group of investors.

But don’t sweat it too much.

As we learned from our Q&A with Shore Morgan Young—when explained properly, the firm moved roughly 90% of their clients into third-party model portfolios without getting pushback from a single person.

If you’re an advisor interested in learning more about WisdomTree’s ETF Model Portfolios and our Portfolio & Growth Solutions program, fill out the contact form below.

Contact Us

1 https://www.broadridge.com/resource/the-rise-of-model-portfolios

2 2020 WisdomTree Third-Party Model Portfolios Research Study.

Important Risks Related to This Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts

Ryan Krystopowicz joined WisdomTree in March 2016 and serves as a Product Specialist, ETF Model Portfolios. He is a leading voice in the content and commercialization of WisdomTree’s Model Portfolio Research Study & Model Adoption Center. Ryan also contributes to the commercial success of WisdomTree’s Model Portfolio offerings by supporting Distribution and the management of host platforms. His passion for third-party model portfolios and investment outsourcing was cultivated during his tenure at a Registered Investment Advisor where he took on a variety of roles within research and operations. Ryan received a degree from Loyola University of Maryland and is a CFA charterholder.