Cloud Computing: Keep Looking at the Growth

As we write these words, we are roughly halfway through the month of November 2022. Investors globally remain focused on inflation, the policy path of the U.S. Federal Reserve and the earnings reports of individual companies highlighting their results for the quarterly period ended September 30, 2022.

Amongst the many software-as-a-service (SaaS) companies delivering their products through the cloud computing business model, a few narratives are emerging:

- Many, though not all, companies are reporting positive results that beat consensus expectations for the period from June 30, 2022, to September 30, 2022.

- Almost all companies are then guiding expectations downward for the period from September 30, 2022, to December 31, 2022.

- Share price performance—depending, of course, on the macroeconomic announcements happening concurrently—has trended in the downward direction, following the narrative that growth in the current period is slowing and the cloud business model is therefore not immune to a possible recession or generally more difficult economic conditions.

A Tale of Two Companies: Twilio vs. Toast

We can look at the summary results of two companies, very recently reported, that showcase the more general trends.

Twilio: A Great Quarter, but Hammered on the Forward Guidance1

For the period ended September 30, 2022, Twilio generated revenue of $983 million, over consensus estimates of $972 million and representing growth of 33% year over year. This was the “good result.”

Twilio then noted that 4Q 2022 revenue could be in the range of $955 million to $1.005 billion, which would correspond to year-over-year growth of 18%–19%. However, this would be below the consensus estimate of $1.07 billion. This would be the “lower guidance.”

Then, there was this quote from Chief Operating Officer Khozema Shipchandler, noted in a letter to shareholders:

Like many of our software peers, we’re seeing negative impacts on our business from the macro environment. As a result of the worsening macro situation, we also feel it is prudent to pull the 30%+ revenue growth target today. We still believe we’ll deliver attractive levels of growth going forward, but in the current market, we don’t believe 30%+ is achievable.

The day after these results and guidance were made, the share price dropped about 35%. We’d note that Twilio, as a business, is delivering on the same services and mission it was before but has just said that revenue growth expectations have to be more reasonable. While it shouldn’t have been as surprising as it was, given the news we see every day, it’s also likely exactly the narrative investors do not want to hear, hence the short-term punishment.

Toast: Raising Forward Guidance amidst an Uncertain Macro Environment2

There are some companies actually increasing their forward guidance after reporting strong results. Toast fits into this category.

For the full year, Toast raised its expected revenues to a range between $2.692 billion and $2.722 billion from a prior guidance range of $2.2 billion to $2.66 billion. For the quarter set to end December 31, 2022, Toast raised the guidance range to $730 million to $760 million when the consensus expectations were merely $725 million.

For the period ended September 30, 2022, Toast grew revenues year over year by 55%, reaching $752 million. Gross payment volume—noting that this is a key part of Toast’s restaurant management software—was $25.2 billion, meaning that the company is now on an annual pace to exceed $100 billion in gross payment volume for the first time.

So, it’s important to note that not all cloud computing companies are lowering guidance for the current period.

The Bottom Line: Growth vs. Valuation

One year ago, in November 2021, nearly all of our discussions around cloud computing were about the high valuation. We would encourage all investors looking at cloud computing to always try to think of both valuation and growth together. Figure 1 shows a measure of year-over-year sales growth per unit of enterprise value-to-sales multiple, meaning:

- November 9, 2021: The EV-to-sales multiple of the BVP Nasdaq Emerging Cloud Index was 15.17x, whereas the weighted average sales growth was 41.40%. If we divide 41.4/15.17=2.73. Growth was high—but the investor at that time was paying for it.

- November 14, 2022: The EV-to-sales multiple of the BVP Nasdaq Emerging Cloud Index was 4.70x, whereas the weighted average sales growth was 29.86%. If we divide 29.86/4.70=6.35. The multiple has dropped a lot, and while the growth has decelerated, the valuation decelerated at a faster rate. The investor is now getting more units of growth for less money than they paid for those units of growth roughly one year ago.

Figure 1: Year-over-Year Sales Growth per Enterprise Value-to-Sales (EV-to-Sales) Multiple

-multiple.jpg)

The Path = Our Emotional Memory

Investors don’t “feel great” when we speak to them, generally, about their tech investments, their growth investments or their software investment in 2022. This is not because the world isn’t using tech or software, but rather, it is because these stocks have rapidly adjusted—through massive multiple contractions—to the shift we are all watching from 0% interest rate policies to much higher interest rate policies at various developed market central banks.

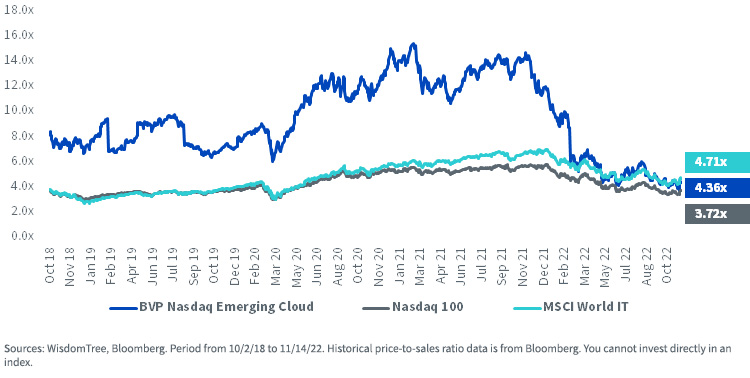

But, as we see in figure 2, if we can reset our thinking, starting from the present period, we can see that the BVP Nasdaq Emerging Cloud Index is trading at a valuation that is quite similar to the more general, broad tech benchmarks, such as the Nasdaq 100 Index or the MSCI World Information Technology Index. If these cloud companies can hold on to faster growth than the broad tech markets, this creates an interesting opportunity for investors with longer time horizons.

Figure 2: Historical Price-to-Sales Ratio since Live Inception of the BVP Nasdaq Emerging Cloud Index

Conclusion: It’s All about the Growth

Cloud companies need to weather the macroeconomic storm of the present period, and those that are able to hang on to their ability to showcase growth will be well positioned for what many are calling the coming “pivot.” We don’t know exactly when the U.S. Federal Reserve will stop raising interest rates, but we are seeing—just look at the performance observed on November 10 and 11, 2022—that the market is keyed into anything that appears even remotely helpful in the case for less tightening. We believe that the long-term picture will be determined by the capability of companies in the BVP Nasdaq Emerging Cloud Index to continue to grow, even if the short-term picture may be more determined by movements in interest rates and interest rate expectations. Those investors looking to implement an investment may consider more closely studying the WisdomTree Cloud Computing ETF (WCLD), which is designed to track the returns of the BVP Nasdaq Emerging Cloud Index after accounting for fees and expenses.

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

As of November 21, 2022, WCLD held 1.08% and 1.66% in Twilio and Toast. Click here for a full list of Fund holdings. Holdings are subject to change

1 Source: Eric J. Savitz, “There’s New Trouble Brewing in Cloud Stocks. Twilio and Atlassian Issue Growth Warnings,” Barron’s, 11/4/22.

2 Source: Emily Dattilo, “‘Toast Is On Fire’ as Management Lifts Outlook. The Stock Is Higher,” Barron’s, 11/11/22.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the internet and utilizing a distributed network of servers over the internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISOR TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX-RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.

Nasdaq® and the BVP Nasdaq Emerging Cloud Index are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.