Celebrating the Three-Year Anniversary of the Siegel-WisdomTree Model Portfolios

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

November 30, 2022, marked the three-year anniversary of the Siegel-WisdomTree Model Portfolios, so it seems an appropriate time for an update.

Before we dive in, let’s remind ourselves of the investment mandates we were solving for when we built these Models back in 2019.

First, most investors have four common investment objectives for their investment portfolios (though each person’s “weighting” to an objective may differ):

1. Generate sufficient current income to maintain or improve their current lifestyle

2. Not outlive their money (i.e., make sure the portfolio lasts at least as long as they do)

3. Ensure that family legacy or impact/philanthropic goals can be met

4. Minimize fees and taxes along the way

These common objectives face two primary challenges as we look out over the investment horizon.

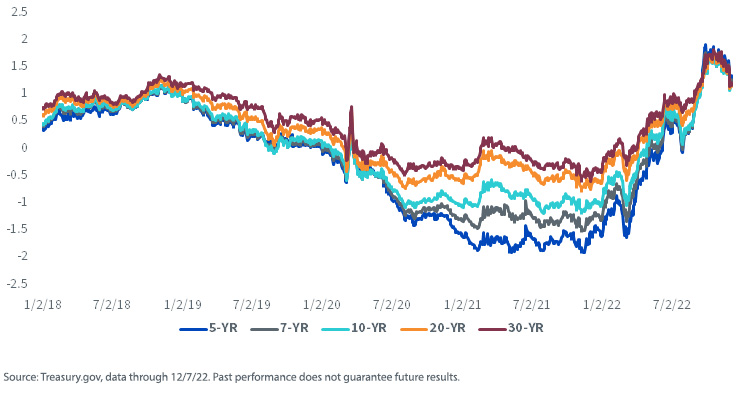

1. Lower interest rates: The Fed’s aggressive rate tightening policy (after remaining too loose for far too long, in our opinion) has resulted in a rise in interest rates, at both the nominal and real yield levels.

Currently, Treasury real yields (the nominal rate minus the inflation rate) are positive—but still fairly low—across the maturity spectrum.

U.S. Real Treasury Yields (%)

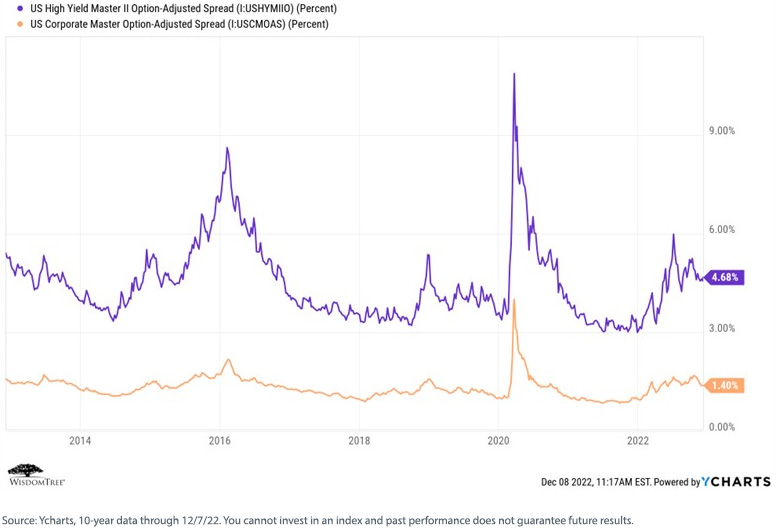

At the same time, credit spreads have widened to slightly to elevated levels relative to history.

The implication is that while “there is income back in fixed income,” we believe it will remain difficult to generate sufficient current income from a fixed income portfolio to maintain or improve current lifestyles, without taking unwanted additional risk (i.e., increased duration or credit risk).

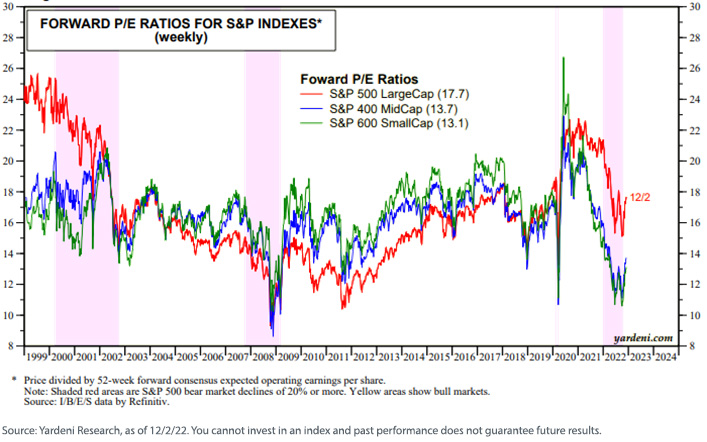

2. Lower forecasted equity returns: The potential return on any investment is at least partly a function of what you pay for it today. The year-to-date market declines have brought equity market valuations down to still elevated but slightly more reasonable levels by historical standards (and they appear more attractive in small-cap, mid-cap and value stocks). Our own estimates for the S&P 500 index are for roughly 5% real return, versus an historical real return rate of 6.5%–6.7%. Given valuations, there is potential for higher real returns in small-cap and value stocks.

For definitions of indices and terms in the chart above, please visit the glossary.

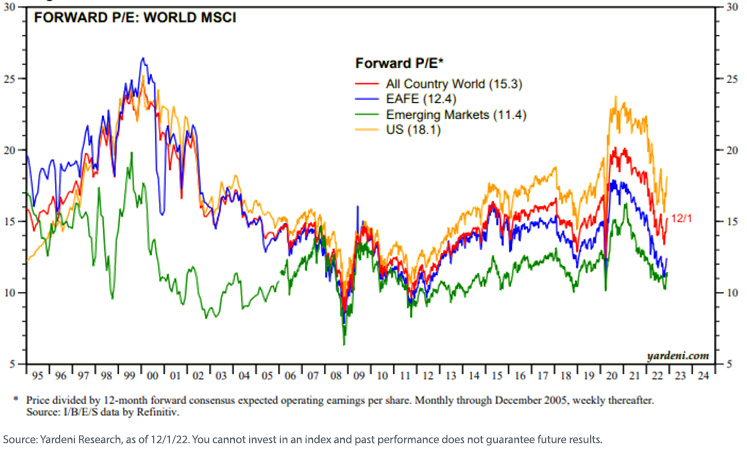

We see similar valuation declines across all major global markets—this is a “nervous” time for equity investors, but valuations suggest that patient investors may be rewarded more now than in recent history for taking on non-U.S. equity risk.

For definitions of indices in the chart above, please visit the glossary.

The implication is that, while currently volatile, we believe the equity markets remain the best opportunity for building long-term value within a portfolio—that is, improving the longevity profile of the portfolio (reducing the risk of running out of money before you die and increasing the odds of being able to leave a legacy).

Finally, and while we do not suggest this will always be the case, this has been a bad year for the traditional “60/40” portfolio, as bonds have failed to provide the hedge to equity risk they historically delivered.

So, the question remains—how can we build a “better mousetrap” than the traditional 60/40 portfolio that can potentially address most investors’ objectives in the face of current and expected future market environments? Fortunately, there are things we can do.

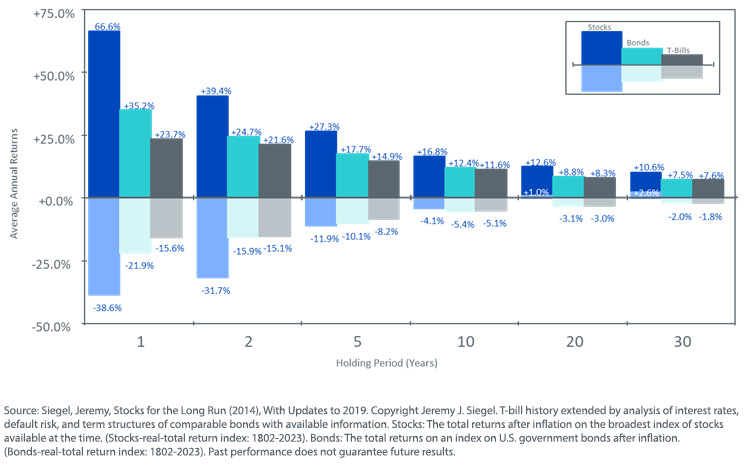

Drawing on the research of Professor Jeremy Siegel of the Wharton School (a since-inception strategic investment advisor to WisdomTree), we know that, over a reasonable time horizon, stocks perform better than bonds, and even the worst historical periods for stocks were better than those of either bonds or cash.

Maximum and Minimum Returns 1802–2020

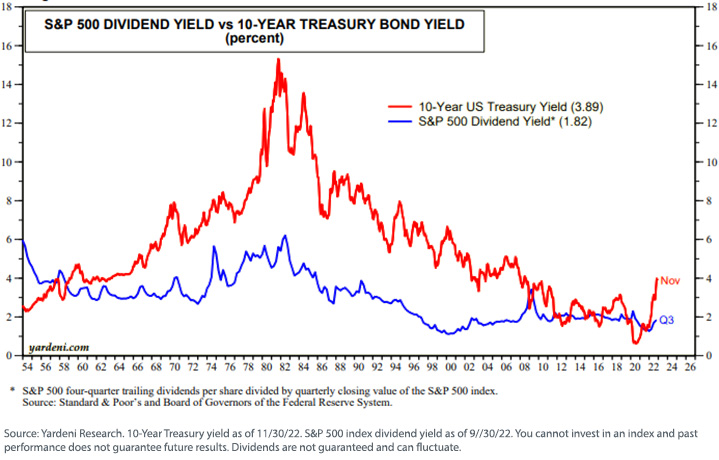

The current dividend yield from the S&P 500 is slightly less than half the nominal 10-Year Treasury yield. We suspect, however, that Treasury yields:

a) do not have significantly more upside potential (maybe to 4%–5%), and

b) will be highly volatile over the medium term.

We believe equity dividend yields are more sustainable as they represent a return on real assets. Further, there has been a distinct investor “rotation” toward dividend, value and quality stocks as we head into uncertain economic times—a trend we believe will continue. In addition, equities hold the potential for upside total return, while bonds do not (if held to maturity).

The Siegel-WisdomTree Model Portfolios

It was with these facts on the ground that, in collaboration with Professor Siegel, we constructed the Siegel-WisdomTree Model Portfolios—a Global Equity Model and the flagship Longevity Model, which is explicitly our attempt to improve on the traditional 60/40 portfolio:

1. A targeted (but not fixed) 75% allocation to yield-focused equities to improve current income generation, the longevity profile and the legacy potential of the overall portfolio (Investor Objectives #1, #2 and #3). The yield-focused nature of the selected equity securities means they tend to have a lower equity beta profile.

2. A targeted (but not fixed) 25% fixed income allocation constructed for quality income generation in a risk-controlled manner and to function as an appropriate equity risk hedge (Investor Objective #1).

3. The portfolio is constructed entirely with ETFs, to potentially optimize fees and taxes (Investor Objective #4).

When we say “targeted but not fixed” allocations, it simply means we can deviate on a marginal basis as market conditions change. Currently the portfolio’s allocation is approximately 71/23/6, with a 6% “alternatives” allocation to managed futures and commodities (funded equally from equities and fixed income).

We built the Global Equity Model on the same principles, but in recognition that many advisors prefer to manage their own fixed income portfolios and/or want to create different risk profile portfolios than our suggested 75/25.

The potential results of our asset allocation, portfolio construction and security selection decisions are:

1. Improved current income generation

2. A better longevity profile (i.e., reduced short-fall risk)

3. Better potential for funding legacy objectives

4. An expected slightly higher standard deviation than a traditional 60/40 portfolio (i.e., the investor and advisor accept slightly higher short-term volatility in exchange for increased current income and a better longevity profile, or, in other words, slightly increasing one measure of portfolio risk, volatility, in exchange for improving a different measure of portfolio risk, longevity)

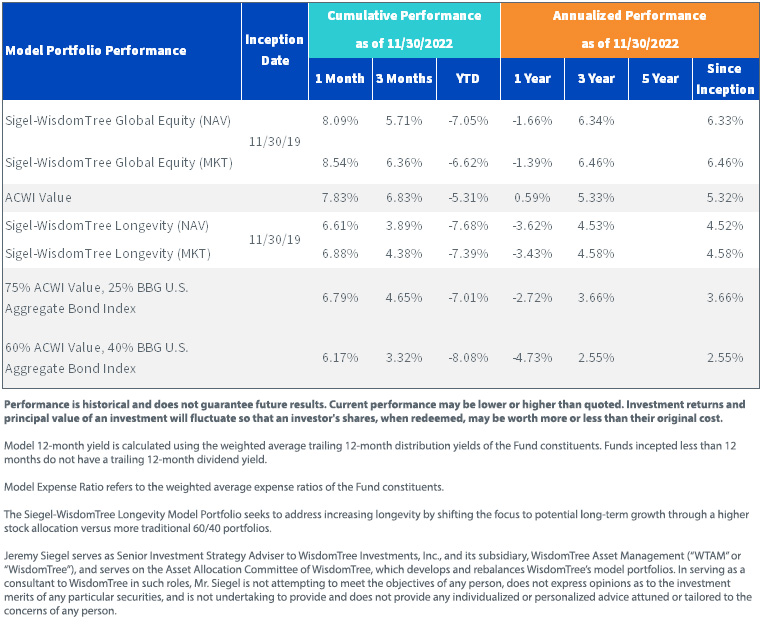

We launched these Models in November 2019, so they now have three years of live performance, under fairly extreme market conditions (in both directions) and (as of 11/30/22), they have performed as expected both from a total return and a yield perspective.

For standardized returns and expense ratios for each underlying fund please click here.

Conclusion

We launched the Siegel-WisdomTree Model Portfolios in an attempt to address what we believe are some of the primary issues and conditions that investors will face in the foreseeable future. Our view, simply, is that the traditional 60/40 portfolio will face significant headwinds in meeting investor objects as we move through this decade and the next. We believe we have succeeded in constructing a “better mousetrap,” and we wish these Models a very happy third birthday.

Financial advisors who register on the WisdomTree website can learn more about these Models, and how to successfully position them with end clients via our Model Adoption Center.

Important Risks Related to this Article

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.