The New Strategy behind PUTW

We’ve written previously about how we believe that the WisdomTree PutWrite Strategy Fund (PUTW) can provide investors with ways to enhance income, lower a portfolio’s overall expected volatility or even help manage taxable gains.

On October 24 this year, WisdomTree updated PUTW's underlying exposure from the CBOE S&P 500 PutWrite Index (PUT Index) to the Volos U.S. Large Cap Target 2.5% PutWrite Index (VULPW25 Index).

Options strategies have generated increased attention and fund flows, and we saw areas to improve upon the prior strategy that sold a single option strike at-the-money every month.

We believe these areas of improvement include diversifying the strategy’s path dependency, improved up- and down-capture ratios, and a more periodical distribution target.

With market volatility expected to continue, we believe systematic put-writing strategies offer an attractive asset class in an investor’s portfolio.

PUTW's New Strategy: Volos U.S. Large Cap Target 2.5% PutWrite Index

The Volos U.S. Large Cap Target 2.5% PutWrite Index (VULPW25 Index) was created to address the areas of improvement mentioned above. The VULPW25 Index tracks the value of a fully collateralized put option sales strategy, which consists of selling (or “writing”) put options on the SPDR S&P 500 ETF Trust (SPY). At any given time, the Index holds two SPY puts with different expiration dates with roughly 50% weight in each.

SPY puts are sold on either the first or third Friday of each month with a target expiration date of either the first or the third Friday of the following month, resulting in a five- to six-week exposure. Contracts are closed out one week prior to their expiration (on the “roll date”) in a process known as “rolling,” which refers to the practice of closing out one options position and opening another with a different expiration date and/or a different strike price.

The SPY puts in the Index are selected to target a minimum premium of 2.5% as measured by the premium collected when selling the option divided by the price of SPY on the day prior to the roll date. The strike price for each position will either be (i) the “at-the-money” strike price (strike price equal to the current price of the SPY) if its premium exceeds 2.5%, or (ii) the strike price for a SPY put that has a premium closest to 2.5%.

By selling a SPY put, the Index receives a premium from the option buyer.

The Index’s potential return is limited to the amount of the option premiums it collects.

VULPW25 Index vs. PUT Index—What to Expect?

One of the clearest differences between the VULPW25 Index and the PUT Index is that the former sells options on the SPY, while the latter writes options on the S&P 500. While this results in a slightly different tax treatment, PUTW still provides exposure to the U.S. large-cap market.

Below we go into further detail regarding the updated exposure behind PUTW in the context of the previously mentioned areas of improvement.

Path Dependency:

Option strategies tend to be path dependent, which means the market conditions on the day (and specific time) an option is transacted have a major effect on the pricing of that option and its performance. A good example of this can be seen in the data below.

The PUT Index went through its scheduled roll on February 21, 2020, days before markets started reacting to the COVID-19 global pandemic. On that day, the PUT Index sold an S&P 500 Index Put option with an at-the-money strike of 3,340 (meaning the S&P 500 closed near that level). The premium collected on that day equaled to a 1.5% buffer in case of market decline. Knowing what ensued—and how option prices are a function of both the price of the underlying asset (in this case the S&P 500 Index) and volatility levels as measured by the VIX Index—we can see how selling the same option one day later would have given investors more than twice the buffer and even more than four times the buffer two days later.

S&P 500 Index: 3,340 Put 3/20/20 Expiration

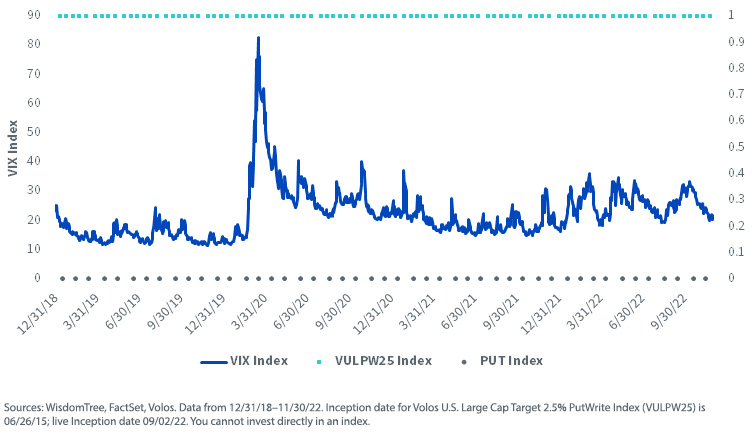

Path dependency is mitigated by increasing (or diversifying) the number of entry points into the market. One of the major differences between the VULPW25 and PUT Indexes is how the former has exposures to two put contracts while the latter rolls contracts once a month. By doubling the amount of entry points into the market, the VULPW25 Index achieves better diversification, and the overall strategy has a better sampling of the VIX Index levels. In the chart below we compare the different option-selling points of the VULPW25 and PUT Indexes since the start of 2019.

Figure 1: Roll Dates

Improved Up- and Down-Capture Ratios:

Another major difference between these two Indexes is the way the strike price is determined. While the PUT Index sells at-the-money put options, the VULPW25 Index is designed to target a specific minimum level of premium every time it rolls contracts. Given how both strategies’ upside and buffer (or downside protection) is capped by the amount of premium collected, this difference can have a significant impact on performance of a strategy.

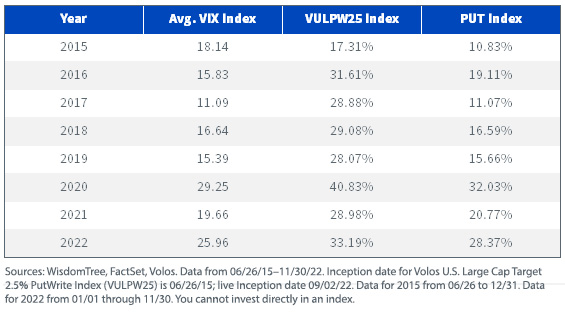

As a rough generalization, the premium of an at-the-money put option as sold by the PUT Index can be calculated as the level of the VIX Index divided by 10. As such, in periods of low volatility or VIX levels, the amount of premium collected by the PUT Index is low. In the table below we can see a calendar year breakout showing the average daily level of the VIX Index along with the total premium collected by both the PUT and VULPW25 Indexes. As previously mentioned, in years of low volatility such as 2017, the PUT Index only collected 11.07%, capping its upside and downside protection at that level. Meanwhile, the VULPW25 Index, which targets a 2.5% monthly premium, saw a number closer to the targeted 30%.

Aggregate % Premium Collected

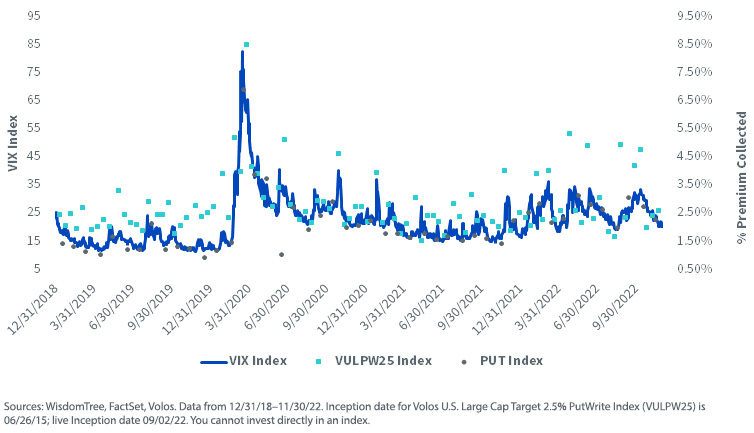

Zooming into the individual contracts sold by each strategy over the last four years, we can also see how VULPW25 Index’s 2.5% premium target does not come at the cost of upside when the VIX level increases and creates consistency in the premium collected, which we will touch upon in the next section.

Figure 2: % Premium Collected

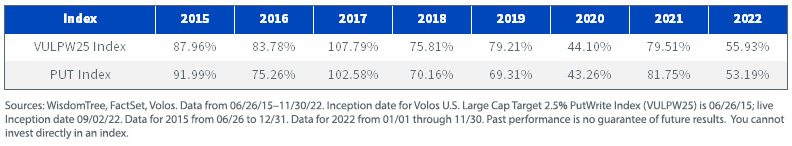

In terms of performance characteristics, it is interesting to see how these two Indexes have behaved compared to the broad S&P 500 Index. In the first table below, we are showing risk-adjusted return numbers measured by dividing each calendar year return by the volatility exhibited by each Index. The second table shows the ratio of each Index’s up capture divided by its down capture versus the S&P 500 Index. Although these numbers vary from year to year, we can see how the investment objective behind the VULPW25 Index is to beat the S&P 500 index in risk-adjusted terms while providing downside protection. Relative to the PUT Index, the VULP25W Index tends to provide investors with a better ratio of up/down capture versus the market in volatile years or when markets are generally trending upwards.

Calendar Year Risk-adjusted Returns

Up Capture/Down Capture vs. S&P 500 Index

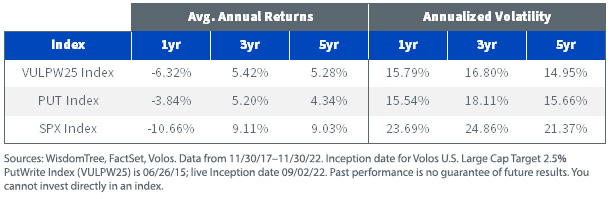

Looking at standardized return and volatility we can see the aggregate impact of the differences between the VULPW25 and PUT Indexes over time.

Periodical Distribution Target:

By targeting a specific premium level, the VULPW25 Index has a more predictable income level. As we can see in figure 2, even in periods of low volatility like 2019, the VULPW25 Index was still collecting roughly 2.5% premium at each roll date, while the PUT Index was consistently under 1%. Besides this higher premium translating into higher upside potential, it can allow for periodical distributions at the fund level.

Conclusion

Although the strategy’s objective remains constant, we believe the enhancements in the VULPW25 Index will prove positive for investors

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities, and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s NAV. Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the amount of option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.