Global ex-U.S. Quality Dividend Growth: 2022 Reconstitution

The WisdomTree Global ex-U.S. Quality Dividend Growth Index (WTGDXG) selects companies from developed international and emerging markets that score well across measures of profitability like return on equity (ROE) and return on assets (ROA), and earnings growth prospects. Companies in the Index are ranked within their respective regions.

WisdomTree recently conducted the annual reconstitution of WTGDXG, which is tracked by the WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL).

This post provides a review of WTGDXG’s reconstitution.

Country and Sector Changes

Given the macroeconomic backdrop, WTGDXG saw a significant decrease in its exposure to the Materials sector. Materials companies have experienced 18 months of solid revenue growth on the back of higher commodity prices. The companies in this sector have negative earnings growth prospects over the medium term and, despite having above-average profitability measures, companies like BHP Group Plc, Anglo American Plc and Vale S.A. were dropped from the Index.

On the other hand, companies in the Consumer Staples sector have shown solid growth over the past year. Market expectation is for this to continue. Therefore, names like Nestle S.A., Unilever Plc and Diageo Plc were added to the Index.

Other noteworthy sector changes can be seen in an increased allocation to the Industrials sector and a reduced allocation to the Health Care sector. Pharmaceutical company Roche Holding was dropped from the Index after being reduced in the 2021 rebalance, while ABB Ltd and Canadian National Railway company were added.

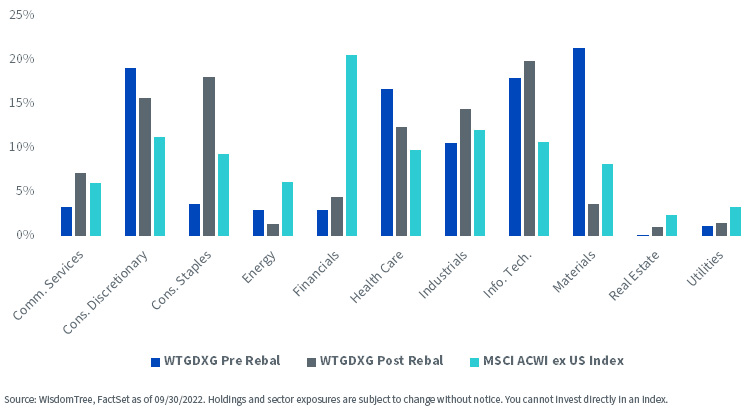

WTGDXG maintains over-weight allocations to the Consumer Discretionary, Health Care and Information Technology sectors relative to its benchmark, the MSCI AC World ex-US Index, and under-weight allocations to the Energy, Financials and Utilities sectors.

Sector Exposures

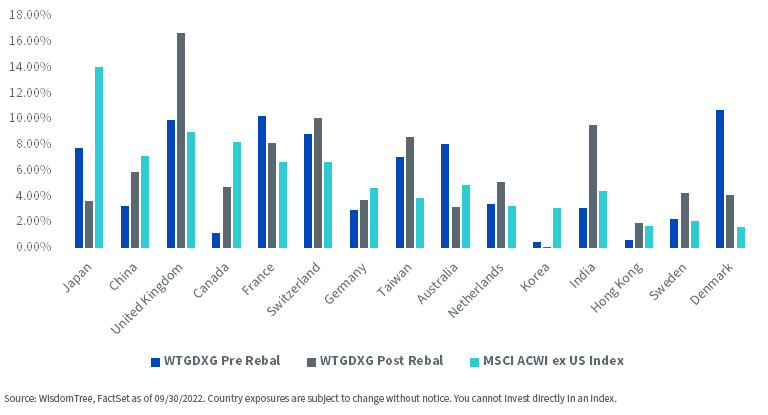

Japan, Denmark and Australia had notable reductions in their weights. Danish Novo Nordisk A/S was WTGDXG’s largest holding prior to the rebalance. It had experienced an increase of 5.26% over the last 12 months.1 Its weight was adjusted to reflect its current fundamentals as measured by its dividend payment. The decrease in the allocation to Materials companies contributed to the nearly 5% decline in the Index’s exposure to Australia.

Exposures to the United Kingdom, India and Canada were notably increased. The largest addition from a country perspective was United Kingdom, whose weight increased by 6.7%. This increase was driven by the addition of Consumer Staples conglomerates like Unilever Plc and Diageo Plc. Both companies are expected to continue to grow despite an uncertain macroeconomic scenario.

The increase in weight to India came from companies across different sectors, as this economy has continued to rebound from the 2020 slowdown faster than others in emerging markets.

WTGDXG maintains over-weight allocations to the United Kingdom, France, Switzerland and Taiwan relative to its benchmark, while having under-weight allocations in Japan, China and Germany.

Country Exposures

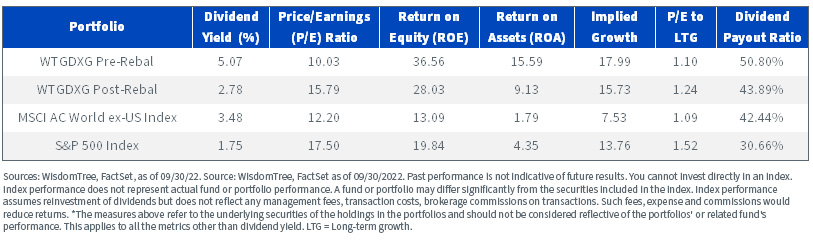

Fundamentals

Post-rebalance fundamentals need to be analyzed in the context of the sector and country changes mentioned above. The dropping of Materials companies that have high payouts on inflated earnings and low valuations can give the impression that WTGDXG’s methodology is not accomplishing its purpose. On the contrary, the portfolio is being repositioned into companies with strong balance sheets, whose growth expectations are solid in the medium term.

WTGDXG's post-rebalance quality metrics, ROE and ROA, continue to be significantly higher than those of the MSCI AC World ex-US Index, while having a higher implied growth as measured by the earnings retention times ROE. WTGDXG’s lower payout ratio post-rebalance also signals how its constituents are reinvesting a higher percentage of earnings in growth opportunities and could have a more sustainable dividend.

For definitions of terms/indexes in the chart above, please visit the glossary.

Within its objectives, WTGDXG’s fundamentals show a portfolio with more attractive quality and growth metrics than the MSCI AC World ex-US Index. We believe these advantages make WTGDXG’s P/E premium seem like a fair trade-off for investors.

Compared to the U.S. market—represented by the S&P 500 Index—we can see how WTGDXG has provided higher growth at cheaper valuations. This basket of global ex-U.S. companies has exhibited a more attractive profitability and growth profile, higher dividend yield and lower P/E ratio than the broad S&P 500 Index.2

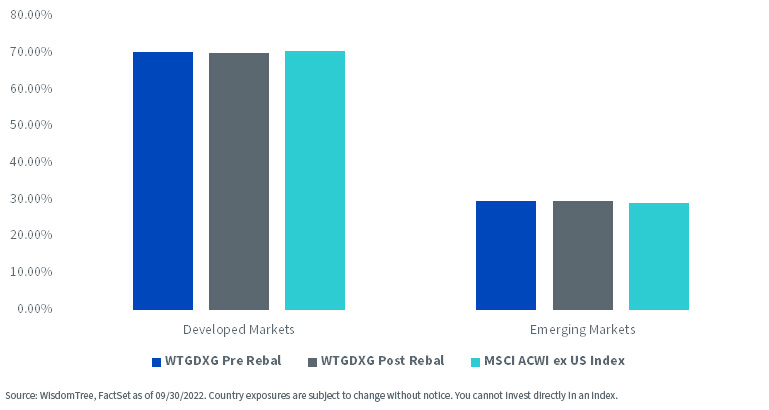

Regional Exposure

WTGDXG’s methodology includes a regional adjustment factor applied at rebalance such that the regional (developed markets and emerging markets) weights are equal to the float-adjusted market capitalization weight of the starting universe. This year, the WTGDXG methodology began ranking companies within their respective regions and selecting the highest ranked from each.

As we can see below, there will be no significant changes to regional exposures at rebalance and the portfolio will remain slightly over-weight in developed markets and under-weight in emerging markets relative to its benchmark.

Regional Exposures

1 Source: Bloomberg. Data from 09/30/2021 – 09/30/2022.

2 Past performance does not guarantee future results.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in fund shares. Such fees, expenses and commissions could reduce returns. WisdomTree, its affiliates and their independent providers are not liable for any informational errors, incompleteness or delays or for any actions taken in reliance on information contained herein.

Additional Index information is available here.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.