DGRW: Know What You (Don’t) Own

Rising interest rates this year have created an inflection point in U.S. equity markets, with virtually every sector crumbling under the weight of a rapid tightening cycle. The “MANAMA” cohort (formerly known as FANG, FAANG, FAAMG, etc., consisting of Meta, Apple, Netflix, Amazon, Microsoft and Alphabet), has been especially vulnerable, as the rate-sensitive Information Technology, Consumer Discretionary and Communication Services sectors are among the worst-performing groups in the S&P 500 through November.

Although U.S. equity weakness has not been confined to these three (the broader index is still down over 13% YTD as of November 30), the 2022 market environment reminds us that outperformance comes in all shapes, sizes and directions. Quite often the companies you don’t own are more important than those you do own.

Yesterday’s Winners Can Quickly Become Today’s Losers

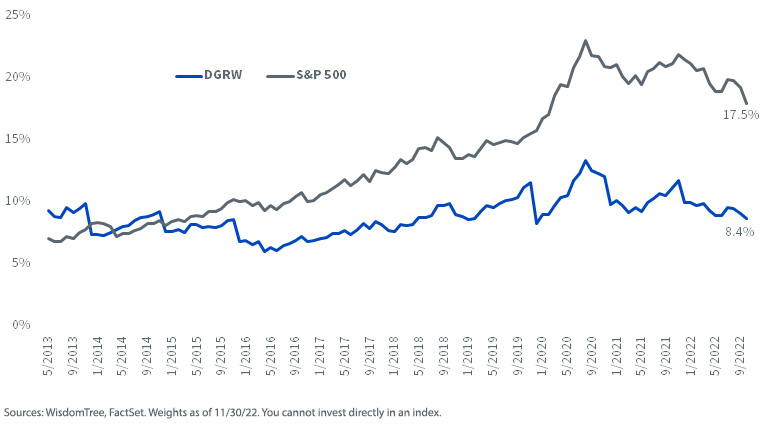

For several years, we’ve fielded questions from clients about the lack of MANAMA exposure in many of our flagship dividend-themed products, including the WisdomTree U.S. Quality Dividend Growth Fund (DGRW). Since four of the six companies do not pay a dividend, DGRW has remained structurally under-weight in this group since inception. It has exposure only to Apple and Microsoft, as they are higher-quality companies that are also growing their dividend payments.

Weight in MANAMA Companies over Time

The skepticism was understandable, as very few equities had better fortunes than the MANAMA group in the post-pandemic low interest rate environment. But 2022 has provided us with some vindication, as the four companies not held in DGRW are now the worst performers of this once high-flying cohort this year.

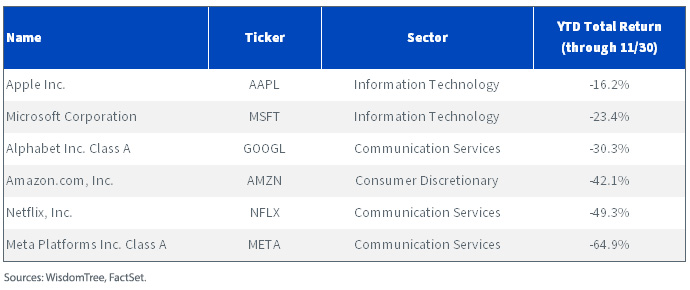

Relative Performance of MANAMA Companies

The Cost of Not Paying a Dividend

Meta, Amazon, Netflix and Alphabet do not pay dividends, meaning they’re not eligible for inclusion in DGRW. Not paying dividends has created an additional headwind for these four companies by making their shares even more susceptible to rising interest rates and attendant volatility at a time when the market has rewarded dividend-payers and other value stocks.

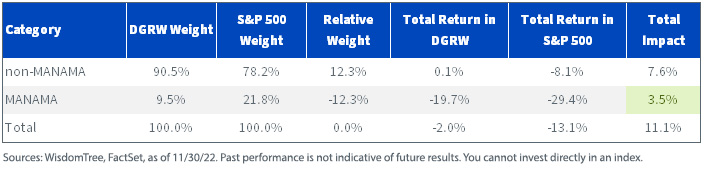

DGRW has benefitted from this year’s trend. Through November, by avoiding these four companies altogether and only retaining exposure to Apple and Microsoft, DGRW has amassed 3.5% of pure outperformance versus the S&P 500. In aggregate, the Fund is outperforming by about 11% YTD.

MANAMA Attribution: DGRW vs. S&P 500, 12/31/21–11/30/22

Apple & Microsoft: High-Quality Blue Chips

There are obviously several factors in addition to rising interest rates that have exacerbated the struggles of MANAMA stocks this year. Both Meta and Amazon announced massive layoffs recently, signaling internal problems that are compounding broader market sentiment. Netflix struggled with subscriber acquisition and retention earlier this year as well.

While these problems certainly weighed on their respective share prices, it’s indicative of how quickly market narratives change and ripple effects magnify when financial health, operational efficiency and business prospects begin to falter.

That’s why it is paramount to screen for quality companies. During market downturns, healthier companies may be more insulated and better able to withstand deteriorating economic conditions.

Of this clique, Apple is a prime example. A notoriously cash-rich company, it is among the top 20 companies in the S&P 500 when ranked by the same quality measures we screen for in DGRW. Microsoft isn’t far behind, as it’s also in the top decile of S&P 500 constituents.

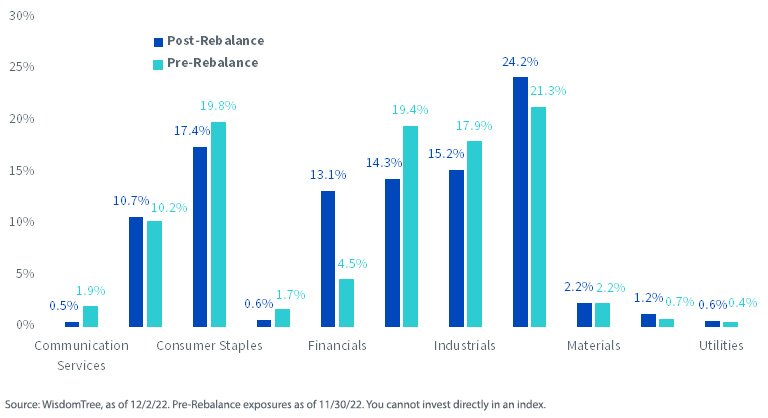

Attractive Exposures for Today’s Markets

DGRW's underlying index (WTDGI) just rebalanced in November, and the sector composition remained relatively similar, with only two notable changes. Financials became one of the larger exposures due to increased growth estimates (one component of our quality scoring methodology), while Health Care’s position was reduced. Most other changes were marginal.

WTDGI Sector Exposures

Among the MANAMA companies, DGRW is once again exposed only to Microsoft and Apple at about 7% and 5%, respectively.

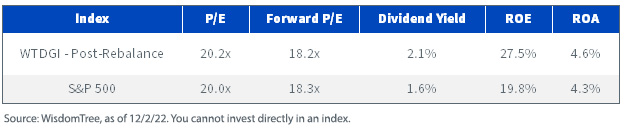

The rebalance also kept the valuation profile intact, maintaining a multiple similar to the S&P 500 on both a price-to-earnings (P/E) and forward price-to-earnings basis. The new stock basket also retains a sizable pickup in return on equity (ROE) versus the market, an advantage that doesn’t require a premium valuation.

Fundamentals Comparison

Overall, the new stock basket provides sizable pickups in yield, ROE and return on assets (ROA), three traits that have helped buffer portfolios during this year’s turbulence.

We’ve long believed in the merit of a quality factor methodology and have seen evidence in 2022 that pairing it with dividend-paying companies can deliver sizable downside protection in a rising rate environment.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.