The Last Good Deal in Town

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Not that you need to be reminded, but 2022 has been one heck of a difficult market to navigate.

Stock markets are off to their worst start in decades. Bonds have failed as diversifiers. Inflation is at a 40-year high. Mortgage rates are skyrocketing. The Fed has been forced to slam on the brakes. Economic growth is diving. Confidence is cratering.

Other than that, Mrs. Lincoln, how was the play?

Unfortunately, we believe two of 2022’s unwelcomed guests may be here for a while: inflation and volatility.

Inflation is no longer limited to just a narrow subset of consumer goods that have been impacted by supply chain disruptions—although some of these persist. Used car prices once represented nearly a third of the increase in annual inflation, but that has broadened out. Today, dozens of subcomponents are seeing rapid price growth (consider that the median component annual CPI now sits just under 6% ). Even if inflation prints come down from their current nosebleed levels, the future floor has been lifted.

It looks like volatility is here to stay as well. Markets were complacent in 2021, and for good reason: stocks just kept rising without much disruption. Loose financial conditions and solid earnings helped drive animal spirits, and the VIX averaged just 19 for the year.

Fast-forward to today: policy is sharply tighter, sentiment is poor and the VIX has spent more than twice as much time above 30 as it has below 20 . Unless we can already see the light at the end of the recessionary tunnel, it’s likely that both implied and realized volatility will stay elevated from here.

The Portfolio Playbook for Inflation and Volatility

How should investors position their portfolios in this environment?

Over decades of research, Professor Jeremy Siegel has shown that stocks have historically been the ultimate inflation hedge—especially those that paid dividends, as dividend growth consistently outpaced annual inflation.

Within equities, we think it is best to anchor portfolios around the quality factor.

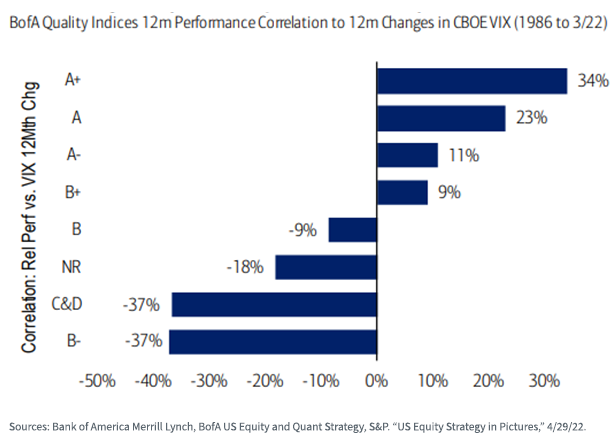

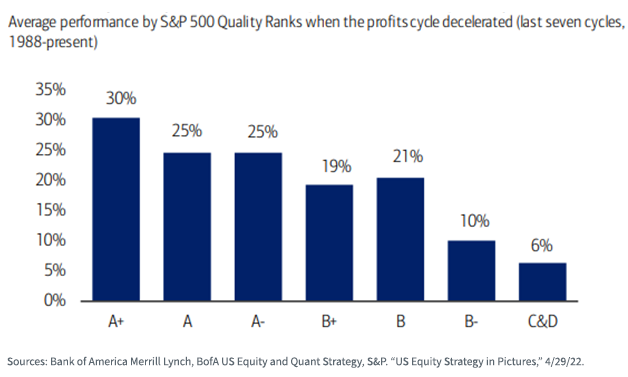

According to Bank of America Merrill Lynch, the highest-quality stocks have historically outperformed when volatility rises. Additionally, these companies have also done the best when profit cycles were decelerating—arguably the same part of the market cycle we find ourselves in today.

High-Quality Stocks Have Tended to Outperform When Volatility Has Risen

For definitions of the terms above, please visit the glossary.

High-Quality Stocks (A+) Have Outperformed When the Profits Cycle Has Decelerated

For definitions of the terms above, please visit the glossary.

The Style That Doesn’t Go Out of Style

It should not come as a shock that when times get tough, companies with strong free cash flows and pricing power are best positioned.

But taking a step back from today’s choppiness, ask yourself: why wouldn’t investors always want to over-weight quality?

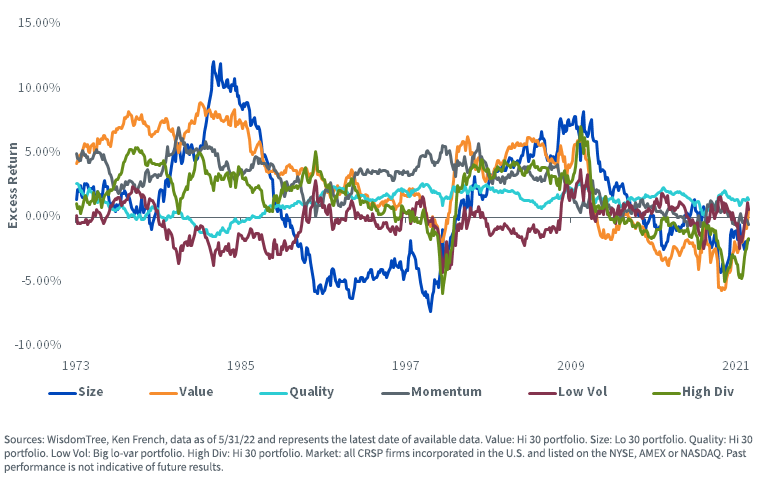

Several investment factors ebb and flow between periods of relative under- and outperformance, depending on where we are in the cycle. Value and size have historically tended to fare best in early cycle periods; momentum has tended to work best in trending mid-cycle markets.

One big exception to this is quality—in our view, the most consistent of all factors.

Sure, quality will likely lag in the sharp risk-on rallies that typically mark the start of an early cycle snapback. But those types of environments don’t tend to last, and neither does quality underperformance.

In fact, there hasn’t been a rolling 10-year period when quality underperformed since the late 1980s.

Investors would be wise to consider quality as their portfolio anchors—not just today, but always.

Rolling 10-Year Excess Return vs. Market

For definitions of the terms above, please visit the glossary.

WisdomTree’s Approach to Quality

Within the WisdomTree ETF product lineup, most equity ETFs track an index that implements a composite risk score, which helps boost the overall quality profile of each Fund.

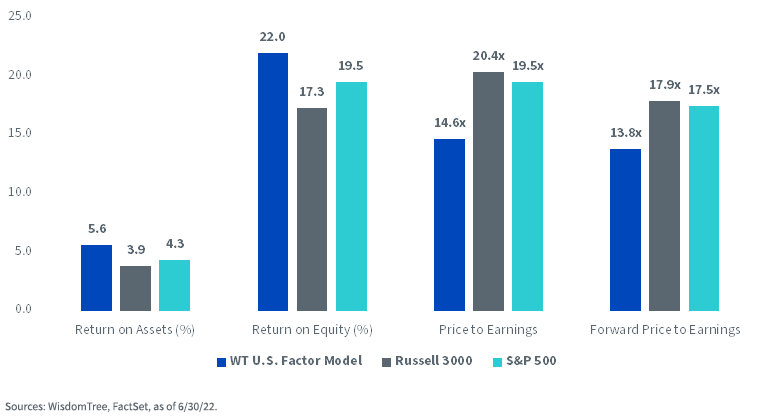

One flagship product that we believe epitomizes this is the WisdomTree U.S. Quality Dividend Growth Fund (DGRW), which has premium quality metrics, such as ROE and ROA, when compared to the S&P 500. The impact of this quality tilt has never been more evident than in 2022, when the Fund has outperformed the S&P 500 by 7.8% through June .

Similar to our ETFs, the WisdomTree Model Portfolios also have an emphasis on quality. In our opinion, perhaps no model better embodies the high-quality ethos than the WisdomTree U.S. Factor Model.

It should come as no surprise that DGRW is an anchor position in the model.

Not only does the model have sharply higher quality metrics than the overall market, but it also currently trades at a significant discount from a valuation standpoint.

In these days of high inflation, it’s hard to find many things that offer a good bang for your buck. We believe that right now, the U.S. Factor Model may be one of the last good deals in town.

For definitions of the terms above, please visit the glossary.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent standardized performance, 30-day SEC yield and month-end performance, click here.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

For financial advisors: WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

For retail investors: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. The performance of your account may differ from the performance shown for a variety of reasons, including but not limited to: your investment advisor, and not WisdomTree, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable; and/or other factors. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded Funds and management fees for our collective investment trusts.

You cannot invest directly in an index.

Past performance is not indicative of future results. Professor Jeremy Siegel is a Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and WisdomTree Asset Management, Inc. This material contains the current research and opinions of Professor Siegel, which are subject to change and should not be considered or interpreted as a recommendation to participate in any particular trading strategy or deemed to be an offer or sale of any investment product, and it should not be relied on as such. The user of this information assumes the entire risk of any use made of the information provided herein. Unless expressly stated otherwise, the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.