International Quality Dividend Growth Rebalance: Filtering out the Noise

Focusing on the short run, it can feel like stock prices are overwhelmingly—if not solely—driven by macroeconomic forces like interest rates and business cycle fluctuations.

It’s tempting to distill investment decisions down to forecasts for these factors.

But if the Federal Reserve’s complete about-face this year on inflation can teach us anything, it’s that even the world’s foremost economic experts, working with the best data, can make catastrophic errors in macro forecasting.

If we can filter out the short-term noise that is today’s market volatility, in the long run what matters to investors is cash flows.

This is why we have a family of Quality Dividend Growth Indexes that rebalance annually back to a fundamental measure of value—dividends—that ties investment decisions to cash flows in a systematic, rules-based fashion.

Let’s look at the impact of the latest rebalance of the WisdomTree International Quality Dividend Growth Index (WTIDG).

Sector and Country Changes

WITDG selects dividend paying stocks in the developed world, excluding Canada and the U.S., with high profitability and growth characteristics. The top 300 ranked companies selected are weighted based on their contribution to the Dividend Stream®.

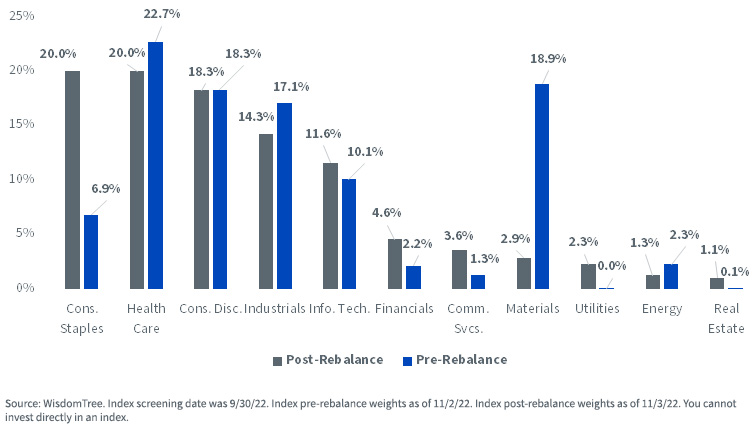

The largest sector weight allocations at the rebalance were Consumer Staples and Health Care, at 20% each. To mitigate sector concentration, the Index caps any sector weight at 20%.1

The biggest increase in the Index was to Consumer Staples (+13%) and the biggest reduction was to Materials (-16%).

Index Sector Weights

The reason for the rotation out of Materials and into Consumer Staples primarily comes from the growth estimates variable for selection and the Dividend Stream weighting for selected constituents.

With the increasing likelihood of a global economic slowdown and the rollover in raw materials prices like copper, nickel, aluminum and zinc, profit expectations for many of the major Materials companies have been reduced significantly.

Since many of these companies tie dividend payouts to realized profits and/or cash flows, it is expected that many Materials companies will be forced to cut dividends from their record-high payouts in 2021 and 2022.

The negative growth expectations for Materials companies and the positive growth expectations for the more recession-resilient Consumer Staples names explains the sector shifts. As the Index weights by dividends paid, when big dividend payers make it into—or drop out off—the top-300 score, the shifts in weight can be pronounced.

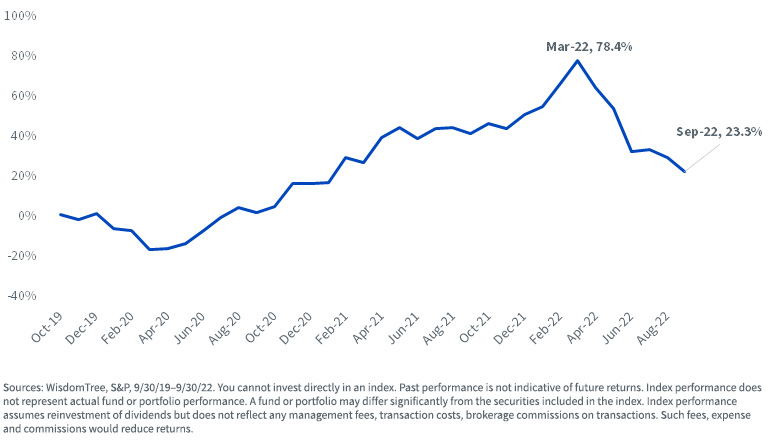

S&P GSCI Industrial Metals Index Cumulative Trailing 3-Year Return

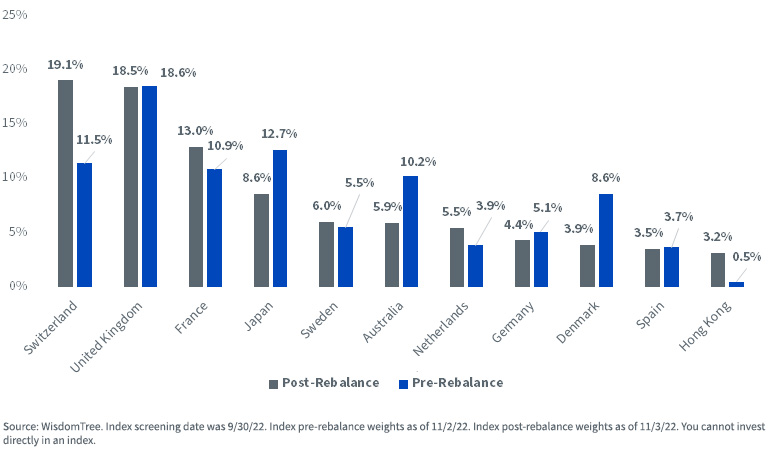

From a country perspective, the Index added notable weight to Switzerland (+7.7%) and reduced weight to Denmark (-4.7%), Australia (-4.3%) and Japan (-4.1%).

Index Country Weights

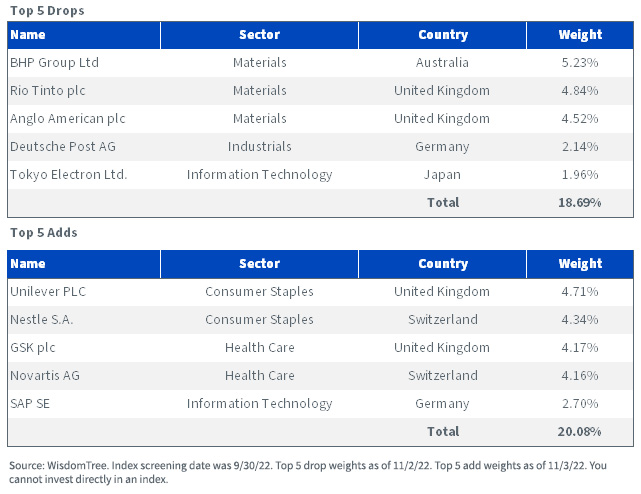

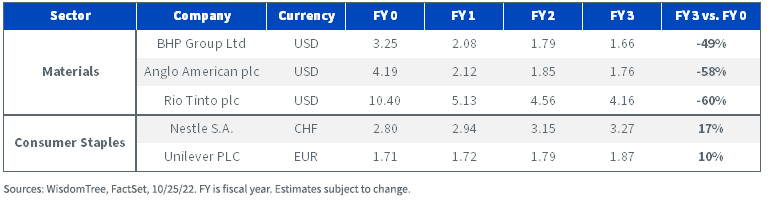

The top Index drops include three Materials companies BHP Group, Rio Tinto and Anglo American.

The top Index adds include the Consumer Staples companies Unilever and Nestle.

Top 5 Index Drops/Adds

Analyst estimates for the next three fiscal years are for these three Materials companies to reduce dividends by as much as 60% from their most recent fiscal year payouts.

Nestle and Unilever, on the other hand, are expected to grow dividends by 17% and 10%, respectively.

Forward Dividends per Share Estimates

The cyclical sensitivity of Materials companies causes them to have structurally low price-to-earnings multiples and high dividend yields.

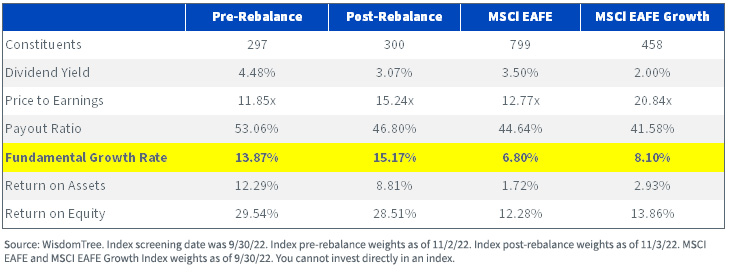

Reducing exposure to the high-yield Materials companies and increasing exposure to lower-yielding Consumer Staples results in a reduction in the Dividend Yield at rebalance from 4.48% to 3.07%, and an increase in the price-to-earnings ratio from 11.85 times to 15.24 times.

Return on equity and return on assets are both reduced in the post-rebalance Index, but are still at significantly higher levels than for both the MSCI EAFE and MSCI EAFE Growth indexes.

As a trade-off for a lower dividend yield and a lower payout ratio, the fundamental growth rate improved from 13.87% to 15.17%.

Index Characteristic

1 Real Estate has a separate sector cap of 15%.