Buying Wine for the “Duration Party” in our Model Portfolios

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Extending Duration; Remaining Cautiously Short

Throughout 2022, we have maintained a short duration profile within the fixed income allocations of our Model Portfolios.

This is based on our view that, given persistent inflationary pressures, increasingly hawkish rhetoric from the Fed and heightened interest rate volatility, it is better to be late than early to the “duration party.”

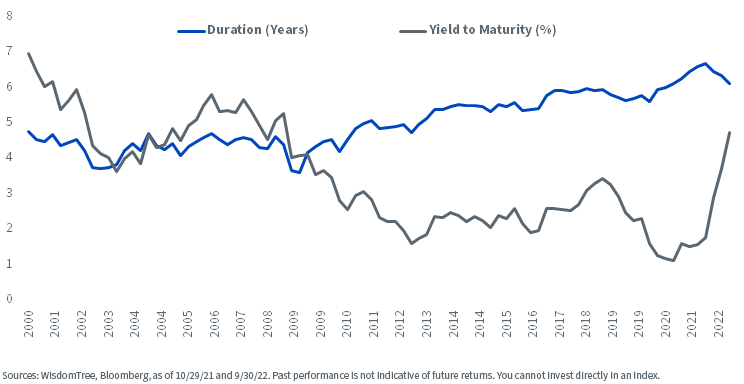

Furthermore, the risk/return trade-off in core fixed income portfolios has been challenged since the global financial crisis, as potential returns (yields) have cratered while interest rate risk (duration) has marched higher.

That environment may be changing—since the start of the year, the yield on the Bloomberg U.S. Aggregate Bond Index has increased from 1.75% to over 4.6%! Bond investors are now being compensated with a greater yield for taking on a similar level of duration risk.

While volatility in both interest rates and credit spreads remains elevated, the income is back in fixed income markets.

Duration, Yield of Bloomberg U.S. Aggregate Bond Index

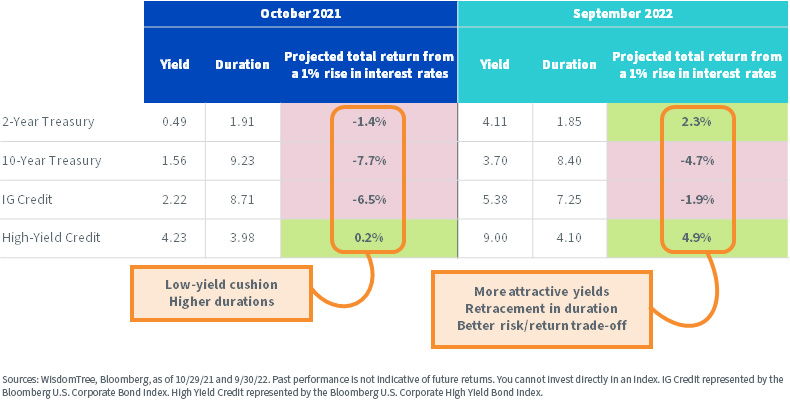

Another way to look at the risk profile of fixed income is to consider the extent to which current yields can offset the price impact of a rise in interest rates.

Going back almost one year to October 2021, when our Model Portfolio Investment Committee made the decision to shorten duration, yields in fixed income were lower and durations higher than today. Put another way, investors had a slimmer yield cushion to offset what was a greater price sensitivity to a move in rates.

Fast forward to today and the combination of higher yields and lower durations has dramatically changed that picture. With the cushion offered by today’s yield levels, fixed income can still deliver positive total returns in a rising rate environment.

Interest Rate Risk Buffer in Fixed Income Yields

While we are not ready to fully close out our short duration position and make our entrance at the duration party, we have begun to move in that direction.

As part of the quarter-end rebalance on September 30, 2022, we extended the maturity profile of our bond allocations, partially closing the existing short duration position in our Model Portfolios.

A straightforward way to evaluate potential changes to the duration profile of a fixed income portfolio is through our “barbell” tool, which allows investors to toggle between short and intermediate/longer duration exposures.

Within our Strategic Model Portfolios, our approach to the barbell strategy consists of the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) for intermediate/longer duration exposure and the WisdomTree Floating Rate Treasury Fund (USFR) for shorter duration exposure.

Rotating Out of High-Yield Municipal Bonds

Another change we implemented in September was removing our existing allocation to high-yield municipal bonds in our Multi-Asset Income Model Portfolios. These strategies live within our Outcome-Focused Model Portfolio suite, where we maintain portfolios that are designed to achieve very specific investment objectives including enhanced yield and income generation, disruptive growth, volatility management and risk factor diversification.

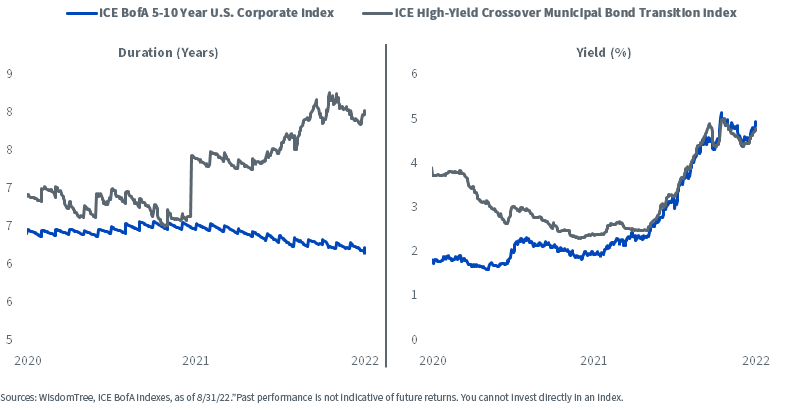

This high-yield municipal bond position was added several years ago when the sector offered a considerable yield advantage to investment-grade corporate credit, in addition to valuable diversification benefits to a traditional core fixed income portfolio.

In recent months, that yield advantage has disappeared while the interest rate risk (duration) of high-yield municipal bonds has steadily increased.

Duration Yield of Intermediate U.S. Corporates, High Yield Municipal Bonds

With these market dynamics in mind, our Model Portfolio Investment Committee made the decision to reallocate from high-yield municipal bonds to investment-grate corporate credit in these Models.

Conclusion

As interest rate volatility remains elevated, we continue to monitor fixed income markets and the trade-offs between risk and potential returns across sectors.

While we maintain our preference for shorter duration exposure, intermediate and longer-term yields may now be less vulnerable to rising rates than they were a year ago.

With this in mind, our Model Portfolio Investment Committee moved to extend the maturity profile of our fixed income portfolios, partially closing the existing short duration position. We still would rather be late than early to the duration party and liken this first step to buying a bottle of wine before arriving.

Lastly, as the relative yield premium of high-yield municipal bonds has diminished, we reallocated from this sector into investment-grade corporate bonds within our Multi-Asset Income Model Portfolios.

Important Risks Related to this Article

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the account; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from the information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds, notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

AGGY: There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

USFR: There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new, and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.