Artificial Intelligence May Be the Hottest Topic of Early 2023

Technology trends are not linear—they are exponential.

Exponential growth makes the path of adoption difficult to predict. A big topic like artificial intelligence—and accurately predicting exactly how ‘big’ the opportunity is—is a daunting task .

Take the current phenomenon that is ChatGPT. This application isn’t just popular—it is one of the fastest applications to get to 100 million downloads that we have ever seen. As a society, we’re still determining what ChatGPT actually is, but its virality is already off the charts.

The market for AI investments has responded in early 2023 with vigor.

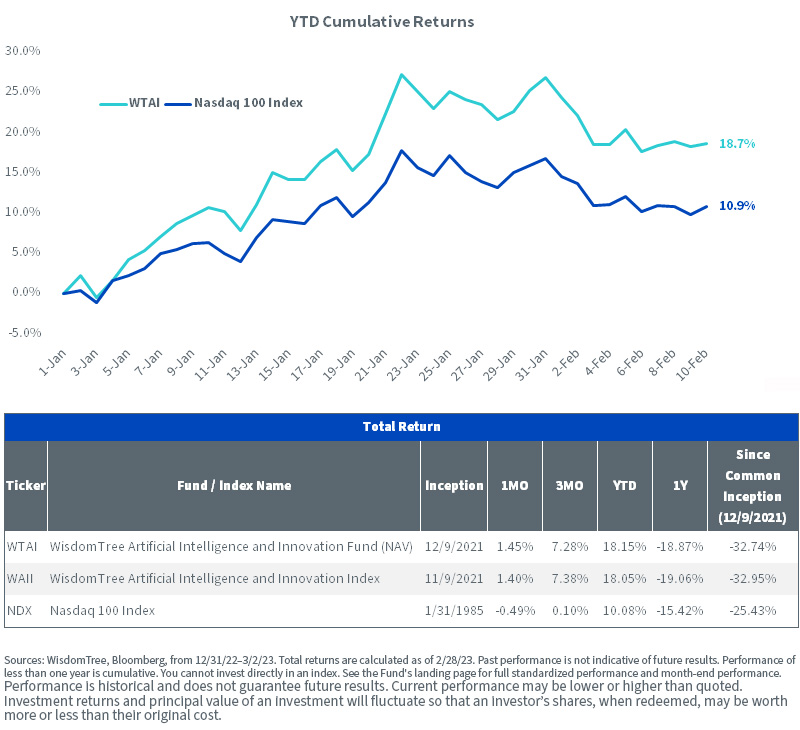

WisdomTree designed the WisdomTree Artificial Intelligence and Innovation Fund (WTAI) to give investors the option of exposure across the AI ecosystem. WTAI has kicked 2023 off with a bang after a very difficult 2022 performance period.

Figure 1: WTAI Exhibited Dramatic Outperformance of the Nasdaq 100 Index in Early 2023

Performance data for the most recent month-end data is available here.

Where Is the Impact of ChatGPT Showing Up in the AI Ecosystem?

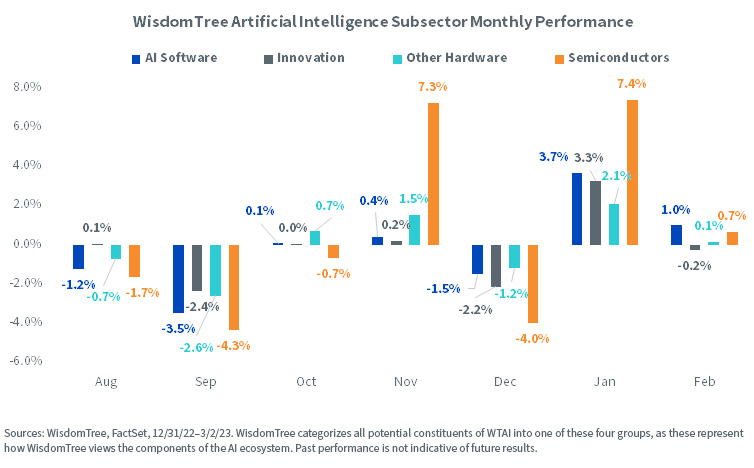

ChatGPT gained attention in late November/early December 2022. WTAI is exposed across the ecosystem and not just to semiconductors or to software. Below we indicate what drove the change from the downdraft in 2022 to more positive performance in 2023.

- August, September and October of 2022 were tough months.

- November 2022 showed a marked change, namely in semiconductors (semis); semis within WTAI exhibited divergent performance.

- December 2022 was another challenging month performance-wise, but then January 2023 kicked off with a bang. All four of our distinct subsectors were in positive territory. This hadn’t happened for some time.

- February 2023 was clearly tougher—particularly at the end of the month—but we see that both AI software and semiconductors were still positive.

Figure 2: How the AI Ecosystem Responded to the ChatGPT Euphoria

The bottom line: Figure 2 illustrates AI is an ecosystem—not just software, not just a few companies. There are established players and new entrants. There are some of the biggest companies in the world, and there are small caps.

In WTAI, we are looking to capitalize on the growing adoption of AI over the coming decades.

Incorporating Generative AI & Chat Bots

The year 2022 was a demarcation in the initial public offerings (IPOs) market. After a very strong 2021, when many companies ventured from the private to the public markets, 2022 saw a near standstill, with little activity.

So on March 1, 2023, the following headline tells us two things:

- Instacart, a widely recognized name in the delivery space, is in the process of readying itself to go public.

- Instacart is interested in tying itself into the frenzy of interest currently surrounding ChatGPT.

Instacart Joins ChatGPT Frenzy, Adding Chatbot to Grocery Shopping App1

Far from being the only instance, a recent scan of news articles produces:

- Microsoft Brings ChatGPT-Powered Bing to Mobile Devices2

- Facebook Parent, Snap Embrace AI Technology that Powers ChatGPT Chatbot3

Companies are embracing this technology. In its first two months, ChatGPT generated 100 million users, and toward the end of February 2023, the tool was getting about 35 million visits per day—a similar figure as the Bing search engine.4

Jumping on the Bandwagon

There was a time where we would see various CEOs on their quarterly earnings calls mentioning AI. If a company is associated with data, they want to use the most cutting-edge tools to extract insights.

Data was, in effect, ‘the new oil’—a common phrase.

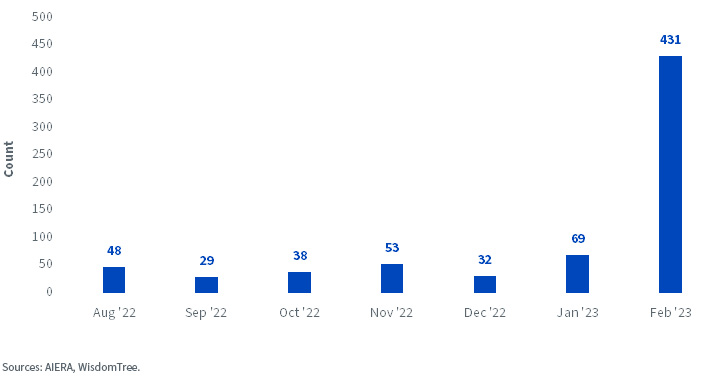

Figure 3 shows that mentions in February 2023 of ‘generative AI’ and ‘ChatGPT’ surged.

Figure 3: Earnings, Events & Documents Mentioning ‘Generative AI’ or ‘ChatGPT

AI Full Value Chain

WisdomTree’s work in AI focuses on the entire AI value chain.

Software, hardware: Some companies are directly building algorithms, while others are building sensors and processing power and other hardware that facilitates AI’s functionality.

Innovative uses: Other companies are using AI at scale to improve services. We frequently think of Netflix’s content platform for 200 million users making distinct recommendations of what to watch next…this cannot be done well with anything other than AI.

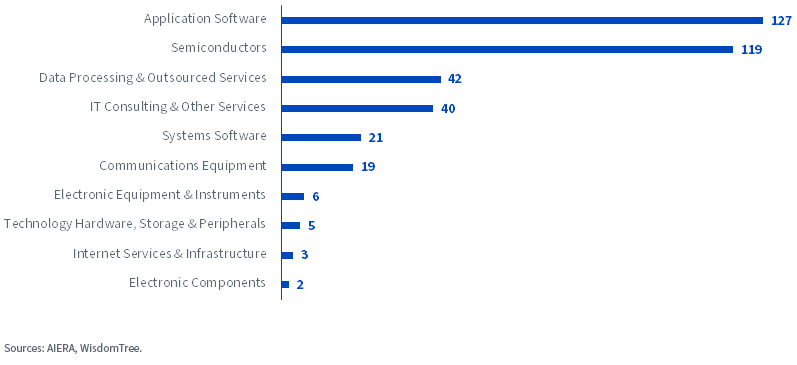

WisdomTree sees application software and semiconductors as the two most closely oriented subsectors to AI. These are the generators of algorithms and processing power. These subsectors have been particularly active in mentioning generative AI or ChatGPT.

Figure 4: Mentions of Generative AI or ChatGPT by GICS Sub Industry

Conclusion

The macroeconomic environment is currently dominating market activity. However, investors clearly remain captivated by the AI secular growth story that ChatGPT has put in the spotlight. Thematic investing is largely about stories, and the story of ChatGPT so far has been a massive performance catalyst.

1 Source: Angus Loten, “Instacart Joins ChatGPT Frenzy, Adding Chatbot To Grocery Shopping App,” Wall Street Journal, 3/1/23.

2 Source: Sarah E. Needleman, “Microsoft Brings ChatGPT-Powered Bing to Apple, Android Mobile Devices,” Wall Street Journal, 2/22/23.

3 Source: Meghan Bobrowsky, “Facebook Parent, Snap Embrace AI Technology That Powers ChatGPT Chatbot,” Wall Street Journal, 2/27/23.

4 Source: Laura Forman, “AI Has its ‘iPhone Moment,’” Wall Street Journal, 3/2/23.

Important Risks Related to this Article

As of March 9, 2023, WTAI held 0%, 1.02% and 0% in Instacart, Microsoft and Facebook, respectively. Click here for a full list of Fund holdings. Holdings are subject to change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in companies primarily involved in the investment theme of artificial intelligence (AI) and innovation. Companies engaged in AI typically face intense competition and potentially rapid product obsolescence. These companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights. Additionally, AI companies typically invest significant amounts of spending on research and development, and there is no guarantee that the products or services produced by these companies will be successful. Companies that are capitalizing on innovation and developing technologies to displace older technologies or create new markets may not be successful. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is governed by an Index Committee and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Blake Heimann is a Senior Associate on the Quantitative Research & Multi Asset Solutions team at WisdomTree, based in Europe. He initially joined WisdomTree in 2020 as an Analyst on the Research team in the U.S. In his current role, he is responsible for supporting the creation, maintenance, and reconstitution of equity and digital asset indices.

Blake's finance career began in 2017 at TD Ameritrade, where he started as an Analyst before transitioning to a role as a Quantitative Analyst. During this time, he focused on research and development of machine learning applications in finance. Blake holds bachelor's degrees in Mathematics and Economics from Iowa State University, and he has completed his Master's in Computer Science with a specialization in Machine Learning at Georgia Tech.