Can Market Volatility Push Gold Miners Higher?

As geopolitics rattles markets, has gold regained its haven status? Gold miners, well known as a leveraged play on gold, have benefited after a lackluster performance last year. The WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN) has gained almost 10% year-to-date on a NAV basis (through February 23)1 as broader equity markets tumble—and we think conditions are prime for more gains ahead.

The three key factors that may drive gold miners’ performance in 2022 are (1) leverage to the price of gold, (2) rising dividend yields and (3) attractive valuations within equity markets.

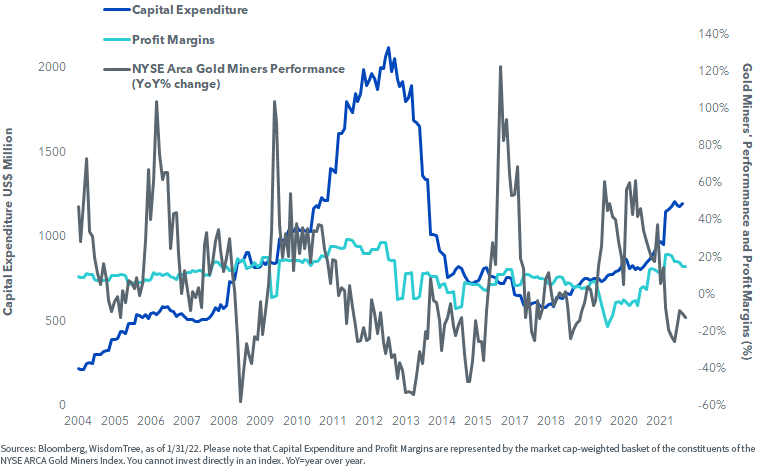

Gold Miners’ Performance Fails to Catch Up with Rising Profitability

The golden era from 2001 to 2011 rewarded gold miners for aggressive growth over cash flow generation, eroding their value over the long run as they were funded by record amounts of debt.

Since the peak attained in the middle of 2012, the gold mining industry conducted a big cost-cutting exercise by slashing capital expenditure (“capex”), selling off non-core assets to raise US$33 billion and shedding nearly 200,000 jobs to boost productivity growth.2

This trend began to reverse in 2018 as exploration activity rose, thereby supporting margins and providing gold miners with some flexibility to further increase exploration spending.

Yet the higher profitability witnessed among gold miners failed to lend a tailwind to gold miners’ performance. We believe this can be partly explained by the upward cost pressures faced by the industry, which contributed to negative price sentiment.

Figure 1: Higher Capex Moves in Lockstep with Profit Margins

Upward Costs Pressure Pales against Higher Gold Prices

Over the course of 2021, total cash costs were impacted by rising inflation across several inputs. Labor shortages, turnover and changing shift patterns due to COVID-19 restrictions and infections led to rising wages for workers.

The World Gold Council (WGC) established a new cost disclosure framework in 2013 by introducing “all-in sustaining cost” (AISC) as an extension to cash costs. AISC focuses on all costs incurred in sustaining production for the complete mining lifecycle, from exploration to closure.

In 2020, gold miners’ AISC rose to its highest level since 2013. Pandemic disruptions put upward pressure on unit costs, mainly during the ramp-down and ramp-up phases around the closure periods when mines were unable to operate at full capacity.

As AISC rose at a faster pace than gold prices in 2021, gold miners’ price performance was negatively impacted. Gold miners’ performance does not appear to reflect just how strong AISC margins are currently.

Figure 2: All-in Sustaining Cost (AISC) Rose to Its Highest Level since 2013

-rose-to-its-highest-level-since-2013.png)

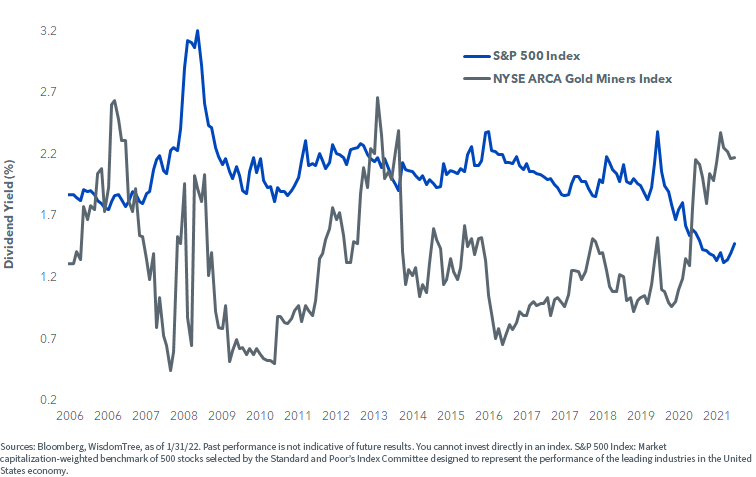

Attractive Valuations Favor Gold Miners

Key valuation metrics such as price-to-book (P/B) at 1.23 for gold miners reveal they are trading at a 21% discount to the long-term average.

Gold miners’ profit margins remain healthy, and companies are generating significant free cash flow. The current free cash flow yield on the NYSE ARCA Gold Miners Index is 4.3%. In the current rising rate environment, dividend yields for gold miners have risen to 2.17% in January 2022 from 0.96% during the pandemic in 2020.

Evidently, despite rising costs, miners’ profit margins have expanded, thereby increasing cash flow. Mining companies are clearly using the recent strength in earnings growth to compensate investors in a higher inflationary environment.

Figure 3: Gold Miners Offer an Attractive Dividend Yield amid a Rising Rate Environment

Conclusion

The market has been too fixated on rising costs for the gold mining sector, causing it to ignore the more important attributes such as higher capex expenditure, stable profitability, rising free cash flows and attractive dividends.

As markets are caught in the crosshairs of rising geopolitical tensions, gold’s haven status is likely to be reignited, which could benefit gold miners.

1 Actual YTD NAV Return = 9.63% (as of 2/23)

2 Source: Metals Focus

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent standardized performance, click here.

There are risks associated with investing, including possible loss of principal. The Fund is actively managed and invests in U.S.-listed gold futures and global equity securities issued by companies that derive at least 50% of their revenue from the gold mining business (“gold miners”). The Fund’s use of U.S.-listed gold futures contracts will give rise to leverage, magnifying gains and losses and causing the Fund to be more volatile than if it had not been leveraged. Moreover, the price movements in gold and gold futures contracts may fluctuate quickly and dramatically and have a historically low correlation with the returns of the stock and bond markets. By investing in the equity securities of gold miners, the Fund may be susceptible to financial, economic, political or market events that impact the gold mining sub-industry, including commodity prices and the success of exploration projects. The Fund may invest a significant portion of its assets in the securities of companies of a single country or region, including emerging markets, and thus, the Fund is more likely to be impacted by events and political, economic, or regulatory conditions affecting that country or region, or emerging markets generally. The Fund’s investment strategy will also require it to redeem shares for cash or to otherwise include cash as part of its redemption proceeds, which may cause the Fund to recognize capital gains. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. EST net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.