Cloud Computing: Are Share Prices Heading Toward Zero, or Is It an Opportunity to Buy?

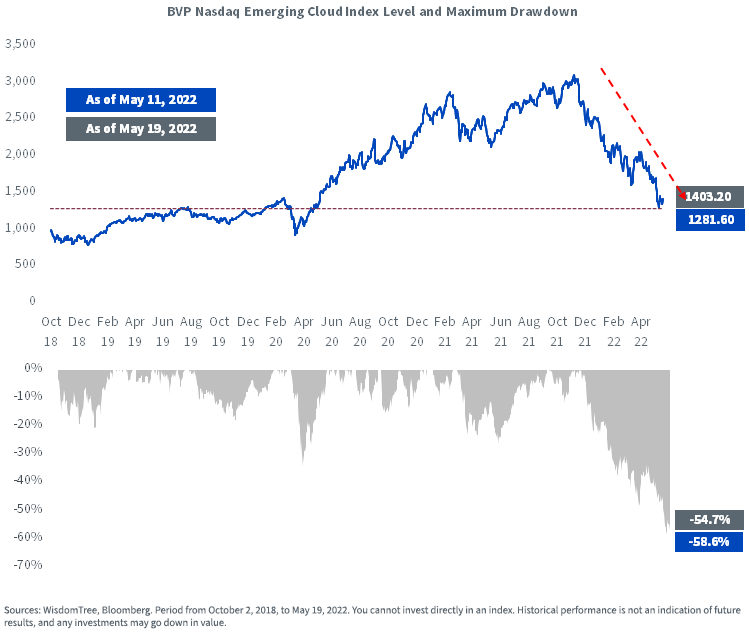

The drawdown in many stocks focused on cloud computing software has been, in a word, unbelievable. In basically one month’s time, from April 11 through May 11, the BVP Nasdaq Emerging Cloud Index (EMCLOUD)—a group of cloud-oriented companies—has lost roughly 30% of its value.

In figure 1, we see:

- The drawdown of EMCLOUD from the peak in November 2021, when the U.S. Federal Reserve began to discuss removing liquidity from the market in a serious way, has been more than 50%.

- From November 9, 2021, to May 11, 2022, the period of “maximum drawdown” to date, we had a 58.6% drop over 126 days.

- On May 11, the closing level of EMCLOUD fell below the closing levels observed for the first time in July 2019.

Figure 1: The Drawdown in Cloud Computing Share Prices Has Been INTENSE

Knowing this, the primary question comes back to the following, which we can simplify into two outcomes:

- Cloud computing as a delivery mechanism through which customers subscribe to software is the wrong business model, and customers will vote with their wallets and go to something different.

- Customers are at least equally excited, if not even more excited, about cloud computing as a delivery mechanism through which they can subscribe to software.

Company Results Support Outcome #2 over Outcome #1

While we are never able to view the future with certainty, the evidence that we can interpret today would tend to indicate that outcome #2 has a higher probability of becoming true.

The big players are still growing—FAST.

One of the risks we monitor in cloud computing regards the biggest players shifting from engines of growth to something more like “utilities”—the concept being that everyone able to adopt cloud computing has done so, so the future growth stabilizes.

- Amazon Web Services (AWS) indicated revenue growth of 37%, $18.4 billion.

- Microsoft indicated that the part of its cloud business most directly comparable to AWS grew revenues at 46% year-over-year. It should be noted that it only had a 7% market share in 2016, so getting to 20% in this short time has been impressive.

- Google Cloud indicated year-over-year revenue growth of 44%, to $5.8 billion.

M&A Activity Is Still Active

While it is true that not every cloud-focused company is involved in M&A, even amidst the share price performance turmoil of 2022, companies are still active.

- Google Cloud has announced its intention to buy Mandiant, a cybersecurity firm, for $5.4 billion. The rationale is to provide its cloud customers with more robust cybersecurity solutions at a time when this is at the forefront of many customers’ minds.

- Shopify has announced its intention to buy e-commerce fulfillment specialist Deliverr for $2.1 billion.

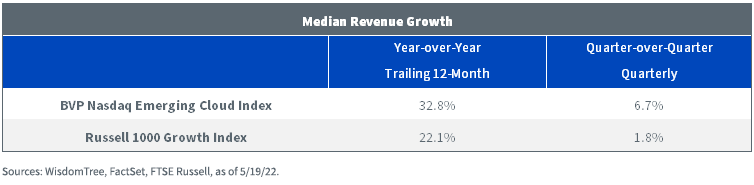

Cloud Computing Stocks Are Still Delivering Elevated Growth Rates

Conclusion: The Cloud Business Model Is Still Robust Amid Substantial Lowering of Equity Valuations

Some of us might have thought that there has been so much discussion about Western central banks shifting policy from extremely “easy” to extremely focused on mitigating the risk of runaway inflation that this must have been priced into equity markets. The recent behavior of software-oriented cloud computing companies would tell us something different—adjustments are clearly still being made. Our bottom line is this—these subscription-oriented businesses are still largely growing their revenues, even if that growth is nowhere near what would have been seen during the pandemic period in 2020. Those with a time horizon of the next few months may have an extremely uncertain outcome. Those with a time horizon in the range of 5, 7 or 10 years—as long as the cloud business model continues to find favor—may see this downdraft as an interesting opportunity.

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.