Forecasting Returns for Floating Rate Treasuries

Just like when we started 2022, our highest conviction call is that the Federal Reserve will need to continue to hike interest rates to meet their dual policy mandate. The most direct way an investor can play this view is by investing in U.S. floating rate notes (FRNs). Year to date,1 the WisdomTree U.S. Floating Rate Treasury Fund (USFR) has taken in nearly $4.2 billion of fresh capital. A question that we’ve been receiving recently is how should investors think about return potential in the second half of 2022 compared to the first half. In our view, the trade may just be getting started.

Mechanics

To review, U.S. Treasury FRNs are backed by the full faith and credit of the U.S. government. There is no credit risk. The income that these notes generate is derived from two sources: the primary source is from the weekly rate resets according to the results of the U.S. 3m T-bill auction. This means that if rates are rising due to changes in Fed policy, investors can reset to a higher level. The second component comes from a spread (positive or negative) that represents the amount of demand for FRNs when they are initially auctioned every quarter. In an average-to-low-demand environment, the spread is positive, so investors receive rates above 90-day T-bill yields. When demand is high, this spread may be zero or even negative, like we saw at the U.S. FRN auctions on January 31 (-0. 015%) or May 2 (-0.075%).2

What’s Priced In

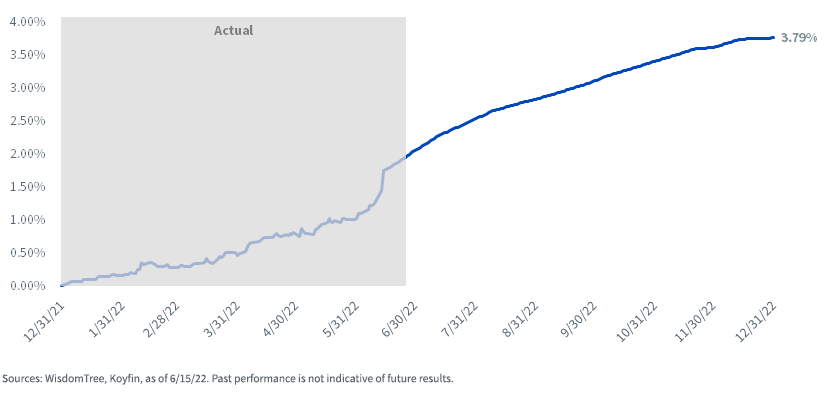

As of June 15, the market is pricing in 2.00% of additional rate hikes by the Fed in 2022. Since U.S. FRNs perform best when the Fed is raising rates, we decided to model what impact this would have on the returns of USFR through the end of 2022.

U.S. 3m Treasury Bill Yield Forecast

Since the U.S. government borrows money for as little as four weeks and as long as 30 years, we are able to observe the potential future path of U.S. 3m Treasury bills based on expectations about Fed rate hikes. Based on current expectations, 3m Treasury bills are currently forecast to return 1.63% through the end of 2022. If the Fed doesn’t hike as aggressively, returns will likely be lower than today’s expectations. However, for our highest conviction position, this seems like a comparatively attractive level of fixed income returns in a year that has seen high levels of volatility in traditionally low-volatility assets.

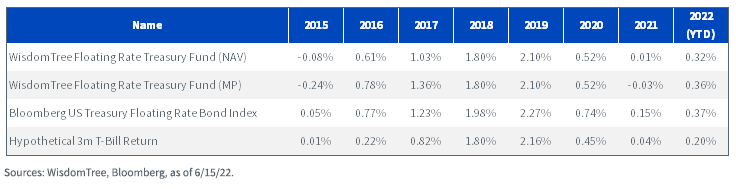

Forecasting FRN Returns

While market expectations drove the forecasting of 3m T-bill returns, the potential “spread” for newly auctioned FRNs is more difficult to handicap. While the spread component has generally been positive, we are assuming a zero spread for the remainder of 2022 given the trends we’ve seen of more recent auctions going negative. As a result, we believe a reasonable forecast for 2022 full-year returns is below. In our view, the real value-add of USFR is the frequency of the reset to higher rates. Below, we compare the returns of a strategy rolling 3m T-bills every quarter against holding USFR. Since the income component on USFR resets weekly, you ultimately accrue more income when the Fed is increasing rates.

For most recent standardized performance, please click here.

As expected, USFR has generated the most significant levels of outperformance in the years that the Fed was hiking rates. In a year like 2022, we expect a significant advantage for floating rate notes compared to 3m T-bills.

While these returns are far from guaranteed, they represent the market’s best estimate of what might be in store for fixed income investors for the remainder of 2022. With high levels of uncertainty in other markets, we think USFR could offer a compelling case for returns as the market continues to grapple with high inflation and bouts of volatility.

1 Source: WisdomTree, as of 6/15/22.

2 Source: TreasuryDirect, as of 5/31/22.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.